Mergers and acquisitions (M&A) could be exactly what UK businesses need to become more popular among UK investors, according to Clive Beagles, co-manager of the JOHCM UK Equity Income fund.

Despite managers typically insisting that the UK has been full of great value opportunities, “the market has been stuck for quite a while” with businesses struggling to convince investors they are worth the investment.

As a result, the UK market has suffered “terrible outflows”, with UK investors withdrawing another £449m from domestic funds in May, continuing a trend of outflows from the market.

Source: FE Analytics

With UK stocks heavily undervalued, the market has been catching the eye of private investors and international firms, with businesses such as Hargreaves Lansdown exiting the stock market earlier this year after a bid from CVC Capital Partners.

For some managers this increased takeover activity could lead to a much smaller public market and a shrinking opportunity set. However, Beagles argued investors have developed the wrong idea about M&A activity because they “do not consider the impact it is having on companies.”

If UK businesses want to become more appealing, they need to become more proactive. Because undervalued businesses are now more likely to get purchased by international firms, companies “can’t just sit on their hands and hope the market eventually looks at them differently”.

“I think there is a fear among boards and corporate structures that they will get a takeover bid from international investors at a 40-50% premium and investors will just take it because there’s plenty of other opportunities on the market”.

To avoid this, UK companies are increasing doing “almost internal M&A” on themselves to identify inefficiencies and sell off parts of their businesses that improve their valuations and catch investors’ attention.

“This subtle internal M&A activity can be just as powerful, if not more, than someone telling you to buy the UK because it is one of the most undervalued markets in the world”.

There are companies “all over the market” that could benefit from this and, in the process, draw investors back to the UK. One example is Curry’s.

Early in 2024, the company was bid for by US private equity firm Elliott, as well as JD.com in China. A potential takeover encouraged Curry's to sell its underperforming Greek business, “which most people did not even know it owned”.

As a result, the company’s stock price surged in March 2024 when the sale was confirmed. Beagles explained that it deleveraged the company, allowing investors to become more optimistic and appreciate the business's strong fundamentals. As demonstrated by the chart below, the share price has climbed 134% over the past two years as a result.

Share price performance over the past 2yrs

Source: FE Analytics

He added that it is still underappreciated and has several subsidiaries under the surface that it could be encouraged to sell if international investors came knocking.

“I think we are beginning to see more activism from boards themselves. No one likes selling a big part of what they see as their best business, but if it is mispriced and there is a lack of domestic interest, there is room to make changes.”

For a more recent example, he identified FTSE 250 chemicals company Johnson Matthey, which invests in speciality chemicals and sustainable technologies. Shares are down 26.3% over the past five years.

Recognising the issue, the business sold the catalyst component of its business for £1.8bn last month, which has caused the share price to surge 28%. As a result, it is now slightly up over the past year and could continue to rally, he said.

Share price performance over the past month

Source: FE Analytics

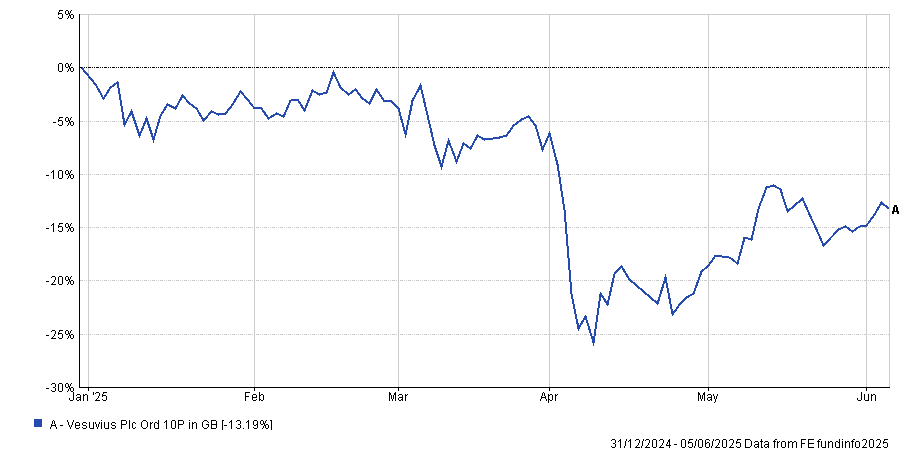

One company that could benefit from becoming more proactive and conducting this internal M&A is FTSE 250 iron and ceramics company Vesuvius, he said.

Year to date its share price has slid by roughly 12% following poor results but the business is full of inefficiencies that it could be encouraged to address if it receives M&A interest, said Beagles.

For example, it has two listed subsidiaries in India, representing roughly 80% of the company's total market capitalisation, but contributing less than 10% of its profitability.

Share price performance YTD

Source: FE Analytics

“Obviously, India is a higher-growth market, but if the whole market capitalisation is run by something worth a fraction of the profitability, I would be asking if there is an opportunity there”.