Despite a turbulent past few years for European equities, there are 19 ‘hidden gem’ funds within Europe, according to Trustnet research.

Over the past three years, European funds have faced several challenges, including geopolitical tensions reaching a fever pitch. However, some funds have successfully navigated this market, delivering strong returns but not receiving much attention from investors.

In this series, we are examining the open-ended funds in each market to find those that have relatively low assets under management (under £250m) but top-quartile returns over the past three years.

Based on these criteria, there are hidden gems in all three Investment Association European equity sectors (IA Europe Excluding UK, IA Europe Including UK and IA European Smaller Companies).

Source: FE Analytics. Returns in sterling as of 30 Jun

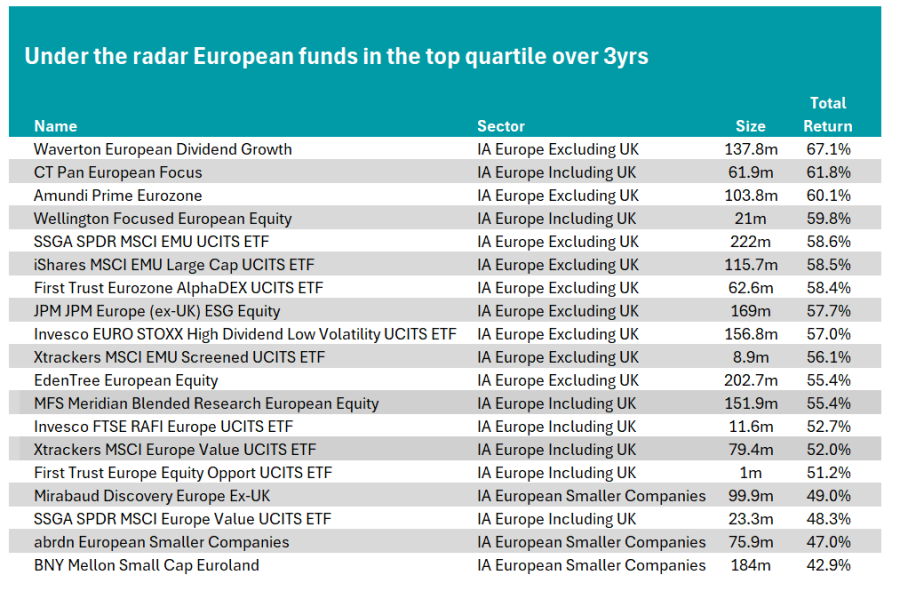

Topping the table is the Waverton European Dividend Growth fund, run by FE fundinfo Alpha Managers Charles Glasse and Chris Garsten.

The fund targets wealth-creating businesses at attractive valuations, investing in a small number of growing companies. As a result, the portfolio has just 38 holdings.

Over the past three years, it has climbed 67.1% the fourth-best result in the IA Europe Excluding UK sector. Additionally, it has achieved these strong returns with the fourth-lowest volatility in the peer group over this period.

Performance of Waverton European Dividend Growth vs sector and benchmark over 3yrs

Source: FE Analytics. Returns in sterling as of 30 Jun

In the recent annual report, Glasse attributed this strong performance to the lack of “China plays” in the portfolio. He explained that although China was attempting to stimulate its economy, “we think this will only have a limited effect”. As a result, the team has reduced the number of companies in the portfolio that are reliant on Chinese imports.

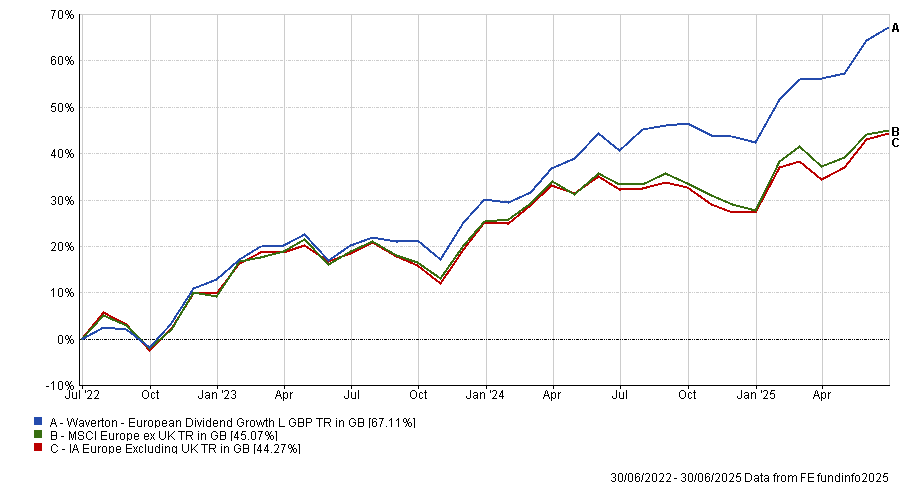

Just behind is the CT Pan European focus fund, led by Alpha Manager Frederic Jeanmaire.

Its three-year return of 61.8% is the sixth-best in the IA Europe Including UK sector, despite having just £61m in assets under management.

Performance of CT Pan European focus vs sector and benchmark over 3yrs

Source: FE Analytics. Returns in sterling as of 30 June

The manager has a very high conviction approach, investing in companies where “the current share price does not reflect the prospect for that business”. The top 10 allocations currently represent 48% of the total portfolio.

The fund follows a growth investment style relative to the benchmark, targeting companies with above-average growth rates and good earnings and sales growth. This has led it to favour stocks higher up the market cap spectrum, such as Rolls-Royce or ASML.

While this high-conviction approach has led to greater volatility than the average fund in the sector, it has also posted top-quartile returns over the past five and 10 years.

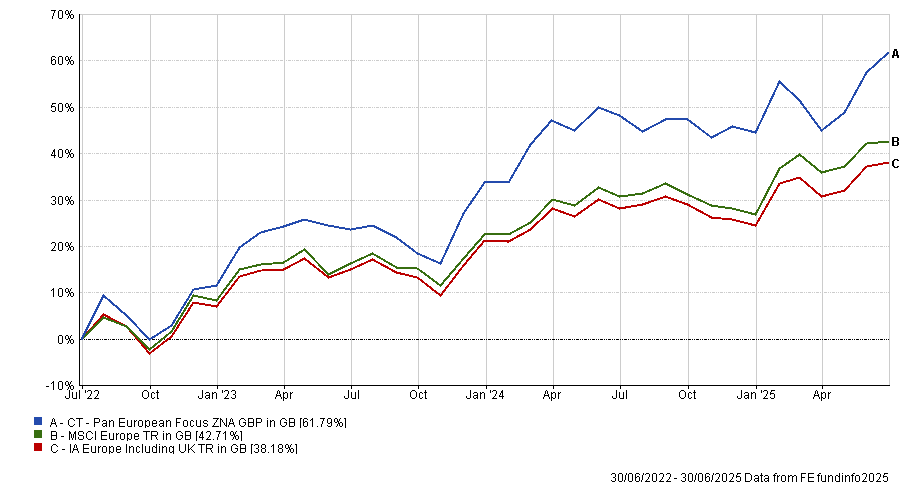

Despite recent poor performances from sustainable investing, ESG mandates such as JPM Europe (ex-UK) ESG equity also matched our criteria.

Led by a team of four managers, including Alpha Manager Joanna Crompton, it is up 57.7% over our period.

Performance of JPM Europe ex UK ESG equity vs sector and benchmark over 3yrs

Source: FE Analytics. Returns in sterling as of 30 Jun

The fund aims to invest at least 80% of the assets in the shares of European companies with “positive or improving ESG characteristics”. This effectively means companies that have effective governance and “superior management of environmental and or social issues”.

As a result, the fund currently has zero allocation towards aerospace and defence businesses, which have been a major driver of returns for Europe so far this year. Nevertheless, the fund has managed to outperform the average peer in the IA Europe Excluding UK sector by 1.3% percentage points so far this year.

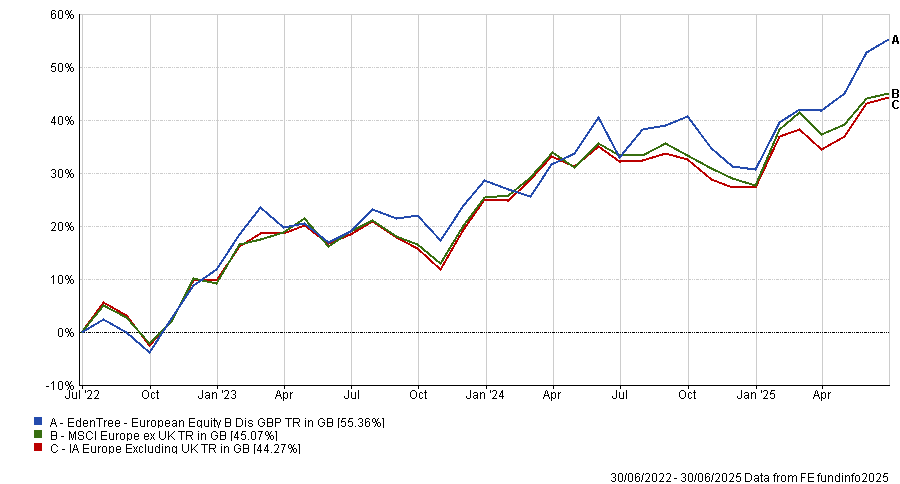

Another sustainable mandate that qualifies is the EdenTree European Equity fund. Led by Chris Hiorns and David Osfield, the fund is not entirely unheralded, with the fund awarded the title of ‘Responsible fund of 2024’ by the RSMR team.

“They believe there is a link between well-managed companies with good governance practices and a clear understanding of their ethical, social and environmental impacts, and their financial returns,” RSMR analysts said.

This approach has paid off, with the fund up 55.4% over our period, beating its average peer and the benchmark.

Performance of EdenTree European Equity vs sector over 3yrs

Source: FE Analytics. Returns in sterling as of 30 June

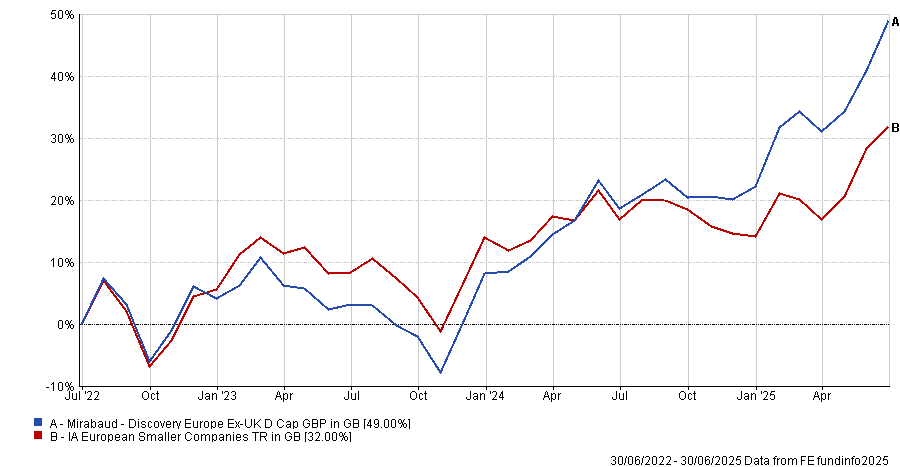

Finally, while many large-cap mandates outperformed, a handful of smaller company strategies also delivered, such as the Mirabaud Discovery Europe ex-UK fund

Its three-year total return of 49% is the second-best result in the IA European Smaller Companies peer group, despite having less than £100m in AUM.

The managers target “hidden gems” in the European market, looking for companies with “niche market dominance” or that are benefiting from transformational changes and innovations.

It also follows a rigorous ESG screening process, excluding companies in controversial sectors and only including companies with the top 80% of ESG scores.

Performance of Mirabaud Discovery Europe ex-UK fund vs the sector over 3yrs

Source: FE Analytics. Returns in sterling as of 30 June

“As the many crises that Europe has faced fall into historical perspective and new challenges emerge, we observe resilience and see opportunity. Inflation is beginning to decelerate and European central banks are easing, but tight monetary conditions continue globally, so we remain vigilant”, the team explained in their recent monthly commentary.