Fundsmith Equity remains one of the UK’s most popular funds but its recent poor relative performance against its benchmark, concentrated approach and premium price tag are issues investors need to consider, according to Andrius Makin, senior portfolio manager at Killik.

The fund, run by veteran investor Terry Smith, is known for its high-conviction, long-term approach to quality companies with strong balance sheets, high returns on capital and enduring competitive advantages.

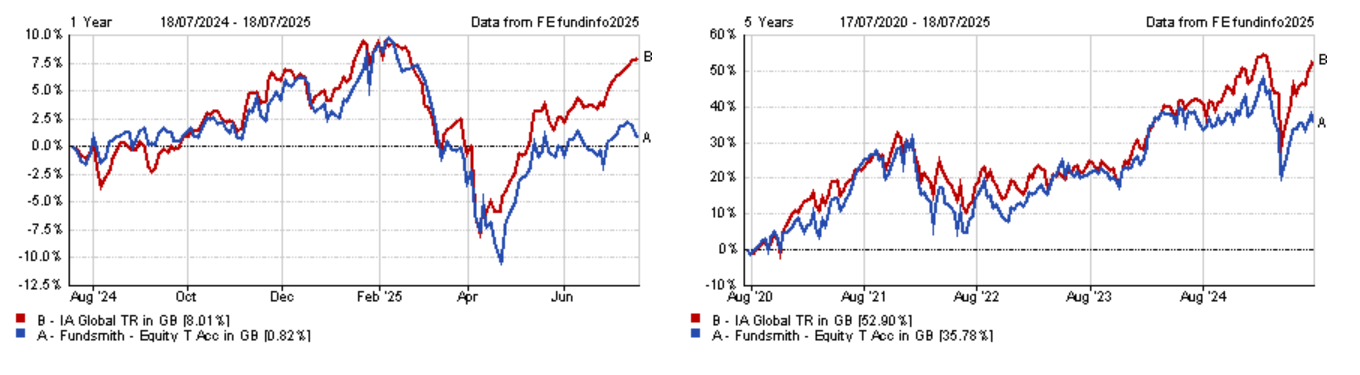

But in recent years, the strategy has fallen out of favour. Fundsmith Equity has returned just 0.8% over the past 12 months, placing it in the bottom quartile of the IA Global sector. It has not delivered a top-quartile return since 2019, as the chart below shows.

Performance of fund against index and sector over 1 and 5yrs

Source: FE Analytics

Makin and his team have been gradually trimming their position for a few years and the case for doing so has only strengthened amid the growing debate around the end of US exceptionalism. The portfolio is 74.3% weighted to the country.

“Just putting money in something like Fundsmith Equity and letting it ride isn’t going to work if the US stops driving returns,” he said.

That comment goes to the heart of the first concern: performance. Fundsmith Equity’s long-term bias to large-cap US names – especially in sectors such as technology and healthcare – has helped in periods when those sectors led the market.

But that same exposure has proved painful more recently. Quality stocks began to lag from 2022 as rising rates and shifting sentiment boosted other areas of the market, including more cyclical and value-oriented sectors.

Fundsmith Equity’s process hasn’t changed and that consistency is often praised, but Makin suggested that buying a global fund and forgetting about it is no longer a safe default.

“Just having a global allocation and letting a manager get on with it isn’t necessarily going to be enough anymore,” he said.

The second point is concentration, with many investors, far less diversified than they assume, he suggested. This can be compounded when picking a concentrated portfolio that owns similar market heavyweights that are prevalent in global funds.

Indeed, Fundsmith Equity’s top 10 holdings include Meta, Microsoft and Alphabet, with 9.4%, 8.9% and 4.4% allocations respectively – a high concentration in some of the same stocks that dominate other global strategies.

The portfolio is built around 20 to 25 stocks, and while its style purity once made it stand out, Makin now sees more risk than reward in such a concentrated approach.

The third concern is cost. Fundsmith Equity’s ongoing charges figure (OCF) is 0.94%, which places it at the more expensive end of its peer group, despite its size and low turnover.

“These days, a 1% fee is quite punchy, especially for a fund of that scale,” said Makin. “And we also don’t have transparency over the underlying asset allocation.”

Investors should note, however, that Smith has long argued the low transaction costs associated with a low-turnover approach make the total costs much more reasonable.

Why Killik still owns Fundsmith Equity

Makin noted the firm still owns the funds in its model portfolios, but has been “trimming down slowly for a couple of years” as it shifts towards a new approach to diversification with an emphasis on clearer geographical distinctions.

“We are trying to be much more transparent about our geographical splits than the industry has been in the past,” said Makin. Relying on a single global fund to manage all these exposures is no longer appropriate, he argued.

But Makin acknowledged the fund retains a clear identity, describing it as a “pure” quality strategy.

“Over time, funds have blended together. A pure value fund that’s been out of favour gets pressured to move away from that to pick up alpha elsewhere. Fundsmith Equity hasn’t, and you know exactly what kind of companies are going to be in there.”

The portfolio manager added that quality investing still has a place, particularly in volatile markets where strong brands and pricing power matter. “It was so popular for so long, the valuation just got very high,” he said. “But the idea itself still makes sense.”

That could provide a tailwind again if sentiment shifts but, for now, Makin is keeping exposure limited. “We’ve been trimming and we’ll continue to do so. I think 2% of a portfolio feels right.”

Not everyone agrees and many fund selectors are sticking with Fundsmith Equity, for example Jupiter Merlin’s David Lewis, who recently defended the fund’s style bias and long-term process.