Investors are too optimistic and not concerned enough about geopolitics, slowing consumer spending and the potential for an inflation surprise, according to a survey of strategists by Natixis Investment Managers.

Markets shone in the first half of 2024 despite myriad headwinds, including sticky inflation and high interest rates, which have caused a cost-of-living crisis in recent years.

This, coupled with wars in Europe and the Middle East, and a turbocharged election cycle, should have weighed on markets, yet they haven’t.

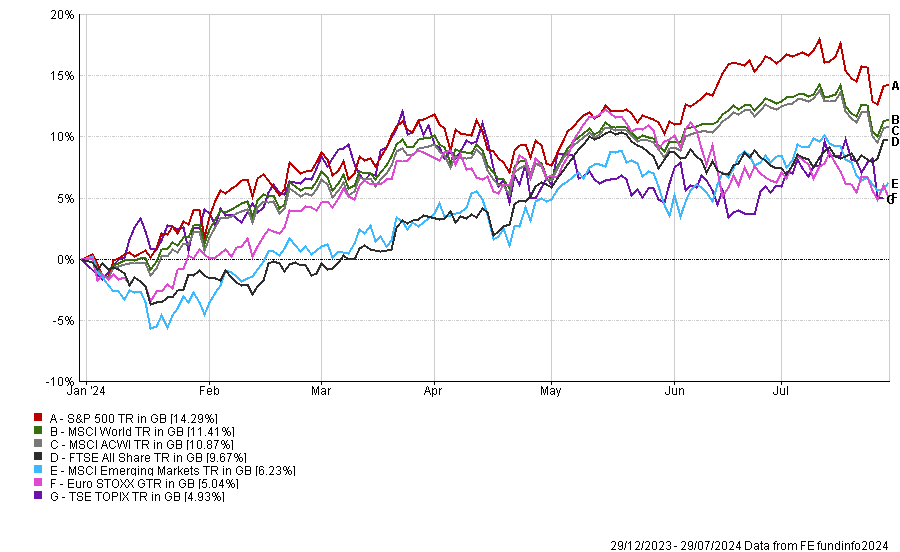

Performance of major equity markets over YTD

Source: FE Analytics

Mabrouk Chetouane, head of global market strategy at Natixis, said: “We have seen a strong start to the year with robust stock market performances, easing inflation and a resurgence of the bond market. Tech growth has continued to bolster US stock markets, with the S&P and Nasdaq up 15.3% and 18.6% respectively, with the strategists having no doubt that US markets will continue to lead the way in the second half of the year.

“However, investors should be cautiously optimistic as they continue to face an array of headwinds in the second half of the year, led by politics, geopolitical tensions, potentially higher for longer rates, slower consumer spending, and elevated levels of government debt.”

Of the 30 experts surveyed, most believe there is no risk of a global recession, but that does not mean the next five months are without challenges. Most see the US election as a medium-to-high-risk event, as “elections matter for markets”. Some 60% think the US election will more likely weigh on the market than support it.

Chetouane said “all eyes” will be on the US and the outcome of the presidential race, which may have “wide knock-on effects to policy, markets, and geopolitics”.

Geopolitics outside of elections are also on the radar of strategists, with most uneasy about wars around the world and tensions between the US and China. Almost half think this could cause the end of the current rally.

Perhaps the biggest issue however is inflation, with 40% of respondents worrying that surprise inflation could stop the current market rally, while almost four-fifths are concerned by the prospect of higher rates for longer.

Strategists are more concerned about interest rates staying higher for longer than for central banks to be too aggressive in their cuts, with the main concern centred around the number of cuts, rather than the timing.

They think rate changes have to be managed across regions and are more worried that rate cuts will be under-coordinated between central banks. Expectations are for the Federal Reserve to cut rates once this year, with the Bank of England European Central Bank at two apiece.

To combat all of the uncertainty, Chetouane said investors should “look to diversify portfolios across bonds, equities and alternative investments to prevent over-exposure to a single asset class”.

In equities, most still believe the US is the place to be, with two-thirds backing the American market to make the highest return in the second half of the year, boosted by the rise of artificial intelligence.

The report said: “While they believe returns will be less concentrated, 60% think the information technology sector will be the top performing in the US in the second half.”

For bonds, there is a focus on quality, with strategists favouring government and investment grade corporates over riskier high-yield and emerging market securities.

Meanwhile, alternative investments are expected to play a diversification role in portfolios, with six in 10 of those surveyed suggesting a portfolio made up of 60% equities, 20% fixed income and 20% alternatives will outperform the traditional 60/40 portfolio.

They have a preference for strategies that offer diversification, rather than those that can boost returns, with precious metals and absolute return strategies popular.

“Strategists see the potential for these traditional risk mitigators to deliver both in terms of downside protection and, in the case of precious metals, a continued hedge on inflation,” the report read.