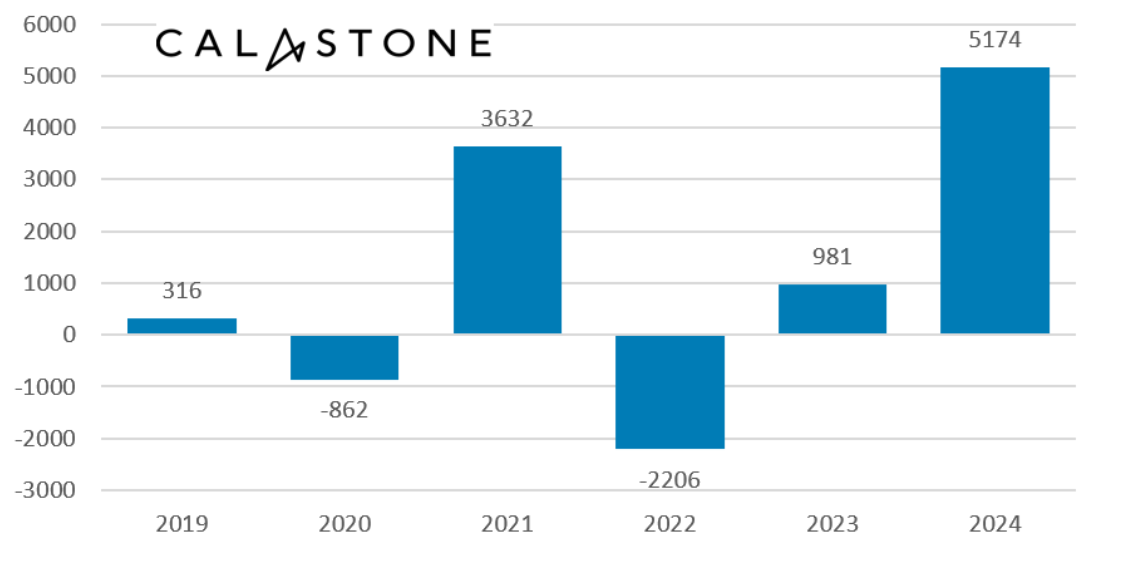

Equity funds raked in £5.2bn this ISA season (from 15 February to 5 April 2024), more than five times their 2023 intake (£981m), making 2024 the best year of ISA investments recorded by Calastone.

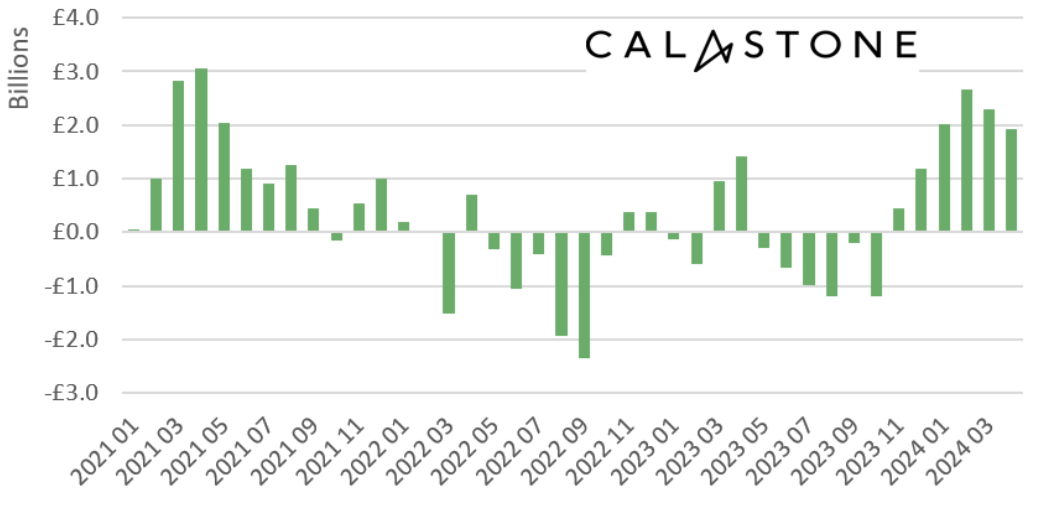

During the month of April, investors poured £1.9bn into equity funds, the 13th highest month in Calastone’s nine years of data. This followed a record first quarter with £7bn of equity inflows.

Passive funds tracking US and global equity indices were the main beneficiaries of investors’ renewed appetite for risk. This is a consistent trend as investors have favoured indexing for 16 consecutive months, having earlier shown a marked preference for active funds in 2021 and 2022.

Passive equity funds have garnered £14.9bn since January 2023, while active equity managers have suffered outflows of £7.3bn.

Net equity inflows during ISA season (£m)

Source: Calastone Fund Flow Index

Global equity funds enjoyed £1.5bn of inflows in April. US portfolios, which make up the lion’s share of global indices, took in almost as much as global funds, with £1.3bn of inflows. European equity funds received £471m. UK and emerging market portfolios were out of favour, however, shedding £665m and £162m, respectively.

Investors have been relentlessly selling down UK equities, which have been in outflow mode for 35 consecutive months, losing a cumulative £21.3bn.

April marked a reversal of fortunes for emerging markets funds, however, which had been gathering inflows for 18 months.

Equity funds’ monthly net inflows

Source: Calastone Fund Flow Index

Meanwhile, investors pulled £100m out of safe-haven money market funds as they gravitated towards riskier equities, marking the first month of net selling since January 2023. Mixed asset funds started to take in money after 11 months of outflows but property funds were subjected to continued selling pressure.

Investors also added £422m to fixed income funds in April, despite poor performance.

Edward Glyn, head of global markets at Calastone, said: “The bond markets had another rough month. The benchmark US 10-year yield rose relentlessly during April, ending the month at 4.68%, up by half a percentage point since the end of March, setting the tone for bond markets around the world. Investors are nursing losses on the £1.7bn of bond-fund purchases they made between November and March.

“Meanwhile inflows to bond markets show that steady and accumulating losses are not deterring new capital – this is not unreasonable as there are substantial gains to be made when interest-rate expectations turn a corner and high yields mean investors can lock in historically high income levels now for the long term.”