Investors have forgotten how to think negatively and are developing optimistic conclusions about markets that will backfire on them, according to James Athey, fixed income manager at Marlborough.

Last week, we spoke to a fixed-income manager who believed that investors had become too pessimistic, blinding them to opportunities in the riskier end of the market. Here we speak to a fixed-income manager who said that investors have become obsessed with momentum and developed incredibly optimistic and “perverse conclusions” about markets.

Since the 2008 global financial crisis “markets have behaved like it is Christmas”, delivering returns well above historical averages. This has led to momentum-driven investing becoming ingrained in markets as investors began to assume that “because today is bullish, tomorrow will also be bullish.”

This is a dangerous assumption because some type of recession is inevitable, as Athey told Trustnet earlier this month. Economic cycles do not continue forever and when a downturn happens, it will move too fast for investors to react, punishing those who are too optimistic.

“I think investors do not know how to forecast or invest negatively unless what they see in front of them is negative,” he explained.

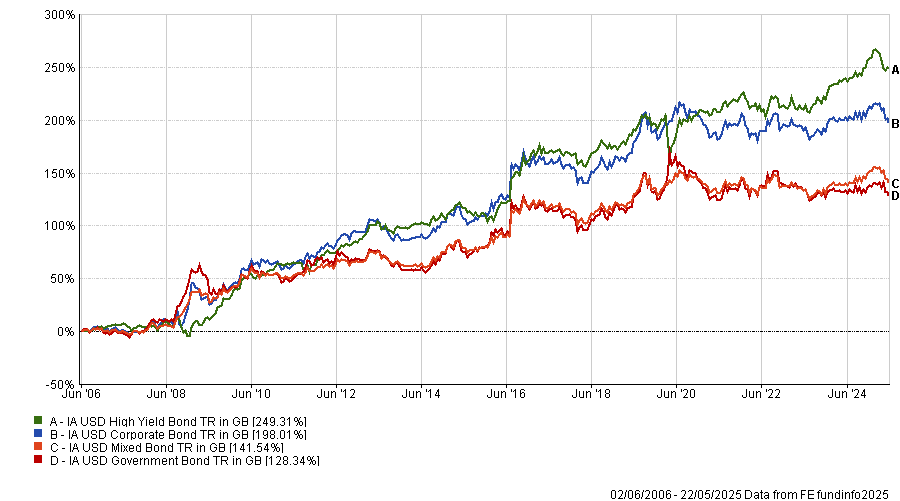

US corporate bonds are a great example of this, he said. While over the past 20 years the asset class has performed well, with the average fund in the IA USD Corporate bond sector up by 197.6%, the sector has underperformed this year with the average fund down 4.4%.

Performance of sectors over the past 20 years

Source: FE Analytics.

Athey argued that years of strong performance have made US corporate bonds “priced for perfection” and they are now failing to meet stretched expectations.

Macroeconomic data such as rising unemployment, declining growth and fluctuating fiscal policy are all broadly unsupportive to the outlook for US corporate bonds. In addition, US assets are “internationally liable”, with countries such as China and Japan owning a “shed load of US assets, almost the size of US GDP”, he explained.

This paints a worrying picture for US corporate bonds that investors are generally ignoring because the asset class has done well for years. Recent months have demonstrated that bad policies such as tariffs can be done “with the swipe of a pen”, however, which could rock markets. Yet the market has become “too hopeful on sequencing and assumed things would get better before they got worse”.

FE fundinfo Alpha Manager Jonathan Golan agreed and told Trustnet in December that his Man Sterling Corporate Bond had almost “completely collapsed our exposure to US investment grade credit” due to expensive valuations and all-time tight credit spreads.

Athey argued that if corporate bonds are too risky and a recession is inevitable, investors should be more defensive, not optimistic. Therefore, government bonds are currently the most appealing part of the fixed-income market.

“You should buy bonds for three reasons: for income, safety and diversification”. For years after the global financial crisis, bonds did not provide these benefits, so investors filled their portfolios with higher-risk assets, such as high-yield bonds and equities.

Government bonds are now in a much better position with most offering yields of around 4%, meaning investors can get a solid income from a defensive asset, he explained.

Additionally, bonds are finally serving as an effective diversifier again. While the relationship between government bonds and risk assets is not static, Athey said: “I would argue that there is no standard financial asset that consistently goes up when risk assets fall in price other than government bonds”.

As a result, his IFSL Marlborough Global Bond Fund has reduced its allocation towards corporate and high-yield bonds this year and increased its allocation towards safer government bonds. At the time of writing, treasuries make up 60% of the portfolio.

He conceded there are significant structural issues with government bonds, with deficits in a “worrying state of affairs” in both the US and UK. Credit rating agency Moody has downgraded the US credit rating in recognition of this deficit problem.

Nevertheless, this is not enough to diminish the importance of government bonds within investors’ portfolios. “This is the time in the cycle when you need your fixed income to be defensive”, he concluded.