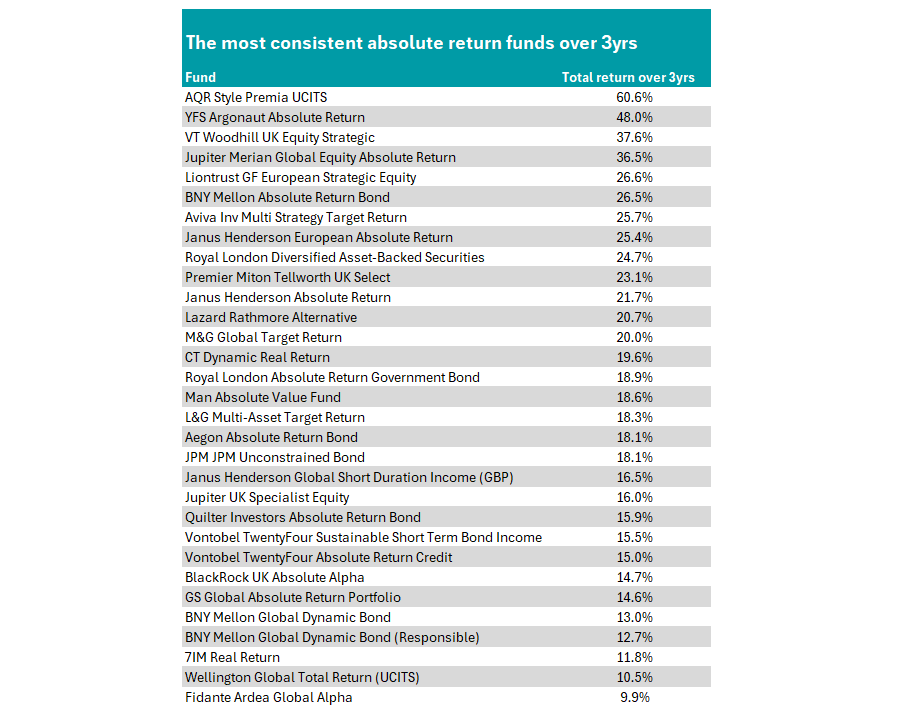

More than 30 funds in the IA Targeted Absolute Return sector have always made investors money over the past three years, according to research by Trustnet.

We examined absolute return funds’ 12-month rolling returns in each of the past 24 months – the same metric used by the Investment Association trade body to compare fund performance.

Of the 68 funds with a long enough track record, 31 (or 45.6% of the sector) achieved a positive gain in every rolling 12-month period, a sharp increase from the seven funds that appeared on this list a year ago.

The past three years have been headlined by volatility, with rampant inflation and high interest rates, the outbreak of war in pockets around the world and an unstable political landscape making it a difficult time to know how to invest.

Absolute return funds are designed to perform in all market conditions, aiming to make the positive gains regardless of the world around them.

The IA Targeted Absolute Return sector is home to a range of strategies, each with their own ways to achieve this. Some use long/short devices, while others use derivatives and futures. Some are market neutral, while others will take large bets.

Source: FE Analytics

The best performer among the 31 consistent performers is the £356m AQR Style Premia UCITS fund, which has made 60.6% over the past three years. Managers Antti Ilmanen, Andrea Frazzini, Jacques Friedman, Michael Katz, Ronen Israel and Tobias Moskowitz aim to build a portfolio that has “low-to-zero correlation to traditional markets” while making “high risk-adjusted returns”.

In second place is the £283m YFS Argonaut Absolute Return fund run by FE fundinfo Alpha Manager Barry Norris, up 48%, while Paul Wood and Michael Bedford’s £32.6m VT Woodhill UK Equity Strategic fund (37.6%) rounds out the top three. Only the latter of the three funds, however, was included in the study last year.

Top of the pile of this research in 2024, Jupiter Merian Global Equity Absolute Return is in fourth place, up 36.5%. Run by Alpha Manager Amadeo Alentorn, it is a market-neutral portfolio of long and short global equity positions that aims to beat the Federal Reserve’s funds target rate over rolling three-year periods.

The £3.7bn behemoth has been popular among investors, receiving £1bn worth of net inflows in the first half of 2025, half of the £2bn added to the systematic equities range.

Jupiter launched a leveraged version of the fund earlier this year, alongside the existing strategy.

Also of note is the Aviva Investors Multi Strategy Target Return fund run by Peter Fitzgerald and Ian Pizer. It was formerly managed by Euan Munro, who left the flagship Standard Life Global Absolute Return (GARS) strategy to set up this Aviva fund. The portfolio aims to beat the returns of cash (the Bank of England base rate) by 5%, over rolling three-year periods.

Analysts at Barclays Smart Investor recommend the fund, placing it on the firm’s best-buy list. They said: “The team is well-resourced compared to peers and is a flagship product for Aviva Investors, giving us comfort that Aviva will continue to invest in the resources and talent required to continuously drive performance. The fund also acts as a good diversifying investment in a traditional portfolio.”

Barclays analysts also recommend the £2.5bn Janus Henderson Absolute Return fund, which appears on our list of the most consistent absolute return strategies. Up 21.7% over three years, the portfolio is headed by Ben Wallace and Luke Newman, the former of whom was given a mandate to run a long/short strategy for US hedge fund Millenium Management worth around $1bn earlier this year, according to reports.

Wallace and Newman run two concurrent strategies alongside one another. The first is a ‘core’ portfolio, where they invest in companies they believe have good long-term growth prospects. The second is a ‘tactical’ portfolio, which aims to take advantage of short-term market anomalies.

“What we also like is that they have quite distinct styles, which complement each other very well,” Barclays analysts said. “Wallace provides a more analytical and detail-oriented approach and takes the lead on portfolio management, while Newman focuses on overseeing the team and managing client relationships.”

The Janus Henderson fund is also rated by analysts at FE Investments, who said it is a “good option for an investor who wants to diversify their portfolio made of traditional assets, without taking too much risk”.

They also gave their approval to Premier Miton Tellworth UK Select, managed by John Warren and Johnnie Smith. It has made 23.1% over the past three years and also appeared on the 2024 iteration of this study.

It is a hedge fund that aims to generate positive returns with low volatility and low correlation to UK equities by making buy and sell calls on UK stocks based on quantitative tools that use alternative data to track various macroeconomic indicators.

“The ability for the fund to benefit from falling share prices has allowed it to protect capital very well in volatile and negative markets, whilst still benefiting from some of the upside in better times,” FE Investments analysts said.

“Overall, we think the fund has an interesting and differentiated philosophy and performance profile and can provide effective diversification within a traditional equity and bond portfolio.”