Finsbury Growth & Income made 4.2% on a share-price-total-return basis over the six months to the end of March, according to the trust’s half-year results, leaving manager Nick Train to ask why his performance has not improved as he would have hoped.

Half of this return has come from the share price, with the underlying net asset value (NAV) up 2.4% in the six months under review. The FTSE All-Share Index rose by 4.1% over the same period.

“I look at the trust’s portfolio and I think – here is a collection of outstanding, predominantly global, companies, with obvious growth opportunities. Then I look at our NAV performance and wonder why it isn’t better,” said Train.

This could be a buying opportunity, he admitted, noting: “Then I think to myself ‘I should probably buy some more shares for myself’.”

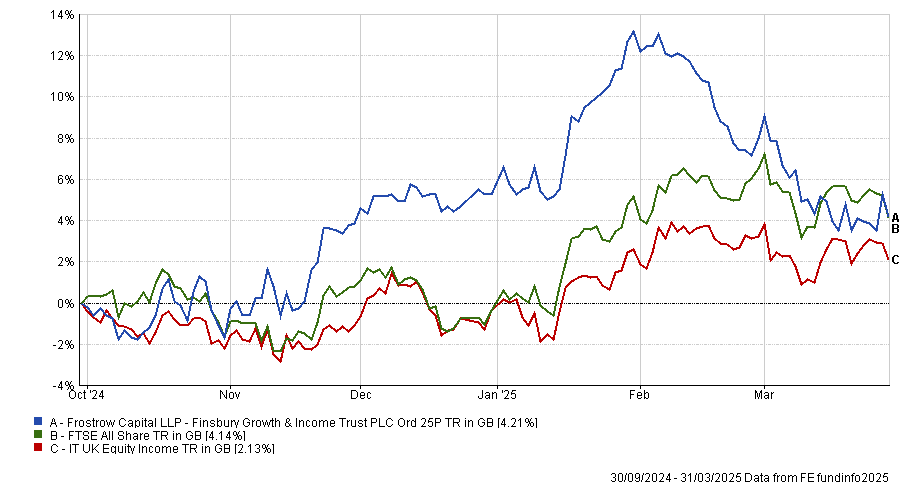

Performance of trust vs sector and benchmark over 6 months to end of March

Source: FE Analytics

He addressed concerns over US president Donald Trump's tariffs, which Finsbury Growth & Income chair Pars Purewal noted was a “threat” and something that the board would monitor closely moving forward.

Train said: “It is not clear that tariffs matter at all for major portfolio holdings, such as RELX, London Stock Exchange Group or Experian, because their products are digital, not physical.

“Moreover, the subscription-type revenues earned by that trio and other important holdings, such as Rightmove and Sage, are reassuringly predictable.”

However, he highlighted two large holdings that make products sold globally – Unilever and Diageo – which combine for more than 20% portfolio.

“Unilever has recently been able to reassure investors that its exposure to any permanent US-imposed tariffs is relatively modest. Only 20% of Unilever’s revenues are derived from the US and a proportion of those are manufactured there and therefore not subject to tariffs,” he said.

“For Diageo, the situation is, ostensibly, less reassuring,” he conceded as the company derives half of its profits from the US.

“It has the misfortune that two of its most important and popular products there are Mexican tequila and Canadian whiskey, both now at risk of tariff imposition,” Train noted, but said he was looking to add to the company rather than sell.

There are two reasons for this. First, Train believes tariffs will eventually be repealed or will become less effective.

Second, big tax cuts for US citizens could improve the prospect of a booming domestic economy, which would be a net benefit for the firm.

The manager also highlighted two new holdings in the trust: Clarkson and Intertek. These were bought following the sale of Hargreaves Lansdown to private equity in April.

“They are both service, not manufacturing, companies – in ship-broking and testing and assurance. Both are the best or amongst the best at what they do in the world. In other words, they contradict the narrative that the London stock market lacks world-class companies,” he said.

The FE fundinfo Alpha Manager has changed up his portfolio since 2020, including a “marked increase” in the trust’s exposure to UK companies that sell software services or data analytics tools.

While this has “not yet produced the sustained improvement in investment performance that all shareholders want to see”, he said the portfolio is now “better prepared to withstand the effects of tariffs and possible trade wars than it otherwise would have been”.

Overall, he concluded: “I do hope all shareholders will be rewarded for their patience, including me.”