The savage market rotation of the past month, with large-cap tech selling off and small-caps rebounding, illustrated the virtues of pairing managers with different styles to dampen a portfolio’s overall volatility.

Even the best managers don’t outperform “in a straight line” and might experience a few years of “absolutely terrible” returns, said Simon Evan-Cook, a fund manager at Downing. “We try to find heroic fund managers that are on different journeys so they will have peaks and troughs at different times.”

Below, Trustnet asked fund selectors to suggest an aggressive and a defensive global equity fund that pair well together.

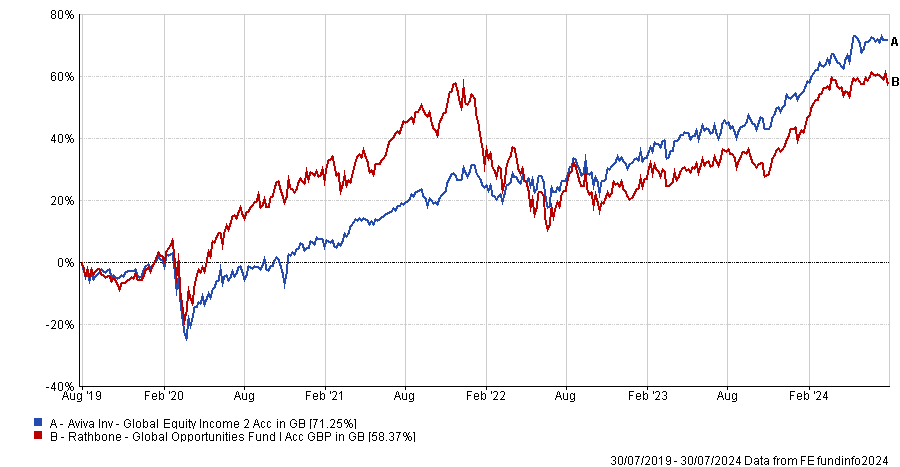

Rathbone Global Opportunities alongside Aviva Investors Global Equity Income

Chris Metcalfe, chief investment officer of IBOSS Asset Management, said one of his firm’s most successful fund pairings has been Rathbone Global Opportunities and Aviva Investor Global Equity Income.

Performance of funds over 5yrs

Source: FE Analytics

Rathbone Global Opportunities, managed by FE fundinfo Alpha Manager James Thomson for more than 20 years, “takes a high-conviction approach with a strong historical bias for US large-cap stocks”, he said.

Thomson’s largest holding is Nvidia but his approach to the chip designer differs from other managers. “He has continuously top-sliced this stock through its exponential growth phase and used the proceeds to fund many other investment ideas,” Metcalfe explained.

Although it has occasionally experienced larger than average drawdowns, the fund is the second-best performer in the IA Global sector over 20 years to 30 July 2024, according to FE Analytics.

The Aviva Investors Global Equity Income fund has been led by Alpha Manager Richard Saldanha for more than a decade, with co-manager Matt Kirby joining him in 2017. It has a blended style focusing on large-caps but is more geographically diverse than Rathbones’ fund, with 40% in the US, 30% in the eurozone and 16% in the UK.

It aims to deliver at least 125% of the income return of its benchmark and has much lower drawdown figures and volatility than its competitors, Metcalfe said. It is the second-best performing fund in the IA Global Equity Income sector over 10 years.

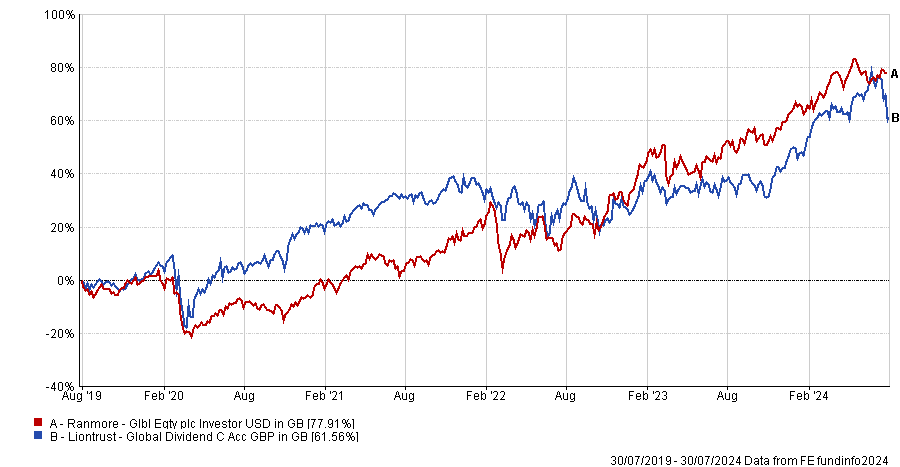

Ranmore Global Equity plus Liontrust Global Dividend

Evan-Cook suggested pairing the growth-oriented Liontrust Global Dividend fund with Ranmore Global Equity, a value strategy. Both funds are reasonably volatile on their own, but a combination of the two would give investors a smoother ride, he said.

Performance of funds over 5yrs

Source: FE Analytics

Liontrust Global Dividend’s managers Storm Uru and James Dowey look for companies with high growth prospects. They have a tighter valuation discipline than many growth managers and have been adept at trimming their largest positions to take profits, which makes market rotations less painful, Evan-Cook explained.

Meanwhile, Sean Peche at Ranmore Global Equity is a “proper value manager” and contrarian investor who is “happy to invest in stocks and industries that are hated by other investors”.

Peche has higher turnover and a shorter holding period than most managers – “the shorter the better, as far as he is concerned” – which suggests he is getting the timing right for when companies’ share prices will correct, Evan-Cook said.

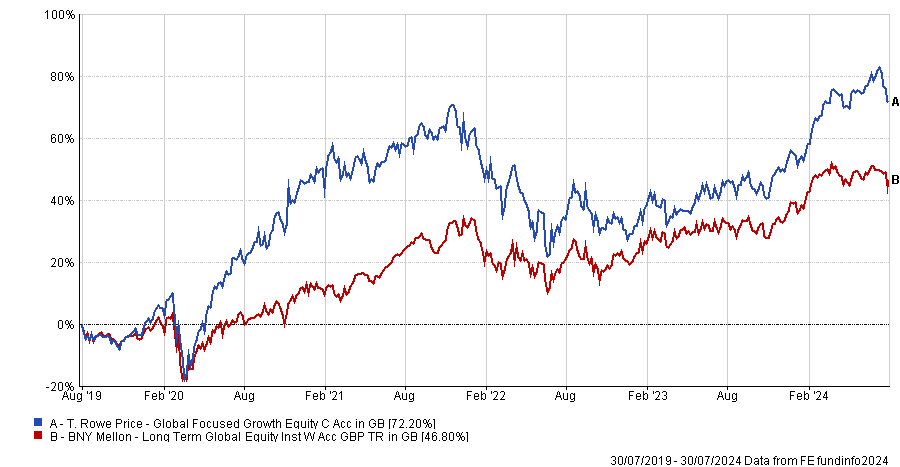

T. Rowe Price Global Focused Growth Equity and BNY Mellon Long Term Global Equity

Ajay Vaid, senior investment research analyst at Square Mile Investment Consulting and Research, suggested pairing T. Rowe Price Global Focused Growth Equity with BNY Mellon Long Term Global Equity. The former has a more aggressive performance objective, while the latter is more conservative and holds up better during times of market stress.

Performance of funds over 5yrs

Source: FE Analytics

David Eiswert has run the T. Rowe Price Global Focused Growth Equity fund since 2012. He invests in 60-80 companies with improving returns on capital and strong growth prospects, most of which are large-caps. The characteristics he looks for include an attractive industry structure, a sustainable competitive advantage and the potential to grow market share, a favourable business backdrop and a shareholder-focused management team.

“The fund has demonstrated an ability to deliver strong relative performance in rising markets, although it may lag its index, the MSCI AC World, at times of market stress, or when its investment style is out of favour,” Vaid explained.

On the other hand, the BNY Mellon Long Term Global Equity fund is “managed collegiately by a well-disciplined team” at affiliate Walter Scott & Partners, with a “simple mantra of investing for the long-term in high-quality companies,” he said.

“The team applies a seven-stage process to produce in-depth fundamental research, which identifies stocks with the potential of generating wealth at 20% per annum. Stocks meeting the team’s criteria have a ‘stock champion’ and any concerns are discussed on a weekly basis, meaning that all members of the team are well-informed on all portfolio holdings,” Vaid said.

The portfolio is benchmark agnostic and tends to have less exposure to companies requiring significant capital, such as miners.

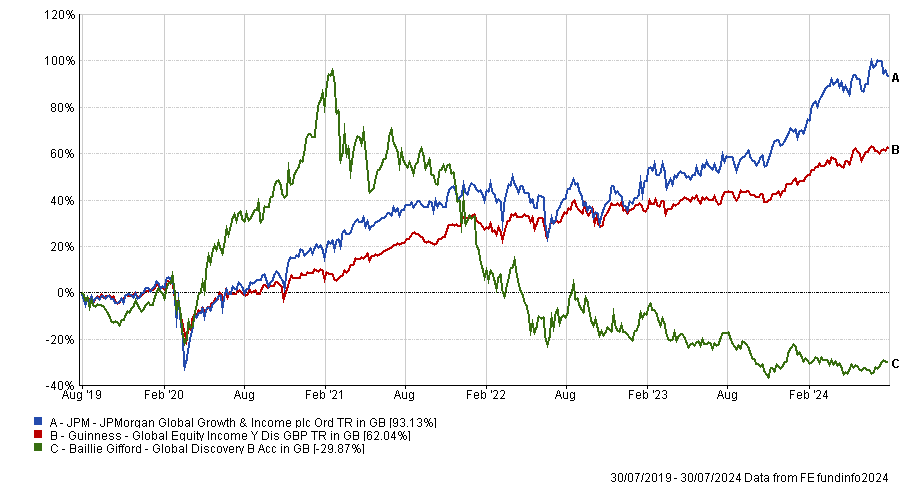

Guinness Global Equity Income with Baillie Gifford Global Discovery or JPMorgan Global Growth & Income

Sophie Turner, research assistant at FE Investments, and Stella Boden, private client assistant investment manager at Tyndall Investment Management, both chose Guinness Global Equity Income for ballast.

Turner paired it with Baillie Gifford Global Discovery, a growth fund with a bias towards small and mid-caps, while Boden suggested JPMorgan Global Growth & Income.

Performance of funds over 5yrs

Source: FE Analytics

Ian Mortimer and Matthew Page at Guinness Global Investors look for resilient companies with a higher return on capital over the long term.

Boden said: “Their focus is on companies that can consistently and sustainably grow their dividends, as they believe this leads them to quality, compounding companies with defensive characteristics.”

Turner added the fund tends to perform well in inflationary environments because it invests in companies than can pass on cost increases to their customers and maintain margins. As such, it is overweight consumer staples companies with pricing power.

Mortimer and Page have also invested in artificial intelligence and semiconductors but are doing so via more defensive, “cash cows” that pay stable dividends – not the “cutting-edge companies” found in Baillie Gifford’s portfolios, she explained.

Meanwhile, Baillie Gifford Global Discovery invests in innovative companies in the early stages of development. It has 43.9% in healthcare including biotech and health tech. It can experience “big spikes” when these parts of the market perform well but it can also be very volatile, Turner warned. The fund performed strongly just after the Covid lockdowns but has struggled in recent years as small-caps have floundered.

By contrast, JPMorgan Global Growth & Income has 27% in large US tech stocks and has outperformed significantly as a result. “It is relatively cheap, with an ongoing charges figure of 0.53% and has a comfy dividend yield, which is why we like holding it for our clients,” Boden said.