Investors piled into global equity funds and trusts in July, according to data from interactive investor (ii) – reflecting rising confidence in stock markets and the appetite for diversification.

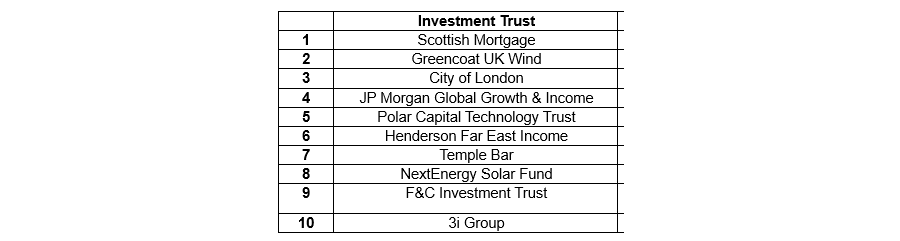

The trend was particularly noticeable within closed-ended strategies. Four of the new entries to the 10 most-bought investment trusts on ii’s platform in July invested in global equities - Henderson Far East Income, Polar Capital Technology Trust, Temple Bar and F&C Investment Trust.

Sam Benstead, fixed income lead at ii, said this reflects “the value investors place on allowing a fund manager to take a ‘go-anywhere' approach to stock picking.”

Income also proved to be a big theme, with five of the top 10 most-bought trusts having income objectives, indicating that investors “continue to value the role that investment trusts can play in income generation”.

Most bought investment trusts on ii in July 2025

Source: interactive investor

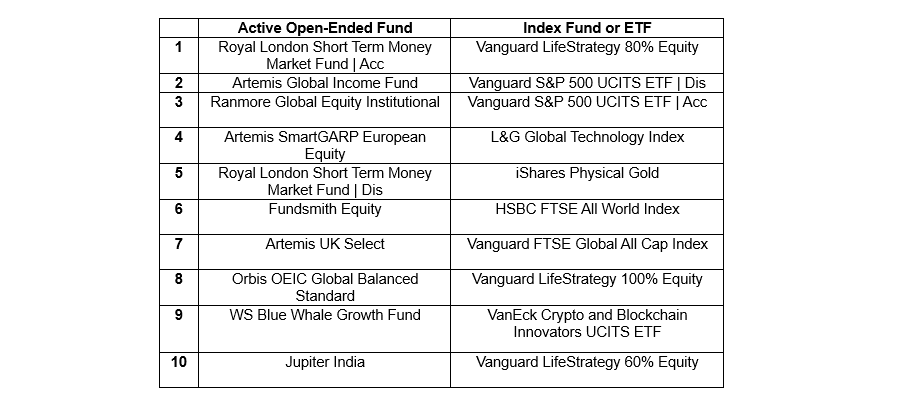

In terms of open-ended active funds, Terry Smith’s Fundsmith Equity fund moved up to sixth place from seventh in June. This rise occurred despite one of its top 10 holdings, Novo Nordisk, cutting its full-year earnings guidance.

Stephen Yiu’s Blue Whale Growth fund entered the list as the ninth most-bought investment. Over the past one and three years, the fund has posted top-quartile returns in the IA Global sector.

Vanguard dominated the list of the most-purchased passive strategies, with six of its funds appearing in the top 10. The Vanguard LifeStrategy 80% Equity fund took the throne as the most popular passive fund among ii customers in July.

Low-cost global funds, such as Vanguard FTSE Global Cap index and HSBC FTSE All World Index, were popular in July, Benstead noted. However, he warned investors to examine these funds' fact sheets to decide if it’s the right fit for their portfolio. For example, some funds invest in developing markets and some do not, which may make a difference for some investors.

Most bought funds on ii in July 2025

Source: interactive investor

Coming to individual stocks, small-cap battery-metals miner Metals One took the top spot. Richard Hunter, head of markets at ii, said there was “feverish speculation in May” around the potential acquisition of a Norwegian company that would give access to gold, copper and nickel deposits.

Paired with claims of a massive uranium find from sources outside the company, the shares peaked at more than 50p in May, but with no confirmation since, the price fell back.

Previous frontrunner Rolls-Royce has been displaced to third place. The stock has surged almost 1000% in the past three years, with the company now at close £90bn market cap, leaving some investors concerned it may not have much room left to run.

However, Hunt noted that investors have not been deterred by valuation concerns.

“With flying hours on the increase and with no signs of defence spending wavering, the story may yet have further to run,” Hunt concluded.