Donald Trump’s return to power would be more problematic for European markets than for US equities, according to a Quilter Investors survey of 21 fund managers.

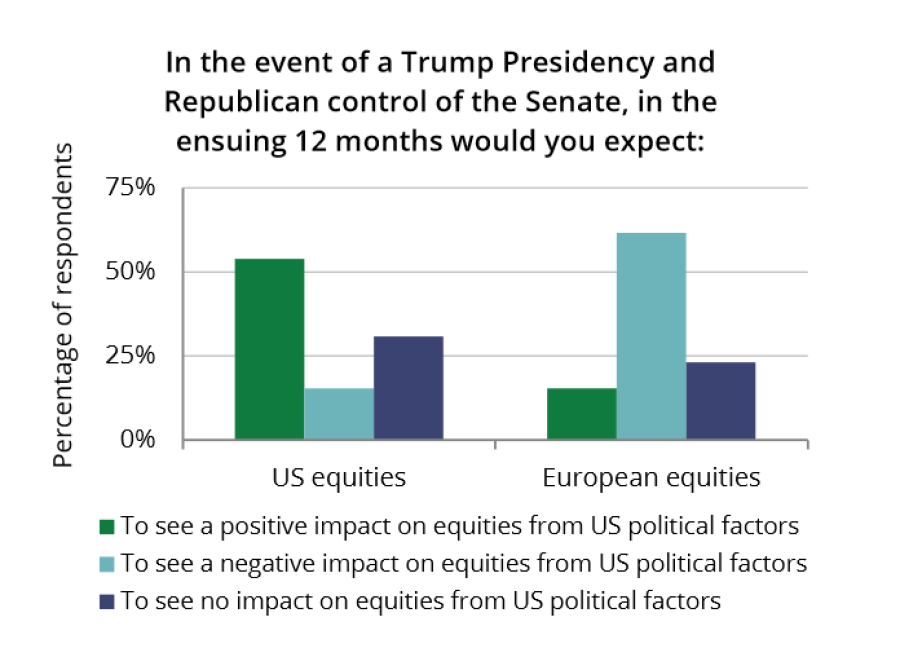

Indeed, 61% of the fund managers polled believe a Trump victory would be a significant blow for European markets.

Those views echo the sentiments of European Central Bank president Christine Lagarde, who said in January that the Republican candidate is “clearly a threat” to Europe.

Lindsay James, investment strategist at Quilter Investors, said: “A Trump victory in November brings about a lot of uncertainty for Europe. While the US will likely see existing tax cuts extended and further ‘onshoring’ of manufacturing and production, Europe is likely to experience volatility from Trump’s ‘America first’ policy.

“Having already imposed tariffs on EU steel and aluminium in 2018, which have since been paused by the Biden administration, Trump is now promising a universal 10% tariff on all imports into the US, and has spoken about rates of 60% on Chinese goods.

"His uncertain support for NATO at a time of Russian aggression is already prompting European countries to increase defence spending, adding further pressure to government budgets. Trump has boasted in the past about ending the conflict in Ukraine in 24 hours, with the strong suggestion he would end all funding support, raising the risk that Europe would become more involved.”

Fund managers are not as pessimistic when it comes to US equities, with only 15% of them seeing Trump’s return to the White House as a negative for the asset class.

In fact, more than half of respondents believe a Trump presidency would be positive for US equities, including if Republicans also win control of Congress.

Source: Quilter Investors

However, the best US election outcome for markets would be a second term for Joe Biden, but with Republican control of the Senate, according to the surveyed fund managers.

A split in power was generally favoured over one-party dominance. Some managers explained that a unified US government may result in a higher budget deficit through higher spending and/or tax cuts, exacerbating concerns around US government debt levels.

Other respondents predicted that a Republican-controlled Congress would pave the way for deregulation, especially in financial services, energy and corporate mergers.

Nonetheless, many professional investors do not expect the US election to have a significant impact on US stock market prospects.

One manager explained: “History suggests that equity markets tend to see lower average returns and higher volatility in US election years versus non-election years. But these averages are skewed by events that have coincided with elections, notably the bursting of the dot-com bubble, the global financial crisis, and the Covid-19 pandemic.

“What’s happening in the economy tends to be much more important for markets than what’s happening in the White House.”

Fund managers identified geopolitics as a key risk, citing tensions between the US and China as a potential trigger for market instability.

James said: “At a time when global growth is decelerating, we are seeing a number of threats that risk the global order that we have become familiar with.

“However, despite the conflicts that have erupted of late, it remains the relationship between the two economic behemoths, US and China, that concerns investment professionals.”

One respondent also highlighted that markets haven’t priced in any risk premium reflecting this increase in geopolitical risk.

Nearly half of the surveyed fund managers believe a return to a 2% inflation target across developed economies is “unreasonable” or “totally unreasonable” due to the surge in geopolitical tensions.

One respondent concluded: “The world is focused on security over the medium to long term. National security, energy security, supply-chain security, and food and water security.

“All this will require capital and fiscal spend, which means inflation will be higher than we’ve been used to in the post-global financial crisis period.”