Sustainable investment strategies have had a tough few years, grappling with headwinds such as higher interest rates and underperformance in the renewable energy sector.

Despite this, the £426m Schroder Global Sustainable Growth strategy has delivered top-quartile returns over three years, with the fund’s manager Charles Somers named FE fundinfo New Alpha Manager of the Year as a result. The award is given to investment professionals who achieved the Alpha Manager designation for the first time in 2024.

Somers attributes his track record to an inclusive approach, hunting for opportunities throughout the market capitalisation and across most regions and sectors. He avoids the energy sector and ‘sin stocks’, but endeavours to find market leaders in almost every other industry.

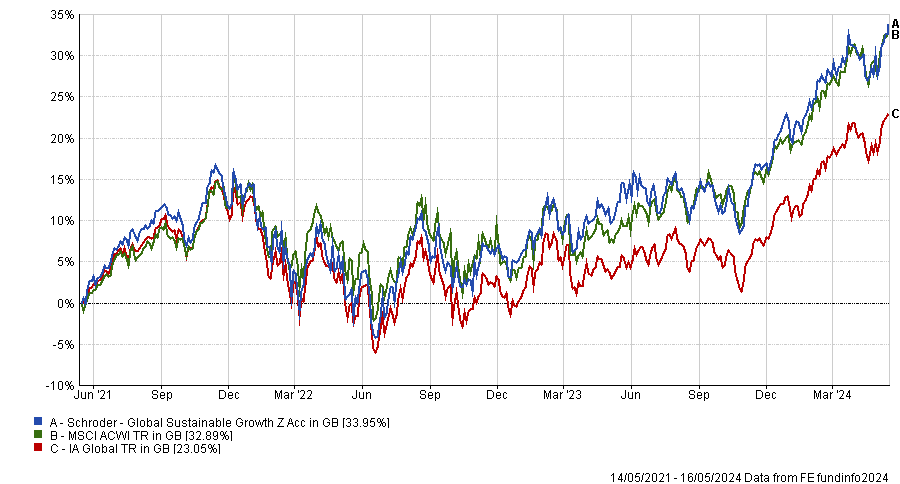

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

Another key element is identifying companies with a ‘growth gap’, where the wider market does not fully appreciate a company’s potential. “If we can correctly identify companies with unanticipated growth then we will generate outperformance, as the market is constantly catching up to the true earnings power and cash flow generation of those companies,” Somers explained.

Most analysts assume a certain level of growth for a company but fade it over time towards the economy’s overall growth rate. “The valuation of a company is quite sensitive to how long you think that growth will sustain at an elevated level,” he explained. He is looking for companies with competitive advantages that can sustain their growth for longer.

The investment process starts with ideas generated by Schroders’ global research platform of sector specialist analysts.

Somers and co-manager Scott MacLennan take ideas that are relevant from a sustainability point of view and put them through 20 questions, which Somers calls the Sustainability Quotient.

These cover seven stakeholder groups: the environment, employees, customers, suppliers, shareholders, society at large and government. “It’s deliberately questions rather than criteria because we want to use all the data available to create a debate,” he said.

Evidence is brought before a committee of six people – fund managers and sustainability experts – who vote on whether a company is eligible for inclusion in the portfolio.

Through this process, Somers and MacLennan whittle down the global universe to a list of 100 companies that have outstanding stakeholder relationships and belong to a wide range of industries, regions and market capitalisation sizes.

“I think that’s quite important to the alpha generation of this fund, in that those 100 companies are giving us a broad enough choice to adapt to the different stages of the market cycle and that flexibility has been quite useful over the past few years,” Somers said.

“We have banks in that list. We have insurance companies, we have industrials and consumer companies, and at different points in the cycle we may want to lean in more heavily to different industries, depending on what’s going on in the wider economy with interest rates and inflation.”

The portfolio is quite concentrated, comprising of 40-45 stocks chosen from the 100 names.

“Whether we divide it up by sector, region or by style factor, the driver of performance has been the individual stocks,” he said. “At different times the regions have helped us or the sectors have helped us but at other times they’ve hurt us and it’s been the stock selection that has carried us through.”

Somers endeavours to run the sustainability aspect of the fund in a way that is compatible with strong investment performance. “One way that sustainability can be supportive is that if a company is doing well by its stakeholders, it has a better chance of sustaining that superior growth than one that is abusing its stakeholders, because those externalities tend to catch up with them,” he explained.