Jet engine maker Rolls-Royce has been a standout performer in the UK market over recent years, as a strong corporate turnaround story, rebounding air travel, and promises of higher defence spending have boosted sentiment towards the company.

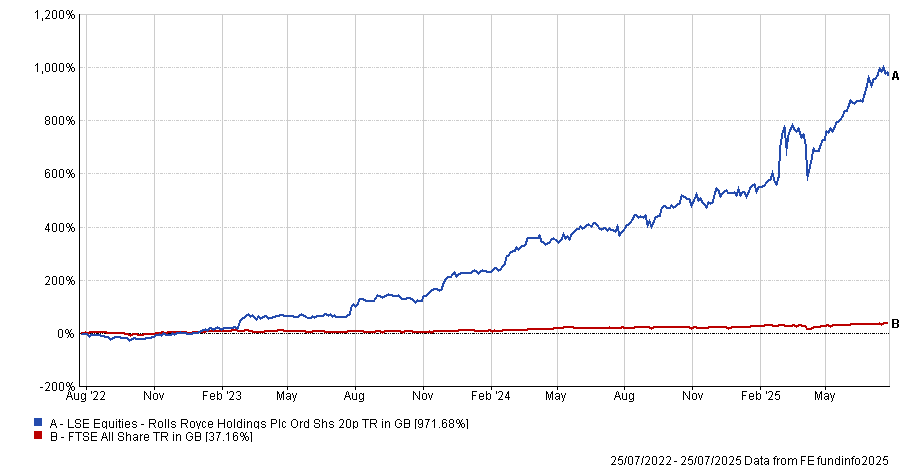

FE Analytics shows Rolls-Royce stocks have posted a 972% total return over the past three years, far outpacing the 37% rise in the FSTE All Share.

Performance of Rolls-Royce vs FTSE All Share over 3yrs

Source: FE Analytics

Over the same period, the firm has also made a higher total return than every one of the Magnificent Seven stocks (Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia and Tesla), which have dominated headlines and market leadership for much of the recent past.

This rally means Rolls-Royce is now the fifth-biggest stock in UK market, accounting for 3.8% of the FTSE 100 and 3.3% of the FTSE All Share. Below, we look at the reasons behind this performance and which funds hold the biggest positions.

Why has Rolls-Royce outperformed?

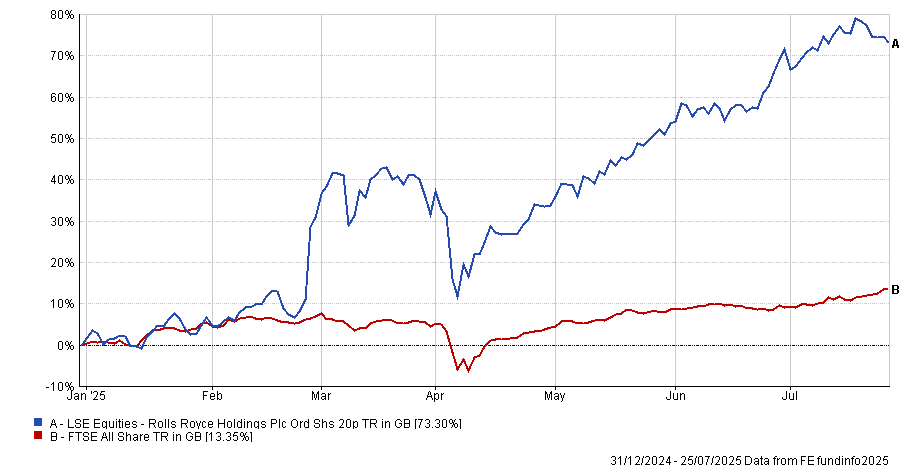

Rolls-Royce’s share price has continued to rise sharply in 2025 following a strong run over the past three years, reflecting the progress in the company’s turnaround strategy under chief executive Tufan Erginbilgiç.

The group met key financial targets originally set for 2027 two years ahead of schedule, improving investor sentiment towards the stock. This included significant improvements in operating profit and free cash flow, underpinned by a sharp focus on cost discipline, simplification of the business and more rigorous capital allocation.

Performance of Rolls Royce vs FTSE All Share over 2025

Source: FE Analytics

Rolls-Royce’s civil aerospace division has been central to its earnings recovery in recent years.

A rebound in widebody air travel and higher utilisation rates pushed large engine flying hours above pre-pandemic levels. This boosted high-margin aftermarket revenue, particularly in engine maintenance and long-term service agreements.

Alongside this, Rolls-Royce’s engine order backlog has grown by over 11% year-on-year, supported by the sustained production momentum at Airbus and Boeing. The company remains a key supplier for both of these aerospace majors and its strong aftermarket performance has helped drive both margin expansion and predictable cash flow.

In recent months, Rolls-Royce’s defence business has become a more meaningful contributor to investor sentiment, as the UK and other European countries pledge to increase defence spending in light of growing geopolitical threats and pressure from the US.

The firm’s defence order intake has increased sharply, underpinned by substantial wins such as the £9bn ‘Unity’ submarine reactor contract with the UK Ministry of Defence. The group is also a core partner in the Global Combat Air Programme (GCAP), developing the propulsion system for the next-generation Tempest fighter platform.

These programmes, along with broader demand for naval and aviation propulsion systems, have lifted the defence backlog and provided greater visibility into future earnings. Rising defence budgets across Europe, Australia and other Indo-Pacific countries are creating sustained demand tailwinds, offering Rolls-Royce additional earnings resilience amid geopolitical uncertainty.

The group’s improved financial position has allowed it to resume shareholder distributions.

In early 2025, Rolls-Royce reinstated its dividend and launched a £1bn share buyback, reflecting a stronger balance sheet and renewed confidence in sustainable cash generation. Net debt has been eliminated and Fitch upgraded the company’s credit rating to investment grade.

Which funds hold Rolls-Royce?

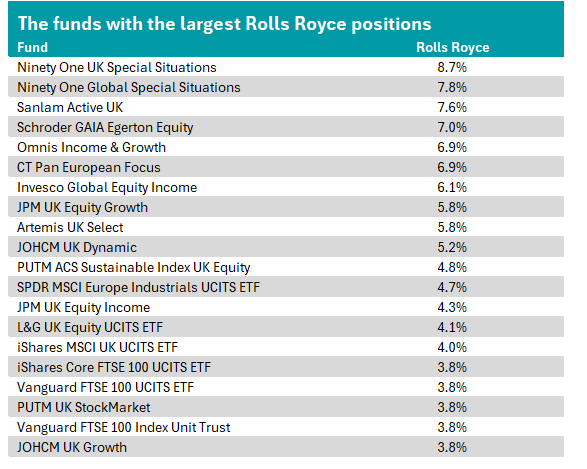

FE Analytics shows that 84 funds in the Investment Association universe hold Rolls-Royce as one of their top 10 holdings. The 20 with the highest allocations are shown in the table below.

Source: FE Analytics, funds’ own factsheets

The funds with the two largest positions - Ninety One UK Special Situations and Ninety One Global Special Situations – are both managed by Alessandro Dicorrado, who has a value approach to investing.

Ninety One UK Special Situations, which has the biggest weighting to Rolls-Royce in the Investment Association universe, has performed strongly in recent years (although this cannot all be attributed to a single holding). It’s the third-best performing fund in the IA UK All Companies sector over one year and the best performer over three years.

In the fund’s annual report to the end of March 2025, Dicorrado noted the contribution of the stock to the fund’s total return, saying: “Jet-engine maker Rolls-Royce rose on the back of multiple hikes to guidance and future targets; the stock has now risen 10-fold in the space of less than three years.”

Other funds with Rolls-Royce as their largest holding (according to their most recent factsheets) include Ninety One Global Special Situations, Sanlam Active UK, CT Pan European Focus and JPM UK Equity Growth.

Sentiment towards the stock remains positive. JOHCM UK Dynamic managers Mark Costar, Tom Matthews and Vishal Bhatia highlighted Rolls Royce as a company that “continues to relentlessly execute”, through recent wins such as securing a landmark contract to build three small modular reactors in the UK and a cost-effective re-entry into the narrowbody engine market.

“These provide new medium-term avenues for growth, adding to the strong momentum at its power systems division and the clearly enhanced prospects for defence operations,” the managers said. “Despite stellar performance over recent years and a dizzying share price chart, remarkably, the equity is still not expensive; as a result, we retain a conviction position in this high-quality situation.”

Some managers are trimming the stock, however. In the latest update for Artemis UK Select, Ed Legget and Ambrose Faulks said they have taken profits from Rolls-Royce in recent months, even though it was one of the fund’s strongest contributors in the second quarter of 2025.