Not every fund in an asset manager’s collection can excel all the time and in every market. This is particularly true for large asset management companies who tend to have a large swathe of styles represented in their portfolios.

As such, in this series we look at different groups and identify the funds (and their styles) that have and have not worked in recent years. This time, we take a look at Schroders.

The asset manager has many successful vehicles on the market, 12 of which have achieved and maintained the maximum FE fundinfo Crown Rating of five this year, only matched by M&G.

Annual results from 2023 confirmed record-highs in the wealth unit’s assets under management, which reached £110bn; profits however dipped 17% from £586.9m in 2022 to £487.6m.

Schroders’ Europe desk has been taking a few hits recently, beginning with James Sym's departure in 2020. He ran five European mandates for Schroders, two of which, Schroder European Sustainable Equity and Schroder European Alpha Plus (now managed by Martin Skanberg and Nicholette MacDonald-Brown) recently featured in Trustnet’s bang for your buck series for failing to outperform their benchmarks over the past five years.

Both of them, as well as Schroder European, featured in Bestinvest’s Spot the Dog report this March.

The sustainable fund was also impacted as environmental, sustainability and governance (ESG) strategies had a tough time over the past three years as oil and gas prices rose.

Jason Hollands, managing director at Bestinvest, said the Schroder European team aims to be pragmatic and tilt between value and growth stocks but acknowledged it had been “hurt” by a value bias in the smaller and mid-cap names in recent years.

There have also been changes within the team. “The European Alpha fund, once a popular fund, has seen a fair bit of manager change over the past decade and last month was handed over to Martin Skanberg, longstanding manager of the European fund,” he noted.

A spokesperson for Schroders said: “Schroders European equities desk has had periods of substantial outperformance over the long-time and we are confident this will return. “Recent performance has been impacted by the returns delivered by European large-caps – a similar trend to what we are seeing in the US with the ‘Magnificent Seven’.”

They added that the past two years have mostly “encapsulated a period of concern for European risk assets” due to energy crisis fears alongside a possible harsh recession in Europe, which has weighed on smaller & mid-sized stocks.

Darius McDermott, managing director at Chelsea Financial Services, agreed with Hollands on many points, but noted there were bright spots.

Schroders’ value offering has demonstrated “enduring strength”, for example with Schroder European Recovery, which achieved top-quartile returns in the IA Europe Excluding UK sector over past three years.

The value team has sparkled in recent years, particularly domestically where Schroders’ UK strategies have shone despite the style remaining out of favour for much of the past decade. Schroder Recovery delivered strong performance over the past 10 years, for example.

Source: FE Analytics

Similarly, its UK income funds Schroder Income and Schroder Income Maximiser – also run by the same team – have achieved top-quartile returns in the IA UK Equity Income sector over one and three years by employing a strict valuation discipline, said McDermott.

The wider UK branch was a mixed bag, however. While the above have performed well, as has the Schroder UK Mid 250 fund (which has been the best performing mid-cap portfolio over three years) others have struggled.

These include Schroder UK Dynamic Smaller Companies and Schroder UK Multi-Cap Income – the former has remained in the fourth performance quartile of the IA UK Equity Income sector over the past 10 years and 12 months, and was in the third quartile over three and five years; the latter was in the top-quartile of the IA UK Smaller Companies sector over one year but stuck in the fourth before that.

A Schroders spokesperson noted that the UK has suffered from a “similar picture” to the one in Europe, where the largest companies in the UK have “outperformed materially”.

Beyond Europe and the UK, all three experts agreed that Schroders’ Asia fund range is impressive. McDermott was particularly struck by the income-focused options such as Schroder Oriental Income and Schroder Asia Income.

“Headed by the experienced Richard Sennitt, these funds leverage a vast network of on-the-ground analysts in Asia,” he said. “This deep research translates into superior stock selection, with company visits playing a crucial role in their investment process.”

For investors seeking a more growth-oriented strategy, he also flagged Schroder Asian Alpha Plus, while Rob Morgan, chief investment analyst at Charles Stanley, preferred the Asian Total Return Investment Trust.

“The trust has an active country and market hedging approach, which tends to mean any outperformance is based on good stock selection rather than country or sector bias,” he said.

“A mid- and large capitalisation bias allows it to buy smaller companies than it can't own in its similar open-ended fund, which again gives it more option. Additionally, it can build in some protection in falling markets using derivatives, which at times has been helpful to returns.”

Overall, the firm has five funds in the IA Asia Pacific Excluding Japan sector. Three are in the top quartile of the sector over five years, while the other two are above average.

Source: FE Analytics

Also of note is the firm’s fixed income offering. Of the seven funds in the IA Sterling Corporate Bond, Strategic Bond and High Yield sectors, only one is in the bottom quartile over five years (Schroder Long Dated Corporate Bond) while four are top 25% of their respective sectors.

Finally, Morgan’s interest in Schroders also spanned to the manager’s energy and renewable energy equity offering through mandates such as Schroder Global Energy Transition Fund.

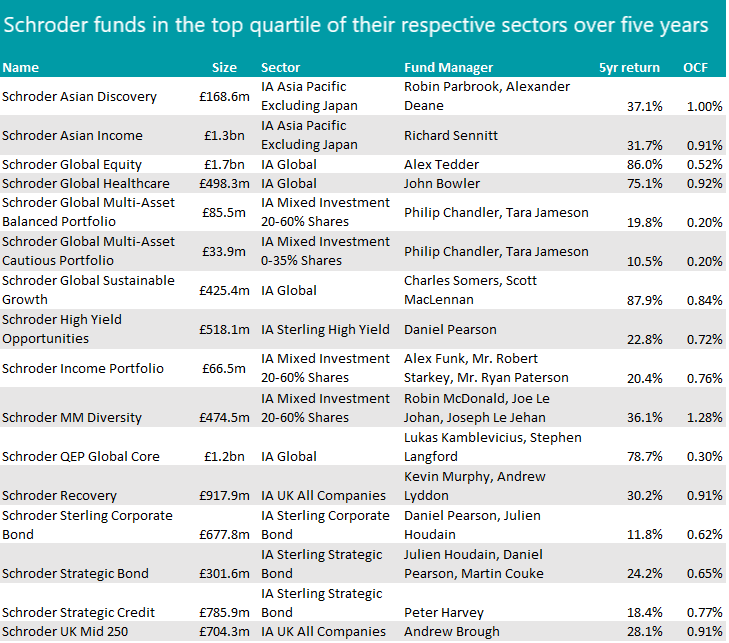

A Schroders spokesperson said: “Across the Schroders Group our key performance indicator, three year investment performance, remains strong with 77% of client assets outperforming their relevant benchmarks.”

Previously covered in this series: Jupiter.