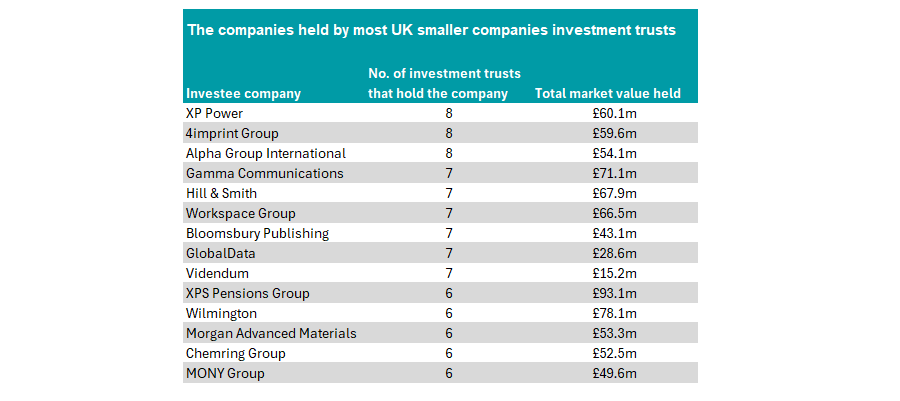

Power-supply firm XP Power, marketing company 4imprint and financial-services business Alpha Group are the most-owned UK smaller companies by specialist investment trusts, according to data from trade body the Association of Investment Companies (AIC).

Of the 22 trusts in the IT UK Smaller Companies sector, eight have a position in one (or more) of the three stocks, as the below table shows.

Source: The AIC

Stuart Widdowson, manager of Odyssean Investment Trust, is one of the backers of XP Power, highlighting its “strong and long-term global customer relationships in industrial, semiconductor and healthcare sectors”.

“The company, like its peers, is going through a periodic industry downturn, which is longer than historically has been the case. We have seen this before and the market recovery, when it comes, is likely to be very strong.”

He noted the business model is highly cash generative and the company is undervalued, with its closest peer trading on the US NASDAQ market valued at almost double XP’s rating.

Indriatti van Hien, co-manager of Henderson Smaller Companies Investment Trust, is another backer of XP Power.

“Its integrated approach, which focuses on reducing power consumption and improving the durability of products, combined with the ongoing support they provide, means it tends to enjoy long relationships with customers,” she said.

“In addition, once it receives product approval from clients, there is an annuity-like revenue stream for the lifetime of the customer’s equipment, which is typically five to seven years.”

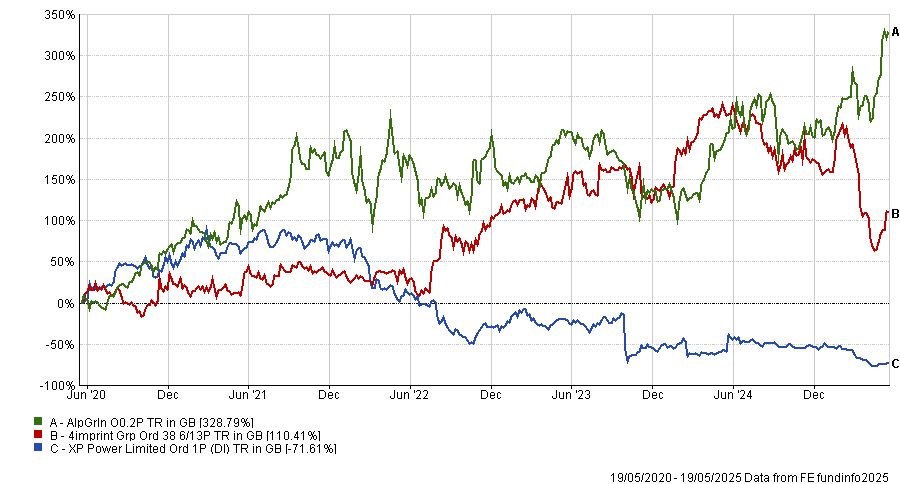

Total return of stocks over 5yrs

Source: FE Analytics

Georgina Brittain, co-manager of JPMorgan UK Smaller Companies IT, holds 4imprint, which she described as a “market leader in promotional gifting in the US” with around a 5% market share.

“Currently buffeted by concerns over the US economic environment and the potential tariff impacts, we expect 4imprint to prove itself a long-term winner as it has in the past,” she said.

“The company has experience of previous downturns and of the impact of US tariffs, and has a playbook of how to manage them. The company has a track record of growing strongly into a recovery in its market and taking market share.”

Six further companies are owned by seven of the IT UK Smaller Companies peer group, including Bloomsbury Publishing, the book seller behind smash hits such as Harry Potter and romantic novel series A Court of Thorns and Roses.

Charles Montanaro, portfolio manager of the Montanaro UK Smaller Companies investment trust, said: “It is the only UK-listed publisher to combine general and academic publishing under one roof – a strategic advantage that brings stability and resilience.

“Academic publishing, with its recurring revenues and strong margins, helps offset the more volatile nature of trade publishing.”

He also lauded the firm for its “remarkable” ability to spot a popular book series early, highlighting chief executive Nigel Newton as the first to recognize the talents of J.K. Rowling (the Harry Potter author).

“With more than 96,000 active titles and a successful shift to digital formats such as e-books and audiobooks, the company is expanding margins and deepening customer engagement,” he added.

“In short, this is a business with creative flair, recurring revenue, a low-risk approach to publishing and an enviable backlist – a rare combination.”

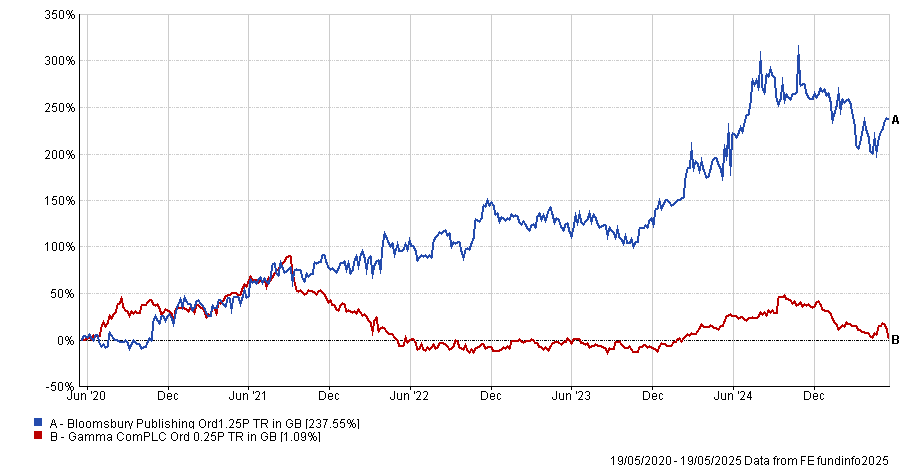

Total return of stocks over 5yrs

Source: FE Analytics

Another with seven backers is Gamma Communications, which provides services to small and medium-sized enterprises (SMEs), such as enabling internet voice calls to be integrated within a company’s existing telecoms system.

Abby Glennie, co-manager of abrdn UK Smaller Companies Growth, is one of the seven. “Over 10 years since IPO, Gamma has delivered an 18% compound annual growth rate. The strategy includes offering an increased range of third-party products, helping its customers drive growth without incurring overly hefty product development costs,” she said.

“With 93% recurring revenue in the UK, Gamma has high earnings visibility, is cash generative and has a net-cash balance sheet. Strong organic growth and bolt-on acquisitions, such as Starface in Germany, enhance its market position.”

The company moved from the Alternative Investment Market (AIM) to the main stock market earlier this month, which could also attract new investors, she noted.

Five additional stocks were each backed by six small-cap investment trusts, including pension consultants XPS Pensions, which Brittain said was “well positioned to benefit from regulatory changes driving increased demand for advice from pension schemes” and MONY, the UK price comparison website.

Owned by William Tamworth and Mark Niznik, co-managers of Artemis UK Future Leaders, they said MONY has consistently generated strong cashflows and has a very strong balance sheet.

“This gives the business options: either to invest, to do M&A or to return surplus cash to shareholders: it’s currently one of the record numbers of small-caps buying back shares,” they added.

“We are particularly excited by the opportunity from SuperSaveClub – which now has 1.3 million members. This has the potential to reduce MONY’s reliance on Google and drive greater repeat business.”