Investors took a lukewarm attitude towards mixed-asset funds in the first half of 2025 but strategies managed by St James’s Place, BlackRock, Coutts, HSBC and Premier Miton can boast strong inflows.

Data from the Investment Association shows mixed fortunes for the various multi-asset sectors this year. Investors have been buying some, such as Mixed Investment 40-85% Shares and IA Volatility Managed, while pulling money out of IA Mixed Investment 20-60% Shares and IA Flexible Investment.

Against this backdrop, Trustnet reveals the best-selling funds from the main mixed-asset, absolute-return and volatility-managed sectors over the past six months. Please note, this data is based on the UT & OEICS universe, which has some funds in different sectors to the Investment Association.

Source: FE Analytics

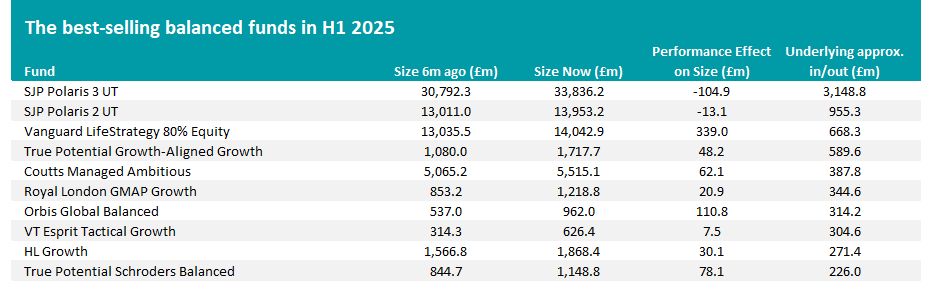

We start with the balanced funds, which tend to reside in the IA Mixed Investment 40-85% Shares sector, the largest mixed-asset peer group in the Investment Association universe; other funds reside in other sectors, like IA Unclassified.

Over 2025’s opening half, the best-selling fund was SJP Polaris 3 with £3.1bn in inflows; SJP Polaris 2 is in second place. St James’s Place launched the Polaris range in November 2022, which since then has become very popular, swelling to include a total of £66bn. SJP Polaris 3 is currently the largest fund in the Investment Association universe with assets of £33.8bn.

The range comprises four multi-asset fund-of-funds designed to match different risk profiles and investment timeframes. Each fund blends underlying investments across equities, bonds and other asset classes, with asset allocation managed by State Street Global Advisors.

The range is aimed at investors seeking a diversified, professionally managed solution, though fees are higher than many passive alternatives such as Vanguard’s LifeStrategy offering.

Other well-known funds on the list include Vanguard LifeStrategy 80% Equity, Coutts Managed Ambitious and HL Growth, although their first-half inflows are far below those garnered by the Polaris strategies.

Source: FE Analytics

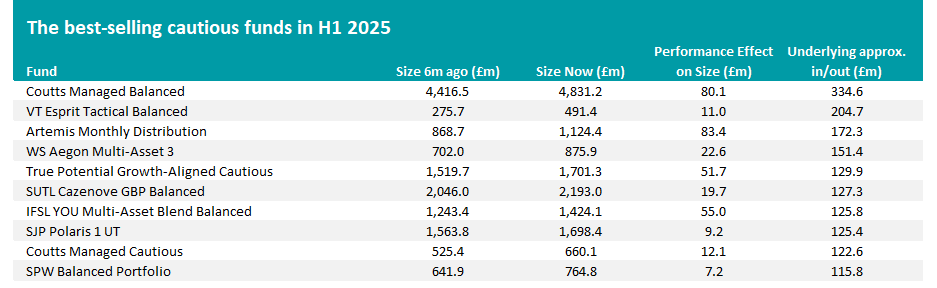

St James’s Place didn’t take the highest inflows among the cautious mixed-asset funds, however, although SJP Polaris 1 – the range’s lowest risk offering – appears in eighth place.

Coutts Managed Balanced was the sector’s most popular fund, with inflows of £334m over the six-month period. Coutts Managed Cautious also took in £123m to become the ninth best-selling fund.

The Coutts Managed Funds range, available through RBS, offers five risk-rated, multi-asset portfolios managed by Coutts investment professionals. Each fund combines active and passive strategies across global equities, bonds and alternative assets.

Artemis Monthly Distribution is another notable mention, with inflows of £172m. The fund is currently the best-performing member of the IA Mixed Investment 20-60% Shares sector over one, three and five years.

Jacob de Tusch-Lec and James Davidson run the strategy’s equity investments, while David Ennett and Jack Holmes are in charge of the fixed income elements.

Analysts at Rayner Spencer Mills Research said: “The fund brings together the expertise of two quality fund management teams, blending global equities, bonds and cash to create a well-diversified underlying portfolio. The fund is a strong option within a large sector.”

Source: FE Analytics

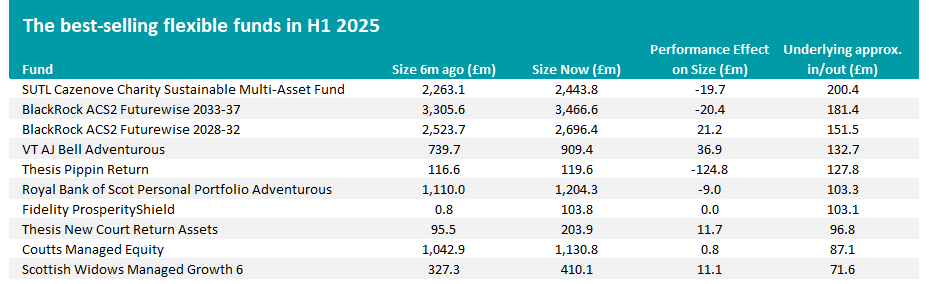

Among flexible funds, Cazenove Charity Sustainable Multi-Asset took in £200m to become the first half’s best seller. It is designed for UK charities seeking long-term capital growth and income through a diversified portfolio that aligns with sustainable and responsible investment principles.

Two BlackRock FutureWise funds are next. These are target-date multi-asset retirement funds tailored to cohorts planning to retire in five-year blocks and are aimed at investors seeking a ‘set-and-forget’ ESG-aligned retirement solution, which adjusts risk over time.

Source: FE Analytics

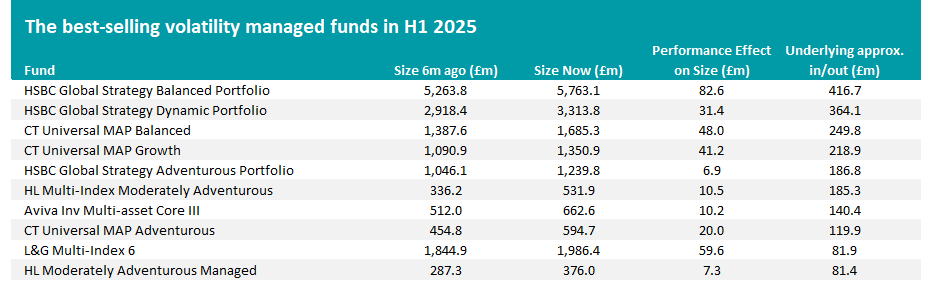

The past six month’s best-selling funds in the volatility-managed sector tend to come from HSBC Asset Management or Columbia Threadneedle.

HSBC Global Strategy Balanced Portfolio (inflows of £417m) and HSBC Global Strategy Dynamic Portfolio (£364m) top the table. The HSBC Global Strategy range comprises five actively managed, risk-targeted multi-asset portfolios – Cautious, Conservative, Balanced, Dynamic and Adventurous – which blend global equities, bonds, property and limited direct assets, with tactical tilts around a long-term, in-house strategic allocation.

They are managed by Nicholas McLoughlin, global head of multi-asset research at HSBC Asset Management, and his team. The range aims to deliver cost-efficient diversification with low ongoing charges, disciplined volatility control and a focus on global exposure without a UK bias.

Columbia Threadneedle’s CT Universal MAP range has three entrants among the best sellers. Each portfolio in the Universal MAP range uses active management for strategic and tactical asset allocation, security selection and risk oversight while maintaining low capped charges (0.29% OCF) to deliver a value proposition at, the firm argues, “a price more commonly associated with passive strategies”.

Source: FE Analytics

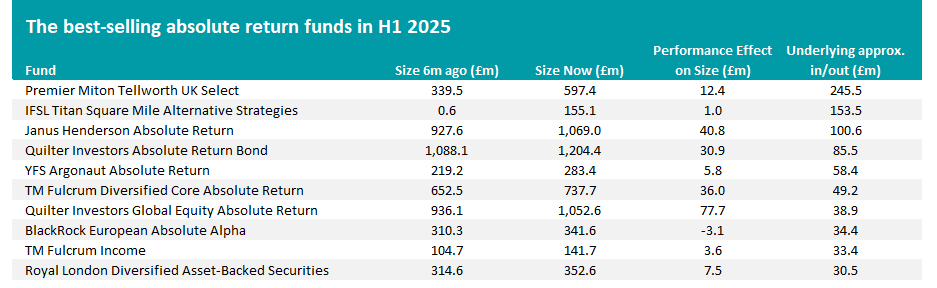

The absolute return sector is one that has fallen out of favour with investors in recent years but some funds still attracted decent inflows over the past six months.

Premier Miton Tellworth UK Select did the best, with inflows of £246m during the period under consideration. Managers John Warren and Johnnie Smith believe investors have biases that drive them to value, growth, momentum, macro or more event-driven investment factors; they also buy and sell calls on UK equities to hedge out this and ensure stock picking is the core driver of returns.

Analysts at FE Investments said: “Returns have been produced with very low correlation to UK markets, meeting its diversification objective.

“Performance during challenging periods for equity markets has been particularly impressive, with the fund generating strong positive returns in March 2020 and 2022 driven by the sell portfolio. Less favourable environments for the strategy have typically been during sharp risk-on moves.”

Janus Henderson Absolute Return is another well-known member of the sector that has been winning fresh inflows this year. Square Mile Investment Consulting & Research pointed out that returns were “meagre” between 2016 and 202, which the managers put down to the low cost of capital limiting share price dispersion.

“The steep increase in the cost of capital in the second half of 2022 and in 2023 brought increased dispersion and significantly better returns,” analysts added. “The managers have a good long-term record of stock selection (and therefore generating alpha) and have also protected investors' capital to a high degree in periods of market stress.”