The world needs more electricity. We believe that population growth, data processing led by artificial intelligence (AI), precision manufacturing and the electrification of the economy will drive power demand growth not seen in a generation. This phenomenon is creating both substantial opportunities and potential challenges for listed infrastructure companies.

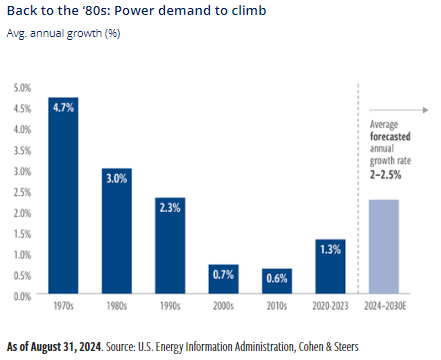

While power demand in the United States has been largely flat for nearly two decades, this trend is now reversing. We expect overall power demand to grow by about 2.5% per year on average through 2030, as the chart below shows. Some utilities are expected to see demand growth above 5%.

There will be winners and potential losers in a world of higher power demand. We believe there will be opportunities for utilities and nuclear power. However, there are regulatory nuances to navigate, as well a need to separate hype from substance. Active managers who are acutely focused on infrastructure markets are well positioned to identify true beneficiaries.

Data centres are a key driver of power demand

Goldman Sachs estimated that data centres will make up 11.5% of total power demand by 2030, up from just 3% today. This demand will require well over $50bn of capital investment in US power generation capacity. We also expect tens of billions of dollars in transmission and related grid investments to support reliability and connect new generation to customers.

There is an arms race among hyperscalers to build and monetise AI models. AI workloads, across both training and inference, require significantly more computational power than non-AI applications.

We expect robust hyperscale capital expenditures to build and maintain AI models and we believe that US hyperscale power demand will grow by more than 50 GW by the early 2030s. To put this into context, 50 GW could power approximately 50 million homes.

Longer term, the ability of hyperscalers to monetise these models will be key to sustaining growth. Further, the ability of utilities and developers to meet this demand remains an open question.

Growth in power consumption is not just a US phenomenon. We expect global power demand to rise nearly 30% by end of the decade.

Electrification creates long-term opportunities

Another driver of higher electricity demand is the increasing internet-of-things economy, including the adoption of electric appliances globally, coupled with the growing number of electric vehicles (EVs) on the road.

This demand is growing faster than the grid can handle, presenting both challenges and opportunities for utilities, which will be critical in meeting surging power demand.

Many utilities have revised annualised demand growth forecasts higher. As data centres look poised to consume a larger share of total generation, concerns have emerged about rate design – specifically, that residential customers might end up subsidising data centres’ power bills, an outcome that could be unacceptable to utility regulators.

Further, several utilities have indicated they simply can’t keep up with potential customer needs for power and there are long lead times to build both new generation and transmission in many areas. This is causing data centres to explore alternative solutions, away from regulated markets. Constraints across the power and utility value chain could hinder supply.

There is also a likelihood of substantial ‘double counting’ in reported utility data centre pipelines, as they are submitting interconnection requests to multiple utilities at once, hoping to obtain the fastest possible time to power.

Overall, the market views rate design and supply chain risks as manageable for now. Optimism about data centres and other demand drivers – as well as lower interest rates – has helped drive the S&P 500 Utilities index to a nearly 20% return this year (through August), slightly ahead of the full S&P 500 return of 19.5%.

However, it is important to distinguish between independent power producers, fully regulated utilities and integrated utilities (regulated utilities that also operate unregulated generation).

Nuclear power will be part of the solution

Energy security concerns, higher power demand and continued challenges associated with the intermittency of renewables are leading to a nuclear renaissance. Consumers and policymakers generally view nuclear as a clean and reliable energy source. Notably, the Inflation Reduction Act included $6bn for nuclear energy production.

That said, new nuclear construction is difficult in developed economies with stringent permitting and approval processes, especially given its long history of cost overruns and substantial construction timeline delays. Regulated utilities are also hesitant to invest in new nuclear without explicit regulatory or government guarantees.

Our expectation is that existing nuclear plants will see their lives extended and start-up companies will work to lower costs on small modular reactors. Whether cost declines happen, we believe that the existing nuclear fleet is far more valuable than investors previously appreciated.

To that point, Constellation Energy recently announced the restart of the Crane Clean Energy Center in Pennsylvania, with a 20-year agreement to sell power to Microsoft. This follows a similar agreement between Talen Energy and Amazon. While these types of transactions will face regulatory scrutiny, other similarly structured contracts are being explored as one solution to meet rising electricity demand.

Power demand is part of a favourable backdrop for infrastructure

Overall, though continued regulatory support for investment remains critical, rising power demand is simply part of a wider backdrop that is favourable for listed infrastructure.

We are entering a macro environment that favours infrastructure. Infrastructure trades at a rare discount to global equities and at a steep markdown to historical relative multiples. The asset class has historically produced favourable absolute and relative returns in periods of slowing growth and greater-than-expected inflation. With the global economy shifting into a lower gear, and amid generally more dovish central bank policies, infrastructure’s appeal is compelling.

Ben Morton is head of global infrastructure at Cohen & Steers. The views expressed above should not be taken as investment advice.