Investors are plunging back into the equity market despite it not being worth the risk due to their own “fear of missing out”, according to Alan Bartlett, chief executive officer at Goodhart Partners and co-manager of the £110m Global Opportunities Trust.

This is a “very counterproductive way to invest for the next 10 years” and has led investors to develop mistaken assumptions around markets and other alternative assets such as cash.

“Cash creates this emotional response from people and many now think it’s unacceptable for an equity manager to own a lot of cash, which I’ve just never understood”, he said.

Partially, this is the result of an “abnormal 20 to 30 years” where it has been an “easy environment to invest” as “the cost of being wrong was quite low”, he said, as markets have broadly trended higher – even with shock events such as the tech bubble, financial crisis and Covid pandemic all taken into account.

A high cash allocation and the flexibility it provides were unnecessary for many investors because, even if they put money into the stock market at the wrong time, the market would rally back before long.

Bartlett said that this is unlikely to remain true for very long but investors are still unprepared for it. To reflect this, the team has raised cash to 35% in the Global Opportunities Trust portfolio.

Bartlett explained that this allocation reflects the team’s belief that in a post-2022 world where the traditional 60/40 approach to asset allocation proved it was not bulletproof, investors need to get more flexible. During this time bonds and equities moved in tandem, rather than the inverse correlation that the investment thesis is built upon.

“We do not believe equity markets are pricing in the significant macroeconomic challenges (fiscal deficits, currency and trade war, real war, political cycles, excessive government debt, et cetera), so we’ve defaulted back to cash”, the team explained.

Increased levels of cash is an “enabler of the portfolio” instead of a purely defensive asset, allowing the team to deploy capital quickly in response to changing market circumstances.

This allows them to be more flexible on asset allocation and balancing risks, secure in the knowledge that the portfolio is unlikely to suffer a total loss of capital.

By contrast, investors who are fully invested in the equity market could end up on the “wrong side of falling markets”, which can make it challenging to do the “sensible thing” and redeploy capital.

Bartlett said: “I wouldn’t want all of my money in the stock market now, because the ideas we’re finding aren’t numerous enough or diverse enough. If I can’t find anything that is attractively priced, why would I force my shareholders to take on equity market volatility?”

This high weighting towards cash has contributed to the trust’s recent performance, he argued. In a year where trade worries and geopolitical tensions shook the market leading to falls like the one following US president Donald Trump’s ‘Liberation Day’, the high cash allocation protected the strategy from the worst of the market falls, while allowing it to deploy capital elsewhere.

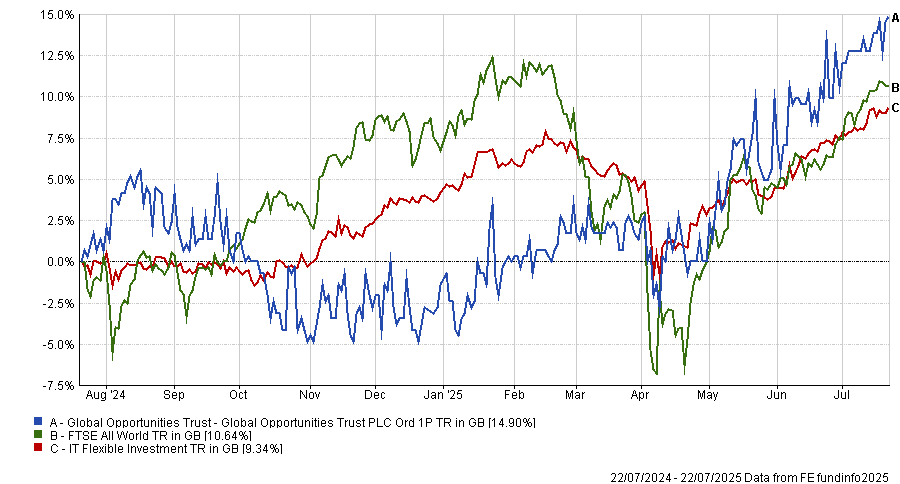

As a result, the trust is the best-performing strategy in the IT Flexible Investment Sector over the past six months and has beaten the FTSE All World over the past year, as demonstrated by the chart below.

Performance of the trust vs the sector and the benchmark over the past year

Source: FE Analytics

“You should deploy capital sensitively, only into the things that are overwhelmingly convincing,” Bartlett added.

For this reason, he found UK equities interesting. When the team first bought into UK equities two years ago, it was “not entirely convinced of their absolute value” but over time it has added to UK stocks that can perform in a more “benign macro environment” but also have strong, resilient balance sheets that could perform well in times of uncertainty.

For example, the team purchased consumer brands company Unilever, hoping it would be “dull as ditchwater” but could withstand a market fall while providing an above-cash return through dividends.

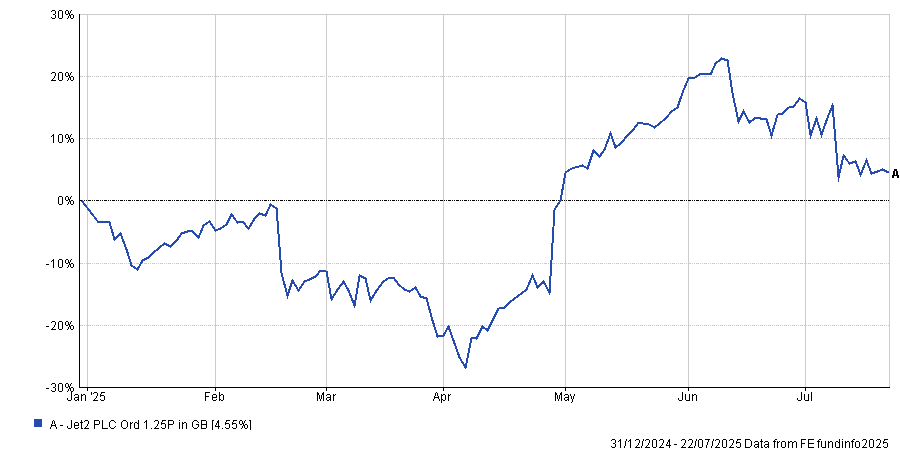

The UK market is also home to some opportunities with long-term growth potential that Bartlett’s team liked. Package holiday provider Jet2 is a recent addition, with the share price up 4.6% over the past year, as seen in the chart below.

Jet2 Share price YTD

Source: FE Analytics.

It is currently on a price-to-earnings ratio (P/E) of about 8x, which is “cheap by our metrics”, but the company also has almost £2bn of excess net cash on its balance sheet and is growing very successfully, he explained.

“It's a vertically integrated holiday company more than an airline and so it's extracting more value through the whole supply chain,” he said. This gives it a pathway to growth while many of its competitors are still struggling to rally in a post-pandemic period.

“I don’t usually like airlines full stop, but sometimes stocks are too good to get away from. There’s no reason why it doesn’t double and double again”, he concluded.