Discounts have always been part of the appeal of investment trusts. Buying assets for less than their underlying value, often with a higher yield as a result, is an attractive proposition – especially for income-seeking investors. But discounts have moved from being a background feature of the market to something much more actively debated.

Boards are under increasing pressure to manage them, buybacks have become more common and activists such as Saba Capital have stepped in to force change. That has fuelled the idea that wide discounts are an opportunity in their own right. But is buying on a discount enough or does something else need to happen to make it pay off?

Below, with the help of QuotedData, Trustnet looks at some of the most discounted trusts 10 years ago in the IT UK Equity Income, IT Global and IT Renewables sectors and whether they have moved relative to the sector median until today.

At first glance, the data appears to support the idea of mean reversion. In each sector, discounts that once looked extreme are now much closer to the sector average. But James Carthew, head of investment company research at QuotedData, said apparent reversion masks a more important point.

“If something is consistently on a wide discount but there isn’t a good reason for it, then something will happen corporately or otherwise to bring that discount down,” he said. “They can deviate for a while, but at some point, something will happen to bring it back down again.”

In other words, discounts narrow because pressure builds, not because markets correct themselves – without a catalyst, a wide discount can persist for years.

UK equity income

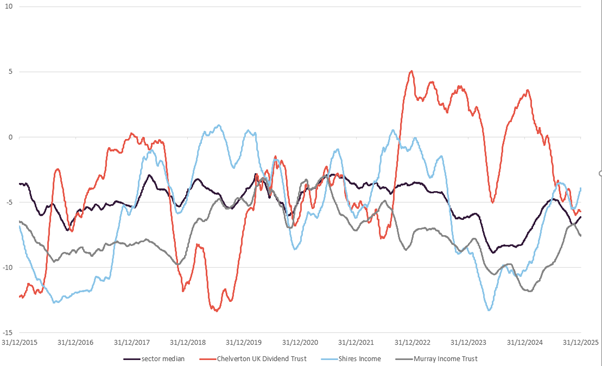

The UK equity income chart shows a clear narrowing over the past 10 years, with all three trusts highlighted – Chelverton UK Dividend, Shires Income and Murray Income – now sitting much closer to the sector median than they did a decade ago. But the route to that convergence has been uneven, with style playing a major role.

UK Equity Income 3-month rolling average discounts for selected trusts

Source: QuotedData

“Chelverton is about small-cap. Murray Income is more about quality versus growth. Shires has an enormous small-cap bias,” Carthew said. When those styles fell out of favour, discounts widened. When conditions improved, they narrowed again.

Structure also mattered. “Shires is a relatively small trust as well. That makes it more illiquid and that tends to be a reason to trade on wider discounts,” he said. Illiquidity and gearing choices helped keep discounts wide for longer than investors might have expected.

Ultimately, two of the three trusts resolved their discounts through corporate action rather than patience. Murray Income is moving to Artemis, while Shires Income announced a merger with Aberdeen Equity Income earlier this month. “With Shires, we’ve now had the corporate action to try to narrow the discount,” Carthew said. In both cases, it was change that closed the gap, not time.

Global trusts

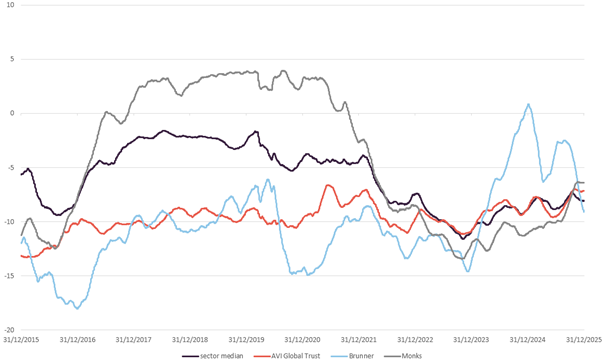

In the global sector, the pattern is similar but the drivers are clearer, with performance and reputation playing a bigger role.

IT Global 3-month rolling average discounts for selected trusts

Source: QuotedData

Monks is the standout example. Strong returns pushed it to a premium, before conditions turned and the discount widened again. “You get strong returns, it moves to a big premium, then when interest rates go up and growth sells off, performance weakens and the discount widens again,” Carthew said.

AVI Global Trust tells a different story. Solid, consistent performance has gradually improved sentiment, allowing the discount to narrow steadily over time. In this case, there was no single corporate event. The pressure came from results and credibility building over a long period.

Renewables

The renewables chart looks different. Here, discounts for individual trusts have tracked the sector median closely, with far less dispersion than in equity sectors. That is not because the forces driving them are largely outside the control of individual boards, Carthew explained.

IT Global 3-month rolling average discounts for selected trusts

Source: QuotedData

“It is much more sector-specific factors driving it rather than stock-specific ones,” he said. Power price assumptions, policy uncertainty and inflation have weighed on the entire sector.

Greencoat UK Wind, for example, was forced to cut forecasts after wind speeds came in lower than expected, yet its discount has not blown out as dramatically as some peers because it is seen as a large, liquid vehicle.

“Discounts in private equity, renewables and all that sort of stuff is persistent and really hard to fix,” Carthew said. When the problem is structural, there may be no obvious corporate lever to pull.

What moves discounts

Style cycles can help but they rarely resolve a discount on their own. Boards act when investors lose patience and, increasingly, that impatience is being amplified by activists.

“Saba has been a catalyst for change,” Carthew said. “Activists are useful in this context because they stimulate corporate activity. They are a normal, healthy part of the market.”

That does not mean activism is always aligned with long-term shareholder value. Carthew is critical of approaches that prioritise forcing outcomes over economic logic.

“A rational activist will buy something on a wide discount and accept an exit when it can get a decent value. Saba hasn’t been doing that,” he said. “It seems its motivation is not to narrow the discount and make a profit but to try to get certain management outcomes, which is not the logical thing for it to be doing for its shareholders.”

Even so, the presence of activists has changed behaviour. Boards are now more aware that doing nothing is no longer an option. As a result, the length of time a trust can remain on an extreme discount has shortened, said Carthew.

So is buying on a discount always worth it?

Making an investment in assets that you like while being able to buy them for less than they are worth is “one of the big attractions of investment companies”.

“Some trusts seem to always trade on discounts, so it doesn’t have much of an impact on your return if you buy at say a 10% discount and sell at the same level,” Carthew noted.

However, for a medium- to long-term investor, returns mostly come from the move in the net asset value, as shareholders in CQS Natural Resources found out last summer.

Those who cashed out their shares to make 10%-15% from the discount closing lost out on what has been an 85% rise in the share price on the back of a soaring NAV since then.

“Buying a trust just because it is trading on a wide discount is rarely a good idea”, Carthew concluded.