Investors often tend to look to well established fund names and managers that have been around the block during times of uncertainty, such as the environment we find ourselves in at present.

With risks abound, including war, geopolitics, trade tensions and a weak economy, investors may be forgiven for sticking with tried and tested funds and managers.

Yet there are some under-the-radar rising stars who could be worth a look, according to experts. Below, they highlight two managers and two funds that are both in the earlier stages of their career, but who could become the next dominant force in the fund management industry.

Rising star managers

First, analysts at FE Investments pointed to Tim Lewis and his work on the BNY Mellon UK Opportunities (Responsible) fund.

“Lucas deserves recognition as a ‘rising star’ in the fund management industry due to his strong track record and ability to navigate an increasingly challenging investment landscape,” they explained.

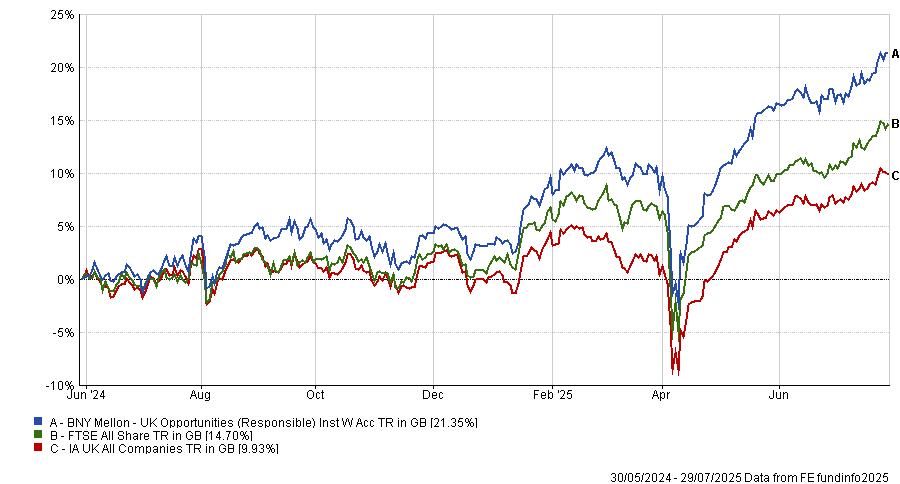

Despite becoming a manager in a “busy five years” for equity funds, he has delivered “standout performance”. BNY Mellon UK Opportunities (Responsible) has outperformed the FTSE All Share and the average peer in the IA UK All Companies sector since he took over as lead manager at the end of May 2024.

Given the “sharp decline in UK sustainable strategies following the SDR rollout in 2024”, this has been a good effort, the analysts added.

Performance of fund vs sector and index since the manager's start

Source: FE Analytics.

“In a space where fewer managers remain, Lucas’ ability to deliver strong, responsible returns under heightened scrutiny underscores both his investment acumen and potential for long-term industry impact,” analysts concluded.

Meanwhile, AJ Bell head of investment research Paul Angell pointed to Jonathan Golan as the “standout rising star in the industry”.

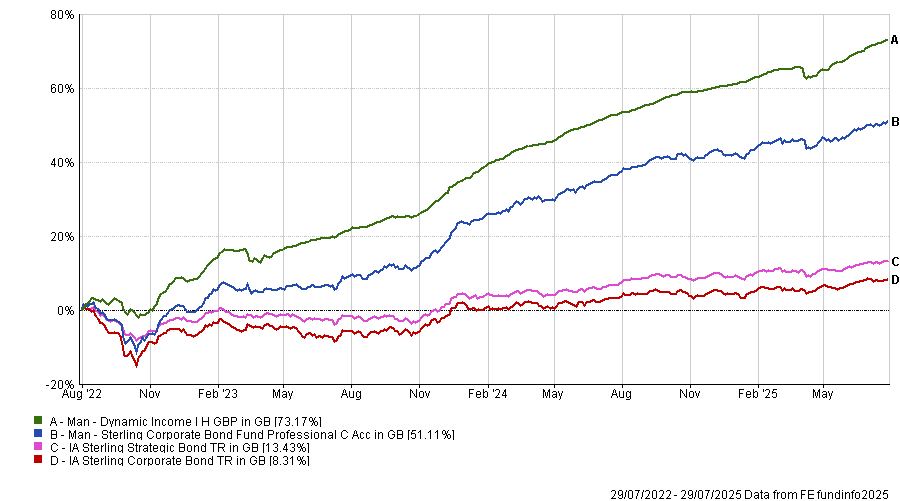

Golan leads the Man Sterling Corporate Bond fund (IA Sterling Corporate Bond sector) and Man Dynamic Income fund (IA Sterling Strategic Bond sector), which were launched in September 2021 and July 2022, respectively.

Despite their short track records, both funds have proven popular among investors and have swelled to £1.4bn (Man Sterling Corporate Bond) and £2.4bn (Man Dynamic Income) in assets under management.

In the past three years, Man Sterling Corporate Bond is up 51.1%, while Man Dynamic Income surged 73.2%. These are the top results in their respective sectors, outpacing the average peer by 40-60 percentage points, as seen in the chart below.

Performance of funds vs sectors over 3yrs

Source: FE Analytics

Angell said: “[This strong performance is] thanks to the team's bottom-up approach to credit investing, in which they focus on smaller bonds which they see as undervalued versus larger equivalents.”

Golan, who became a fund manager in 2017, was recently awarded the title of FE fundinfo Alpha Manager of the Year.

Rising star funds

While some fund managers are future stars, there are also funds run by more established names whose best days are ahead of them. Downing Fox fund manager Alex Paget, identified Mark Ellis’ Nutshell Growth as one such fund.

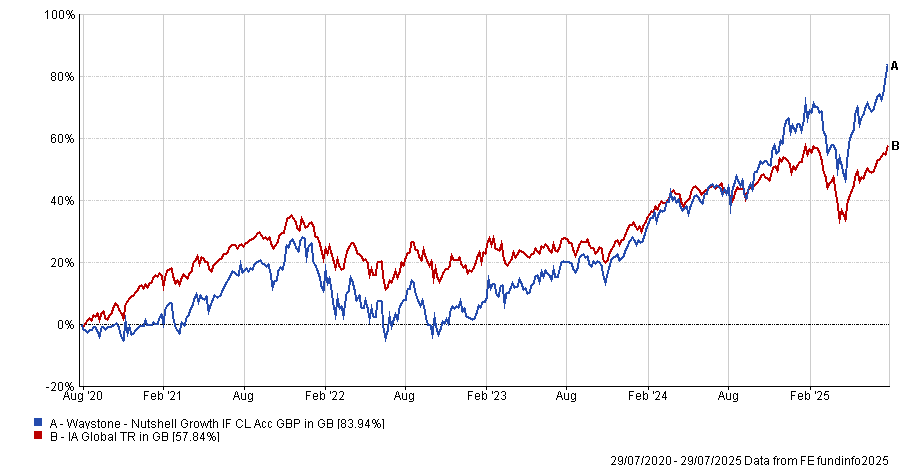

Although Ellis became a fund manager in 2020, he has 20 years of experience as a derivatives trader, which he uses to “re-jig the portfolio to maximise returns”.

The fund invests in high-quality businesses, indicated by stable profit margins, low earnings volatility and high returns on investor capital, paired with a 30-factor, data-driven model. This makes it different from many quality-growth funds, which Paget said usually place more emphasis on meeting with management

“A unique selling point of the process is Ellis’ frequent portfolio recalibrations and intra-day, relative value trading as he is aiming to maintain exposure to high-quality growth companies but at the most attractive valuations,” Paget explained.

This has led to strong returns, with the fund posting top-quartile results in the IA Global sector over the past one, three and five years. In the past five years, the fund is up 83.9% beating the average peer by nearly 25 percentage points, as seen in the chart below.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

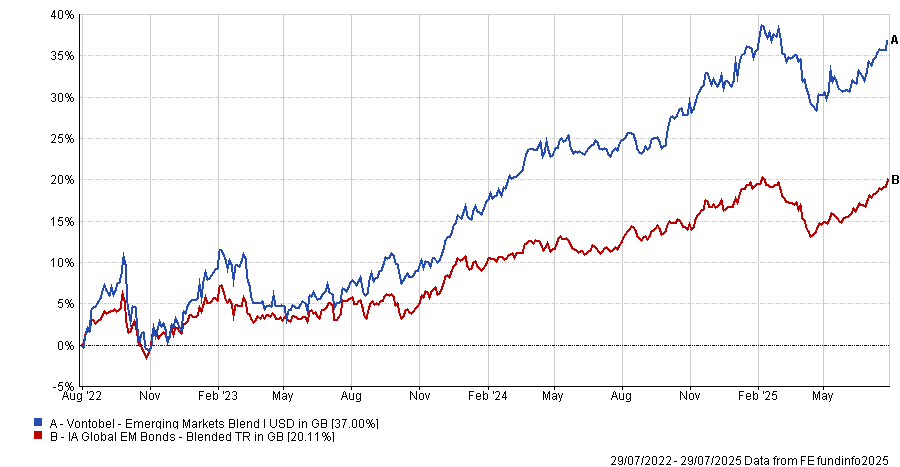

Elsewhere, IBOSS investment analyst Jack Roberts pointed to the Vontobel Emerging Markets Blend fund as “one of the most compelling rising stars in fixed income right now”.

“Despite its relatively modest size of £132m, the fund has delivered standout performance in the IA Global EM Bonds – Blended sector, a space that has delivered strong performance since markets bottomed in October 2022,” Roberts said.

The team of specialist portfolio managers takes a “high conviction and active approach”, venturing off the benchmark into overlooked areas. This approach has “paid off substantially”, according to Roberts, with the fund outpacing the average peer by 17 percentage points over the past three years.

Performance of fund vs sector over 3yrs

Source: FE Analytics

“While the fund may not be on every investor’s radar, its performance and differentiated strategy make it a standout candidate for those seeking active exposure to emerging market debt, making it a compelling option for diversifying fixed income holdings,” Roberts concluded.