FE fundinfo Alpha Manager Nick Train has revealed his plan to increase his holdings in Burberry, Sage, and Experian.

In Finsbury Growth & Income Trust’s latest factsheet, Train stated these three FTSE 100 businesses are executing on their stated strategy, “albeit to greater or lesser success” in the short term.

“For each we believe successful implementation of the stated strategy should lead to higher future earnings and a higher [price-to-earnings] P/E rating for those earnings,” he said. “Accordingly, we intend to add to each when we judge appropriate.”

Burberry’s shares are down 27.2% since the beginning of the year. The luxury fashion house reported a 4% decline in revenue in the past year, bringing it to just under £3bn.

Although Train expects further revenue declines this year due to ongoing challenging market conditions, he highlighted that the company is now attractively valued.

Performance of share YTD vs index

Source: FE Analytics

He said: “We note that at today’s market capitalisation of £3.6bn, Burberry is valued on c1.25x historic revenues. This seems low for a business that has generated operating margins of over 16% per annum on average for the past decade and will definitely be too low if the current, relatively newly installed, CEO, CFO and head of design can restore excitement to the brand and grow revenues again.”

Sage also disappointed investors as the software company's growth expectations were slightly revised downward. However, this has not dampened Train's optimism about the company's prospects.

“As long-term holders we must avoid being backward looking, but have to note that the new medium-term forecasts for Sage, of its revenues growing at high single or low-double digits, would have appeared incredible five years ago, when the company was struggling to grow at all,” he said.

Performance of share YTD vs index

Source: FE Analytics

Moreover, Train explained that Sage should benefit from two “big opportunities”. One of these is the growth of its Intacct subsidiary in the US and other geographies, while the other is to capitalise on new artificial intelligence (AI) enhanced services to deliver substantial efficiency gains.

“There are few listed UK companies with a global strategic opportunity comparable to this and Sage’s current market capitalisation of c£10bn could be much higher, we expect, if it can execute on that opportunity,” Train said.

Earlier this year, Train shared a list of six FTSE 100 companies that he believes will benefit from the advancement of artificial intelligence. That list already included Sage.

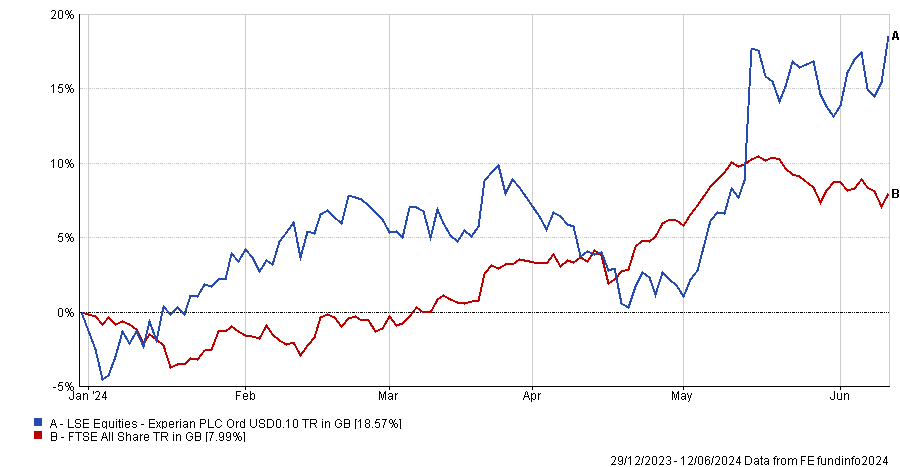

Another company in this list was Experian, which Train is intending to top up as well. Unlike the two previous holdings, Experian has performed well recently, with its latest results prompting analyst upgrades for the company’s medium-term revenue growth and higher profit margins, which Train assesses as credible.

Performance of share YTD vs index

Source: FE Analytics

He said: “The lessons we have learned from watching successful digital and software businesses over the past decade is that growth rates and profitability can scale as such companies’ services become increasingly valuable to a growing customer base. Experian is one of a relatively small set of UK-listed companies that offer participation in such effects.

“Those lessons also suggest that the ostensibly “high” prospective P/E that Experian trades on, of c28x, is, in fact, not high at all and the shares offer good value.”

Finsbury Growth & Income achieved a total return of 1.6% in May, while its year-to-date performance stands at 0.1%, according to FE Analytics.

Performance of investment trust in May and YTD vs sector and benchmark

Source: FE Analytics