The UK isn’t the first market investors think of for high-growth tech companies. That mantle has long been held by the US, which is home to behemoths like Microsoft, Meta and Alphabet – all of which have helped to drive the US exceptionalism narrative in recent years.

However, with the US under pressure and the likes of software group Visma expected to IPO in London, could this be a sign that times are a-changing, with the UK tech sector set to benefit?

Fund managers told Trustnet that the UK tech sector has a lot to offer investors, citing companies with strong fundamentals, recurring revenues and sector-specific expertise. They are also typically valued below international peers, even when the financial performance is comparable.

Sage

Arguably one of the most well-known on the UK tech scene, Sage was highlighted by Madeline Wright, co-manager of the £2.1bn WS Lindsell Train UK Equity fund.

Specifically, Wright points to the company’s financial management platform Sage Intacct which “has a chance of becoming a global standard product for the supply of digital services to small- and mid-cap companies”.

She added that the company’s management has indicated that Sage is close to achieving a combination of revenue growth and operating margin that equals more than 40%.

“Sage’s current margins are in the high 20%’s, implying Sage expects an acceleration in its revenues to above 10% per annum,” she said.

US comparators trade on much higher multiples than Sage’s 5x revenues – for example, Salesforce trades on 8.5x revenues for 12% growth – which “suggests that there could be significant further upside in Sage’s share price”, according to Wright.

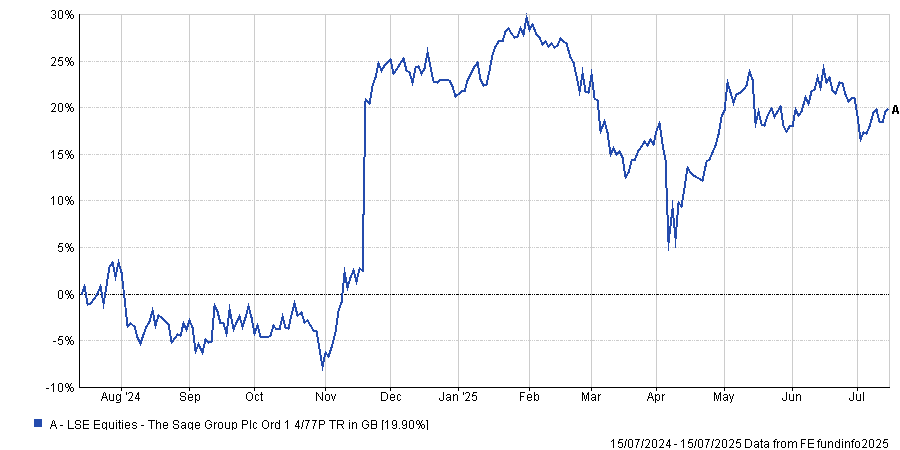

Sage’s total return over 1yr

Source: FE Analytics

Softcat

IT solutions provider Softcat is a top 10 holding for the Schroder UK Multi-Cap Income fund (3.2%).

Fund manager Duncan Green said the company offers a “rare blend of quality, resilience and long-term growth”, citing its focus on helping clients navigate IT infrastructure, cybersecurity and digital transformation.

“This positioning, in a space where spend is increasingly non-discretionary, makes the business highly relevant and defensible,” he said.

Softcat’s asset-light model delivers high returns on capital and strong cash generation, he added.

Alfa Financial Software

Henry Lowson, head of UK alpha strategies at Royal London Asset Management, pointed to software provider Alfa Financial Software, which is a top 10 holding (2.6%) of the Royal London UK Smaller Companies fund.

Against competitors such as Fidelity Information Services, Oracle and SAP, he said the company’s cloud-based, innovative and easy-to-implement technology is having “major success”.

Lowson also highlighted Alfa’s over 30% earnings before interest and taxes margins, subscription growth and cash generative model, noting that these have enabled it to pay “generous dividends”.

“The quality of earnings has also improved with a more diversified, larger customer base and more visibility of earnings - justifying a much higher multiple than the 14x EV/EBITDA the stock currently trades on,” he added.

ActiveOps

ActiveOps offers software as a service (SaaS) solutions predominantly to sectors such as banking, insurance, healthcare and business process services.

Natalie Bell, fund manager in the Liontrust Economic Advantage team, highlighted its “highly valued” capabilities as organisations face increasing pressure to reduce costs, noting its solutions are “scalable, low-risk and integrate seamlessly with existing IT infrastructure, supporting global rollouts across large enterprises”.

“Despite the recent strong share price performance, the shares remain attractively valued at around 4x annual recurring revenues and we see significant further growth potential,” Bell said.

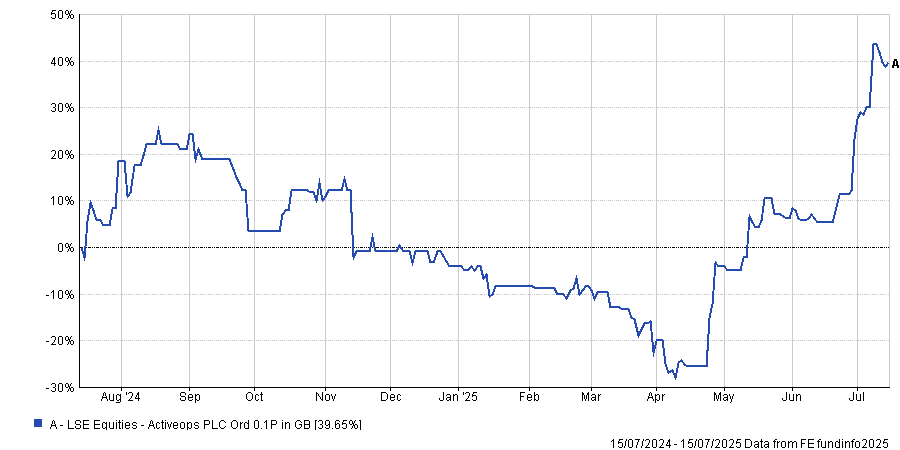

ActiveOps’ total return over 1yr

Source: FE Analytics

Trustpilot

Karan Singh, part of the management teams for the Fidelity Sustainable UK Equity and Fidelity UK Opportunities funds, said both funds have invested in consumer review platform Trustpilot (1.2% and 1% respectively).

Trustpilot is ultimately a SaaS business, “with retention rates above 100%, strong cash flow generation and low capital intensity”, he said, noting that management also runs the company “prudently” with a net cash balance sheet and good capital discipline.

“While the valuation looks high on today’s profits, applying a more mature margins forecast and considering its growth potential, the business has an attractive risk reward profile,” he added.

Eleco

Simon Moon, fund manager at Unicorn Asset Management, pointed to Eleco, which is a new position for the Unicorn UK Smaller Companies fund at 1.2%.

Eleco is capitalising on the digital transformation of one of the least digitised parts of the economy through the provision of software to blue chip companies in the construction sector. The breadth of its software allows for resilience and cross-selling, Moon said.

The company has also transitioned almost entirely to a cloud-based subscription model, with over 75% of revenues recurring and high retention rates.

“This shift is driving improved earnings quality and operating leverage,” Moon said.

Boku

Alexandra Jackson, fund manager of the Rathbones UK Opportunities fund, pointed to payment provider Boku, noting that the company ticks their investment criteria across multiple areas, including strong cash generation, high and growing EBITDA margins, recurring revenues, clear capital allocation and strong management.

“Ideally, we’d prefer Boku had a main market listing and clearer accounting around share-based payments, but it has upgraded numbers multiple times and should be able to double EBITDA over the next three years,” she said.

“A beat and raise cycle tends to be very powerful for UK share prices, especially in the tech sector.”

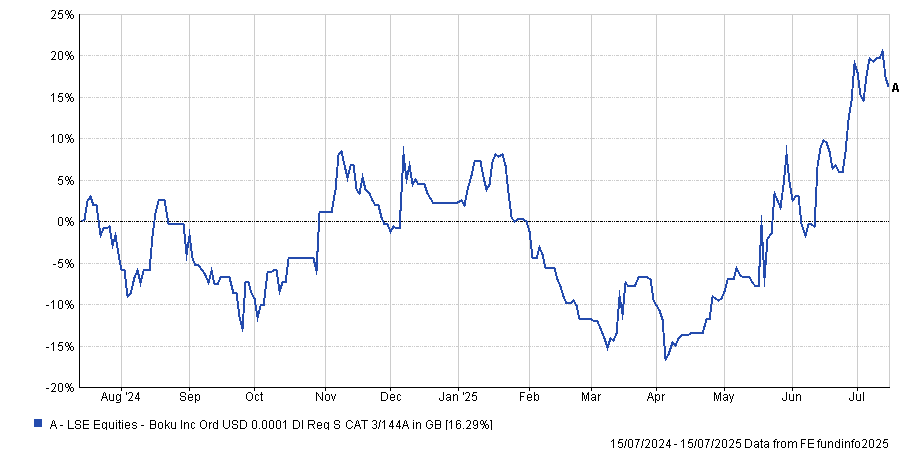

Boku total return over 1yr

Source: FE Analytics