TACO, or Trump Always Chickens Out, is the kind of acronym that markets shouldn’t take seriously but have been in 2025. With the 90-day tariff pause from Liberation Day set to expire on 8 July, the question now might not be whether Trump will make another threat but whether this time he might actually follow through.

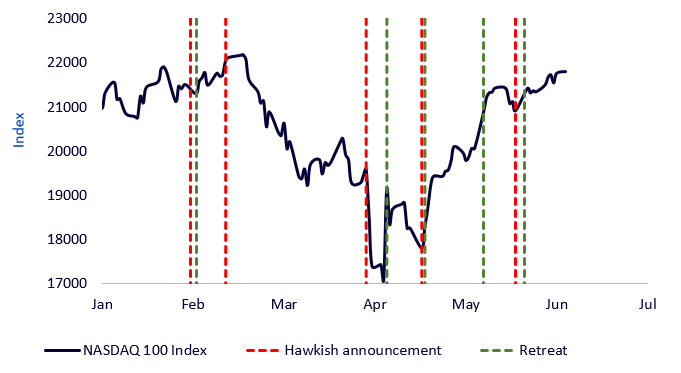

Coined by FT columnist Robert Armstrong, TACO has become a shorthand for a trading pattern that’s shaped much of this year: a Trump policy threat sparks fear, markets tumble, the US president pulls back and then markets rebound. The Nasdaq 100 has become the main stage for this drama.

Mobeen Tahir, director of macroeconomic research & tactical solutions at WisdomTree, said: “It describes president Trump’s pattern of making bold policy announcements, like imposing tariffs or threatening the US Federal Reserve, only to retract and soften later. This, of course, has resulted in significant market volatility.

“For investors in the Nasdaq 100, TACO has created a rollercoaster ride. For those inclined to trade tactically around these sharp market fluctuations, there have been plenty of opportunities to take views in either direction.”

The rhythm has been pretty consistent, almost to the point of a policy threat on Monday, a softening on Wednesday and a rally by Friday. Tahir explained that a typical reaction of the Nasdaq 100 to the US administration’s announcements has been “negative in response to the hawkish announcements and positive following the subsequent retreats.”

The Nasdaq and the TACO trade

Source: WisdomTree, PBS News, ABC News, Bloomberg, as of 10 Jun 2025

There’s no shortage of examples. In February, Trump signed an executive order slapping tariffs on Mexico, Canada and China. The Nasdaq 100 dropped. Two days later, he paused tariffs on Mexico and Canada. Markets bounced.

In April, he revived reciprocal tariffs – his Liberation Day – and the index sold off again. A week later, a 90-day pause was announced. Cue the rally.

May brought threats against the EU and Apple, and once again, markets whipsawed before those threats were delayed.

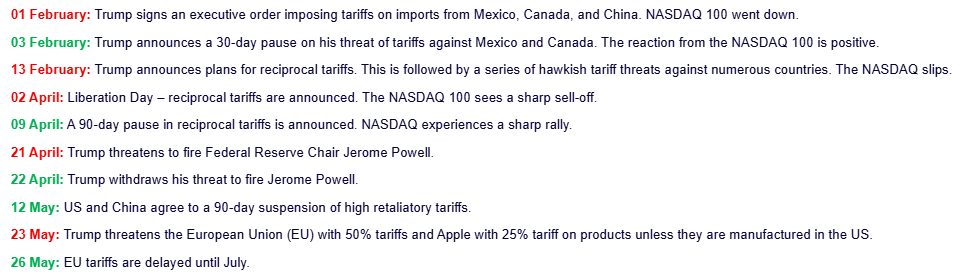

US policy announcements and Nasdaq reaction

Source: WisdomTree

Of course, it’s worth asking: is this really Trump backing down or was there never a real intention to follow through? Maybe these aren’t policy reversals, but strategic bluffs or strongarm negotiating tactics.

Regardless if it’s chickening out or The Art of the Deal, the market has learned to trade them like clockwork. And that’s where the risk lies.

“One hypothesis is that the TACO trade may be over because markets have become immune to new hawkish announcements from president Trump, knowing they will eventually be reversed or at least dialled down,” Tahir said.

“If markets anticipate this pattern, new tariff threats no longer deliver a shock effect.”

The danger, though, is that this perceived ‘immunity’ is not genuine resilience. Rather, it could just be a new habit. Markets are no longer pricing the threat but a pattern, and if that pattern breaks, the fallout could be significant.

So the question now isn’t whether Trump has bluffed before or backed down, because he has. The question is what happens when he doesn’t. What if one of these threats sticks? What if a 50% tariff on EU goods actually goes into effect?

Or if he acts on his past threat to fire Jerome Powell as Fed chair? What if companies like Apple, already walking a tightrope on global supply chains, face punitive tariffs for failing to move manufacturing back to the US?

Tahir summed it up: “What if president Trump announces a hawkish measure and does not retreat? What if he delivers a surprise that truly catches markets off guard?”

The scenarios might seem outlandish, but they’re just past threats that didn’t materialise. That’s what makes them dangerous: they’ve been seen as noise, not risk.

The Nasdaq 100, in particular, has become the lightning rod for this behaviour. Its high concentration of growth stocks, global revenue exposure and sensitivity to rate expectations make it vulnerable to shocks that challenge the TACO assumption of policy reversals.

None of this means that Trump will follow through next time. He may well continue to use threats as leverage without enacting them. But markets might not be properly hedging the possibility that he won’t. And when everyone’s on the same side of a bet, being wrong is rarely a trivial matter.

The TACO trade has worked because it’s been predictable. But when patterns become too predictable, markets stop preparing for the alternative. If 8 July arrives without a walk-back – if the tariff suspension expires and the bluff turns real – it won’t be just another dip to buy. It will be a lesson in just how fragile those expectations really were.

Gary Jackson is head of editorial at FE fundinfo. The views expressed above should not be taken as investment advice.