The market is expecting central banks to start cutting rates this year as inflation is receding, but a rebound might not be off the table.

While UK inflation in January came in lower than expected, a spike in the costs of living as a result of stronger global demand or unforeseen geopolitical events is not entirely off-the-table.

Moreover, some experts, such as Paul Skinner, investment director at Wellington Management, believe that inflation will be more volatile and structurally higher than it has been over the past 15 years.

Investors who fear a resurgence in inflation have plenty of options to explore across different asset classes to protect their savings. Trustnet asked fund selectors to recommend a range of inflation-hedging strategies.

Equities

Tom Stevenson, investment director at Fidelity International, suggested two equity funds to protect a portfolio against the harmful impact of inflation.

However, he stressed that investors would need to identify the reasons why prices are rising again first.

Stevenson said: “The beneficiaries would be very different if inflation was rising because of higher demand for goods, or rising wages, than if it were rising on the back of supply shortages.”

If inflation was due to higher demand in a strong economy, Stevenson would favour a cyclical, value-focused fund, such as Dodge & Cox Worldwide Global Stock.

This fund, which benefits from a global remit, looks to invest in out of favour shares trading on depressed valuations that would benefit from an improving economic backdrop.

Performance of funds over 10yrs vs sector and benchmark

Source: FE Analytics

If inflation resulted from supply chain issues – potentially due to geopolitical tensions – Stevenson suggested a defensive, quality-focused fund investing in companies with the ability to pass on price increases. BNY Mellon Long-Term Global Equity, which invests in businesses with reliable cash flows, brand strength and pricing power, is such a fund.

Commodity and natural resources

If inflation were to spike again, Dan Coatsworth, investment analyst at AJ Bell, suggested looking into the commodity and natural resources space. Commodity producers would probably be one of the first places investors flocked towards if there was an unexpected increase in the rate of inflation.

He added: “Commodity prices have a strong correlation to the rate of inflation and often it is a spike in the cost of energy or metals which contribute to a higher cost of living.

“We could feasibly see investors willing to pay a higher multiple of earnings to obtain commodities exposure in this situation and a re-rating in mining, oil and gas stocks would benefit a fund invested across those areas.”

To get exposure to this asset class, his fund of choice is BlackRock Natural Resources, which invests in the big natural resource industry stocks such as Shell and TotalEnergies on the oil and gas side and Glencore, BHP and Vale on the mining side.

Performance of funds over 10yrs vs sectors

Source: FE Analytics

Rob Morgan, chief investment analyst at Charles Stanley, would also look for cyclicality in the energy and commodities space, but via BlackRock World Mining Investment Trust.

He said: “With dividends cut across the sector, the trust’s own payouts have dipped, which won’t have pleased income seekers, but this trend could quite easily reverse in an environment of growth and rebounding raw material inflation that comes from an accelerating global economy.

“A further possible tailwind comes from the ongoing energy transition that stands to broaden and amplify demand for commodities.”

Gold

Dzmitry Lipski, head of funds research at interactive investor, invited investors feeling nervous about where markets are heading to consider gold.

He explained: “The historic role of gold has been as a store of value during economic crisis. It is generally accepted that gold could also be used as an inflation hedge and, therefore, rising inflation is necessary for the cost of gold to increase.

“That's because gold is priced in US dollars, so when each dollar becomes less valuable it takes more of them to buy the same amount of gold. Conversely, low inflation and a strengthening US dollar should be seen as negative for gold prices.”

Lipski added that the outlook for gold is positive over the longer term, as the US Federal Reserve is expected to start cutting rates, the US dollar is likely to weaken and there is more demand to come from China.

To gain exposure to the precious metal, Lipski picked iShares Physical Gold ETF.

Money market funds

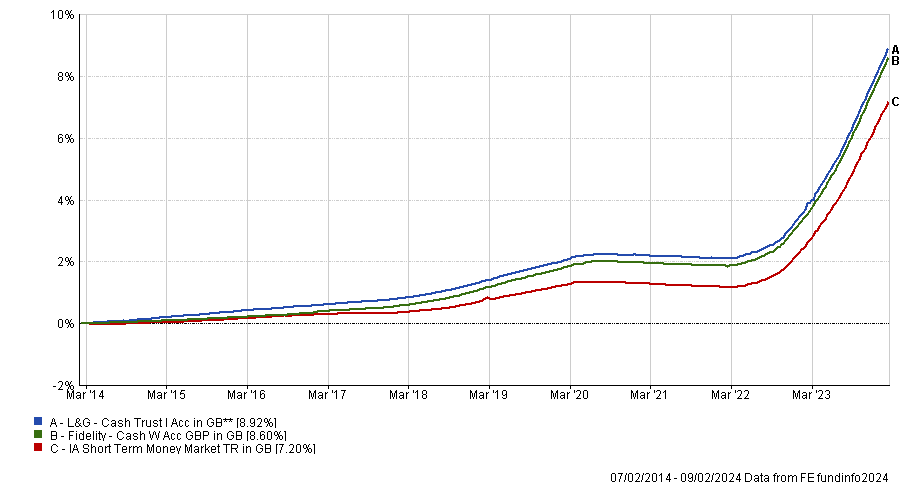

As the consequence of rising inflation would likely be higher interest rates, Fidelity’s Stevenson explained that money market funds would work in different inflationary scenarios, and pointed to L&G Cash Trust and Fidelity Cash .

He said: “Both would benefit from an extension of the higher-for-longer interest rate environment.”

Performance of funds over 10yrs vs sector

Source: FE Analytics

Multi-asset funds

Alternatively, investors could look at multi-asset funds, as some of them are positioned for an inflationary rebound, such as Ruffer Investment Company.

Gavin Haynes, co-founder of Fairview Investing, said: “Whilst most investment strategies are now pointing towards falling inflation, the team at Ruffer are taking the opposite view and look to offer exposure to a genuine, uncorrelated alternative that can protect against a spike in inflation.”

The fund is currently focused towards short-dated bonds, but also holds index-linked bonds, commodities and gold. It also has a small equity exposure, with a preference for the energy and financial sectors which should prove resilient if inflation remains elevated.

Performance of funds over 10yrs vs sector

Source: FE Analytics

Another multi-asset fund that could do well if inflation ticks up again is Capital Gearing, according to Lipski.

Index-linked government bonds account for around 50% of the portfolio, offering protection against a stock market fall and a shield against inflation.

Lipski added: “The investment trust has two objectives: to preserve capital over any 12 month period and to deliver returns well in excess of inflation over the longer term.

“It aims to achieve its investment objectives through a long-only, multi-asset portfolio of bonds, equities and property, with small holdings in infrastructure, gold, and cash.”

Lipski also noted that the trust has a track record of holding its ground in the direst of times, including the dot-com crash, the global financial crisis and the market sell-offs of 2018 and 2020.