Despite a year of election fever, with more than 70 countries are expected to go to the polls, wealth managers have become more bullish on equities, according to a survey by Asset Risk Consultants (ARC).

Sentiment towards stock markets has risen to 57% amongst wealth managers, a dramatic rise from the -22% sentiment over the past 12 months. This swing suggests investment managers are becoming less concerned with the consequences of upcoming elections.

Additionally, 63% of the 90 surveyed chief investment officers (CIOs) from wealth management firms were now expressing positive views on equities, a rise from just 13% this time last year.

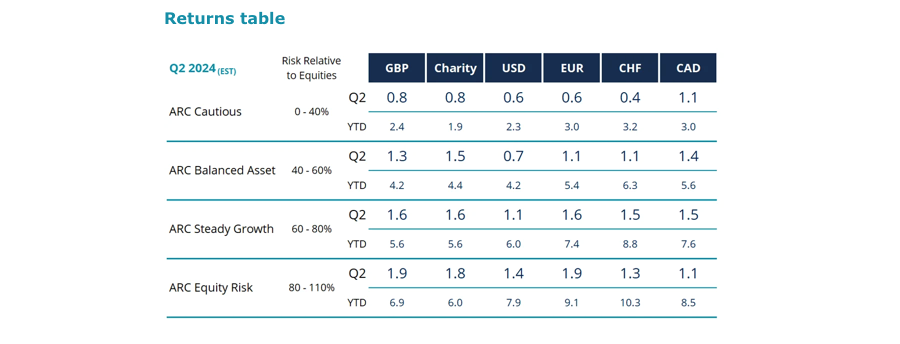

Source: ARC

ARC CIO Grant Wilson said, while elections can drive market volatility, recent analysis suggests that new government proposals can boost demand.

“In the medium-to-long term, reforms could create a more favourable business environment and support sectors with a high domestic exposure.”

However, Wilson also noted that, despite increased positivity, “the longer-term outlook is more uncertain, with the US election likely to have a far greater impact on the global economy, which could influence bond yields and potentially lead to higher interest rates in 2025.”

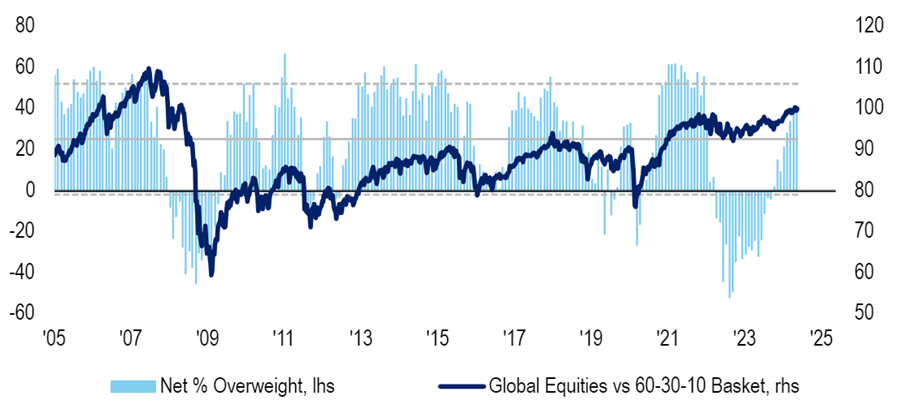

Indeed, last month’s Bank of America Global Fund Manager Survey found a net 39% of asset allocators are running overweights to equities.

Percentage of investors overweight equities

Source: Bank of America Global Fund Manager Survey, Jun 2024

The survey, which polled 206 fund managers running a collective $640bn, revealed that investors are underweight bonds, cash and real estate. Commodities were the only other overweight, although at much lower levels than stocks.

However, Bank of America also found fund managers consider politics to be a growing risk. The US election was cited as the market's main tail risk by 16% of investors, up from just 9% in the previous survey, while the proportion worried by geopolitics moved from 18% to 22%.