The market calm following Israel’s attack on Iran looks more fragile than it first appears, with the performance of global equities being propped up by a handful of sectors and countries, Trustnet analysis suggests.

This morning, Israel and Iran appear to have agreed to a ceasefire after 12 days of war. Both countries exchanged heavy fire overnight, before it came into effect.

Israel began Operation Rising Lion on 13 June, striking over a dozen sites across Iran, including nuclear facilities in Natanz, Isfahan, Parchin and Tehran. The operation targeted nuclear enrichment sites and eliminated Islamic Revolutionary Guard Corps commanders, marking the most direct Israeli action against Iran since April 2024.

Iran responded with Operation True Promise III on 15–16 June, launching hundreds of ballistic missiles and drones at Israeli cities, military bases and a hospital in Beersheba. Although Israel intercepted the majority of projectiles, several strikes caused civilian deaths and disrupted oil facilities.

The conflict escalated with continued Israeli airstrikes on Iranian command centres and infrastructure in Tehran. Diplomatic talks, including efforts in Oman, broke down amid the attacks.

Russia and China condemned Israel’s offensive and Gulf states voiced concern about regional instability, while European governments called for de-escalation. The US initially backed diplomacy, then shifted to threats against Iran before later moving toward military engagement.

On 21 June, US president Donald Trump authorised Operation Midnight Hammer. US bombers, submarines and jets struck Iran’s nuclear facilities at Natanz, Fordow and Isfahan using bunker-buster munitions.

The US administration said the strikes severely damaged Iran’s underground enrichment facilities. Iran placed its forces on high alert and warned of new retaliation, including possible action against US bases and shipping in the Strait of Hormuz.

But despite the tumultuous geopolitical events, markets have appeared calm on the surface. Below, Trustnet takes a closer look at how the markets reacted in the first week after Operation Rising Lion.

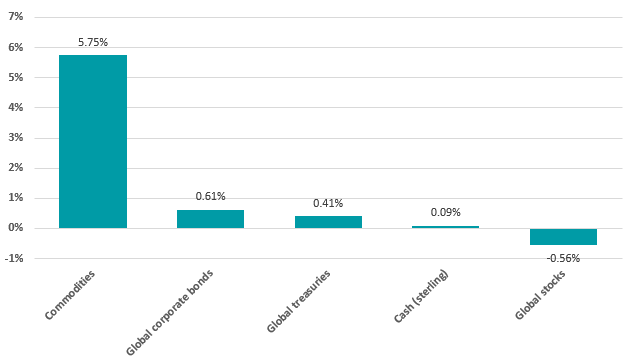

Performance of asset classes in the week following Israel’s attack on Iran

Source: FinXL. Total return in sterling between 13 and 20 Jun 2025.

The first wave of market response to Israel’s military strikes on Iran has been clearest in commodities, with the broad S&P GSCI index gaining 5.75% over the week. This sharp move reflects an immediate pricing-in of geopolitical risk to energy supply chains, particularly as key Middle Eastern infrastructure came under threat.

Elsewhere, investors rotated modestly into fixed income, with global corporate bonds and treasuries gaining ground. Equities, by contrast, fell only 0.56% globally, which seems a relatively muted decline but masks more significant cross-sector and cross-market divergence, which becomes clearer in the following charts.

Danni Hewson, head of financial analysis at AJ Bell, said: “It’s at times like these that investors must wish they had some kind of crystal ball to gaze into, but in the absence of such a magical mechanism a ‘wait and see’ approach could be the most logical choice.

“Markets were muted as investors waited for Iran’s response to America’s military move, but so far it seems most aren’t ready to price in a full-scale conflict.”

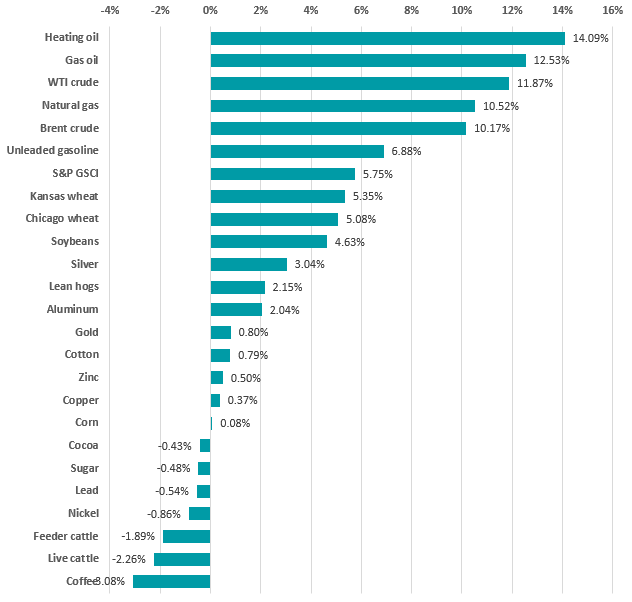

Performance of commodities in the week following Israel’s attack on Iran

Source: FinXL. Total return in sterling between 13 and 20 Jun 2025.

The rally in commodities last week was driven almost entirely by a spike in energy prices, with heating oil, gas oil, crude oil and natural gas all posting double-digit gains. These moves reflect market fears of direct supply disruptions in the Middle East and potential retaliatory attacks on regional infrastructure or shipping routes, particularly through the Strait of Hormuz.

Industrial metals and agricultural products were mixed or down, underscoring that the price action is geopolitical in nature, not cyclical. The differentiation within the asset class suggests investors are not betting on a global demand surge but pricing in a higher probability of conflict-related supply shocks.

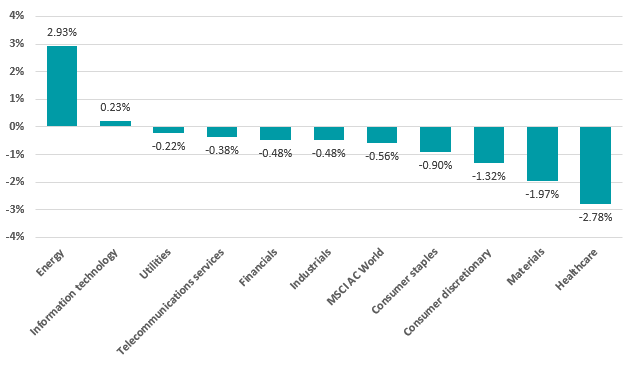

Performance of equity sectors in the week following Israel’s attack on Iran

Source: FinXL. Total return in sterling between 13 and 20 Jun 2025.

Global equities may have shown only a modest decline overall, but the sector breakdown reveals far greater stress beneath the surface. Energy was the standout, rising nearly 3% and effectively masking broader weakness, with economically sensitive and defensive sectors alike such as consumer staples, healthcare and materials posting sharp losses. Information technology stocks also rose, albeit slightly.

The leadership of energy stocks reflects not just rising oil prices but also a rotation into perceived geopolitical hedges, while losses in healthcare and consumer names suggest risk-off positioning extending beyond the obvious names.

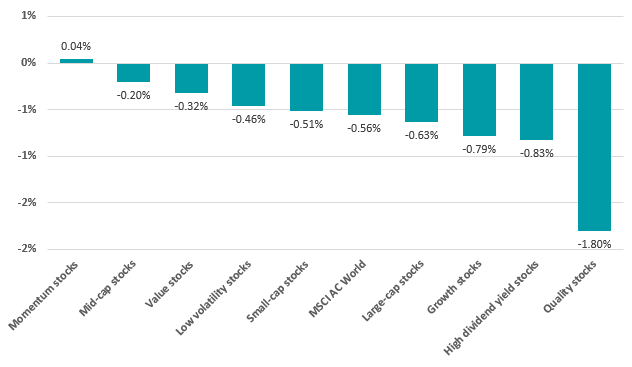

Performance of investment factors in the week following Israel’s attack on Iran

Source: FinXL. Total return in sterling between 13 and 20 Jun 2025.

Factor performance over the week further underscores how unusual and reactive the market environment has become. Momentum stocks made marginally positive returns, likely buoyed by their exposure to tech stocks, while quality stocks (typically seen as safe havens) posted the worst returns, down nearly 2%.

The underperformance of high-dividend, low-volatility and quality names implies a shift away from defensive consensus trades.

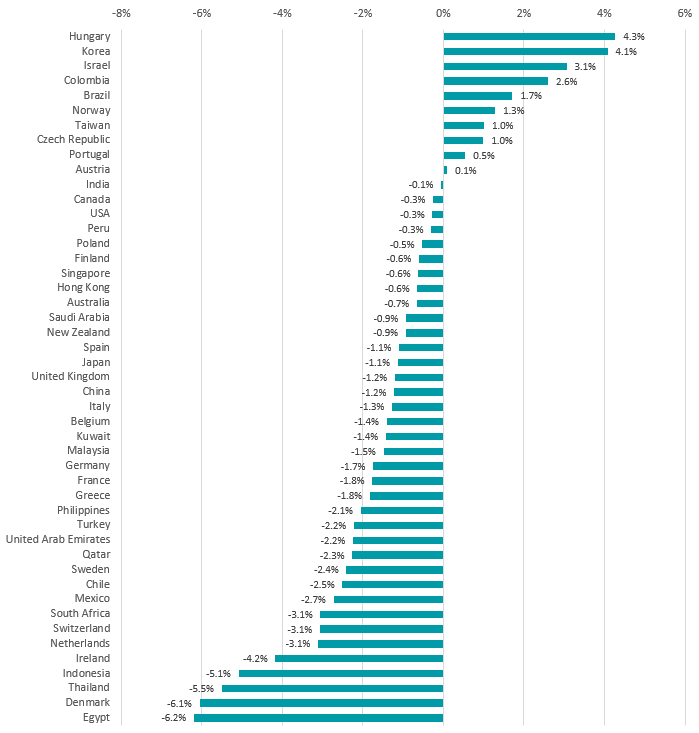

Performance of MSCI AC World countries in the week following Israel’s attack on Iran

Source: FinXL. Total return in sterling between 13 and 20 Jun 2025

The country breakdown reinforces that last week’s equity weakness was broad-based, with the majority of MSCI AC World constituents making negative returns. Egypt, Denmark and Thailand led the declines – each down more than 5% – while only a handful of markets, like Hungary, Korea and Israel, managed gains.

The wider picture is one of global de-risking, with steep drawdowns in both developed and emerging markets pointing to a reaction to geopolitical uncertainty rather than isolated idiosyncratic moves.

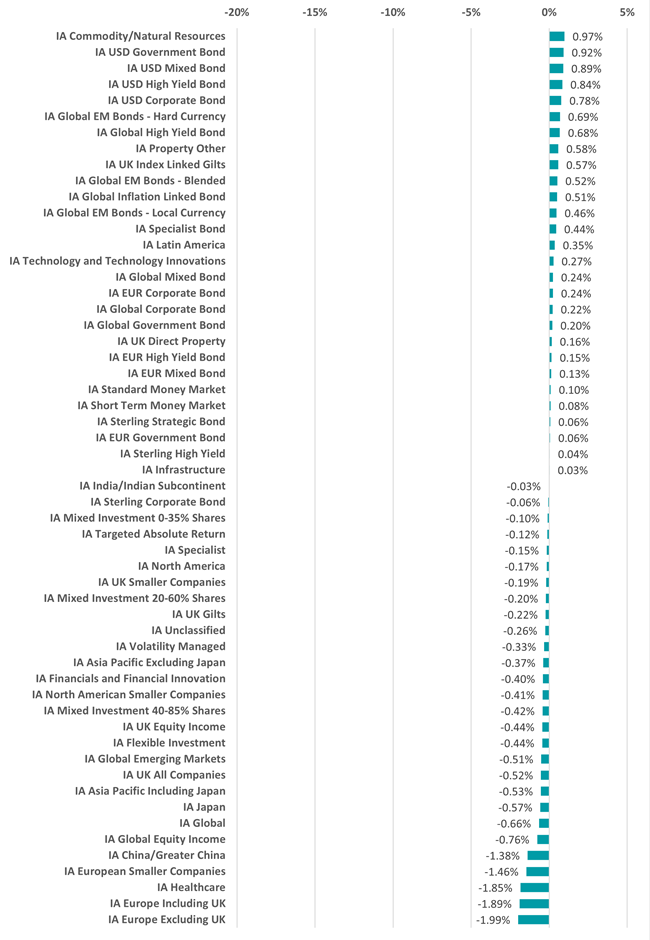

Performance of Investment Association fund sectors in the week following Israel’s attack on Iran

Source: FinXL. Total return in sterling between 13 and 20 Jun 2025

Commodity funds were the clear winners last week, with the IA Commodity/Natural Resources sector returning nearly 1%. This aligns with the sharp upward move in energy prices, as investors quickly repositioned around a risk premium on Middle Eastern supply disruption.

Bond and money market funds also saw modest positive returns, suggesting a measured flight to safety. US government bond and mixed bond sectors led fixed income gains.

Equity fund sectors, by contrast, showed widespread weakness, with the worst hit areas being those with regional concentration in Europe and healthcare exposure. The IA Europe Excluding UK sector lost nearly 2%, and IA Healthcare was down 1.85%, highlighting how risk-off sentiment extended across both cyclical and defensive allocations.

The depth of negative returns across regional equity funds reflects the global de-risking trend noted above. UK, Japan, China and global equity income strategies all underperformed, suggesting the volatility wasn’t confined to geopolitically sensitive geographies but instead reflected a repricing of global equity risk as a whole.