BlackRock is going into the second quarter with a pro-risk stance as it expects the market to look past sticky US inflation and continue to perform strongly.

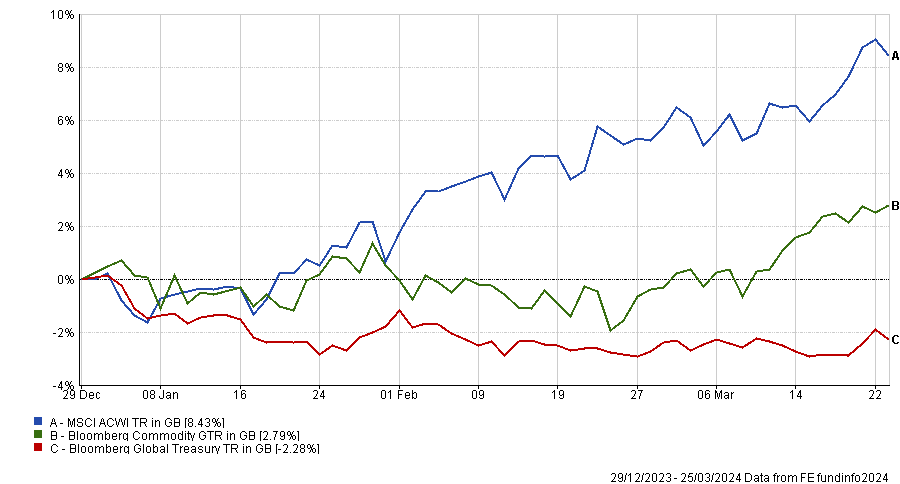

Equities have had a good start to 2024 as investors eye rate cuts from the world’s central banks, with the MSCI AC World index gaining 8.4% so far to outpace government bonds and commodities.

However, the latest US inflation print saw the consumer price index rise from 3.1% to 3.2% - a slight move, but one that caused some investors to worry the Federal Reserve would be pushed to delay cuts to interest rates.

Performance of indices over 2024 so far

Source: FE Analytics

At its meeting last week, the Fed lifted its growth and inflation forecasts but reiterated its intention to make three quarter-point rate cuts later in 2024. This was enough for BlackRock, which said in its latest update that it remains pro-risk in on a six- to 12-month tactical view.

Wei Li, global chief investment strategist at the BlackRock Investment Institute, said: “We see stock markets looking through recent sticky US inflation and dwindling expectations of Fed rate cuts. Why? Inflation is volatile but falling, Fed rate cuts are on the way and corporate earnings are strong.”

In the very near term, BlackRock sees the backdrop as being more supportive for risk-taking with US inflation well below its high of 9.1% and economic growth holding up. Meanwhile, expectations for S&P 500 earnings growth for 2024 have been revised up to about 11%, according to LSEG data.

“Against that backdrop, we remain tactically overweight US stocks. We think upbeat risk appetite can broaden out beyond tech as more sectors adopt [artificial intelligence] AI and as market confidence is buoyed by recent Fed messaging and broadly falling inflation,” Li explained.

“We still prefer the AI theme even as valuations soar for some tech names. Stock valuations are supported by improving earnings, with the tech sector expected to account for half of this year’s S&P 500 earnings.”

Li also put the ‘soaring valuations’ of tech stocks into context, as price-to-earnings ratios have fallen thanks to improved earnings – in sharp contrast to the dot-com bubble, when they surged.

BlackRock’s systematic equities team also analysed 400 metrics related to valuations and other features; it found that the number of metrics “flashing red” now is 50% lower than when the dot-com bubble burst in 2000.

The asset management giant has also gone more overweight Japanese equities, which is now its highest-conviction tactical view. The firm likes Japan because of its solid corporate earnings, shareholder-friendly reforms and supportive policy from the Bank of Japan.