From 10 June 2024 onwards, private investors will be able to get their hands on Nvidia’s shares for a fraction of their sky-high price.

Current shareholders will receive nine extra shares for every one they hold after the market closes on 6 June and trading in the split shares will commence on 10 June.

At the time of writing, Nvidia shares were priced at $949.50, implying that after the split, individual shares will be worth about $95, putting them squarely within the reach of individual investors.

Nvidia said the forward stock split would “make stock ownership more accessible to employees and investors”.

However, Dan Coatsworth, investment analyst at AJ Bell, pointed out that a share split does not change the investment thesis or the company fundamentals.

“Playing around with the share price by making technical adjustments is a psychological trick. The value of the business won’t have actually changed and the value of someone’s investment is completely unaffected,” he noted. “It’s a classic technique that has been adopted by Apple and Tesla, among others, many times over the years.”

Nvidia unveiled its results yesterday for the first quarter of its 2025 fiscal year, beating analysts’ expectations yet again. Quarterly revenue of $26bn was up 18% from the fourth quarter and up 262% from a year ago.

“Expectations were high for Nvidia in the run-up to its latest results so to smash forecasts is a major achievement. That makes it six quarters in a row it has beaten the consensus earnings estimate and seven consecutive quarters for revenue,” Coatsworth said.

“Nvidia’s earnings forecasts had already been upgraded six times by analysts since the start of January, according to Stockopedia data, and the latest results means financial models will have to be tweaked upwards again.”

Nvidia also announced a quarterly cash dividend of $0.01 per share on a post-split basis. This equates to $0.10 per share of the current common stock and represents a 150% increase from $0.04 per share. Shares were up 6.85% in pre-market trading at the time of writing.

Alex Umansky, who manages the Baron Global Advantage fund and has invested in Nvidia since 2018, expects the chipmaker’s exponential growth to continue but warned that the share price may not rise in a straight line.

He had predicted yesterday’s results would surprise on the upside but warned that at some point Nvidia will disappoint the buy-side’s lofty expectations.

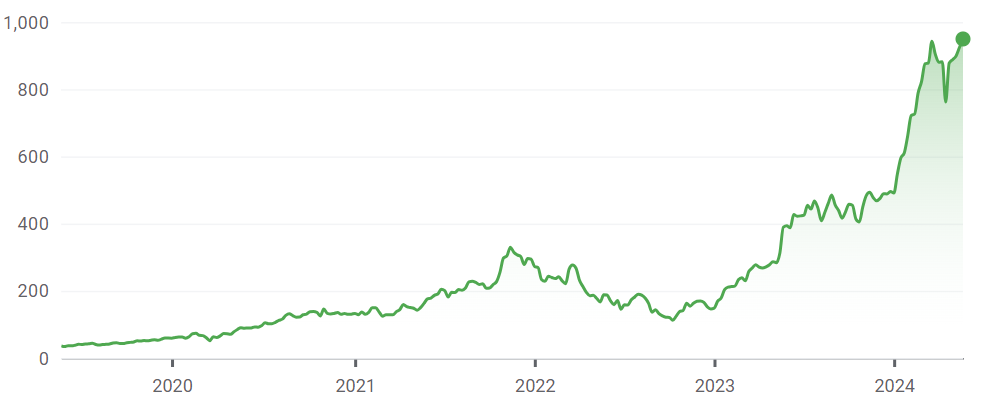

As a quality-growth manager investing in big, disruptive ideas, his portfolio lost about half its value in 2022 and he watched Nvidia’s share price tank from $315 on 26 November 2021 to $112 on 14 October 2022.

He used the dip as a buying opportunity and Nvidia has been his fund’s largest position since early 2023. “It just ballooned after that. It’s up nine times in the past 18 months,” he said.

Nvidia’s share price over 5yrs

Source: Google Finance

Umansky thinks generative artificial intelligence (AI) will be transformative for a vast range of companies and should benefit 95% of his portfolio, although it is difficult to tell at this early stage who the eventual winners and losers will be. But whatever happens to the rest of the market, Nvidia is in the eye of the storm.

“Nvidia is at the epicentre of this tsunami. It’s the arms dealer although we don’t know who will win the war,” he said.

Over the long-term, he foresees Nvidia growing as large as $15trn from its current market capitalisation of over $2trn, but he does not know how long the chipmaker will take to get there. The company’s growth in the past five years has been twice as fast as he initially expected. “We don’t have a lot of conviction on timing but we do have a lot of conviction in the destination,” he added.

Umansky does not think Nvidia is expensive at 28x earnings. Nvidia’s revenues tripled last year and Umansky expects them to double this year, while the share price has not kept pace with earnings growth.