There was a lot to unpack in the latest Budget, but whether you loved it or hated it, one thing is clear: Britons need to get investing.

Although she rather bungled the delivery, the message was clear from chancellor Rachel Reeves: we need to stop saving so much.

That was the driving force behind cutting the cash ISA allowance to £12,000 for anyone under the age of 65, while keep the full allowance at £20,000 for stocks and shares ISAs.

The data backs up just how important it is to invest. Statistics from AJ Bell show investing £1,000 each year since 1999 in the average IA Global fund would now be worth £92,349 versus just £36,290 in the average cash ISA – a difference of £56,059.

Laura Suter, director of personal finance at AJ Bell, said there is a “hidden cost of playing it safe”.

“While keeping money in cash can feel comfortable, over time it’s an almost guaranteed way to lose purchasing power. Inflation quietly eats away at savings and even the average cash ISA will have struggled to keep pace,” she added.

But even over short timeframes the phenomenon is true. You don’t have to go back to the turn of the millennium to get pretty stark numbers.

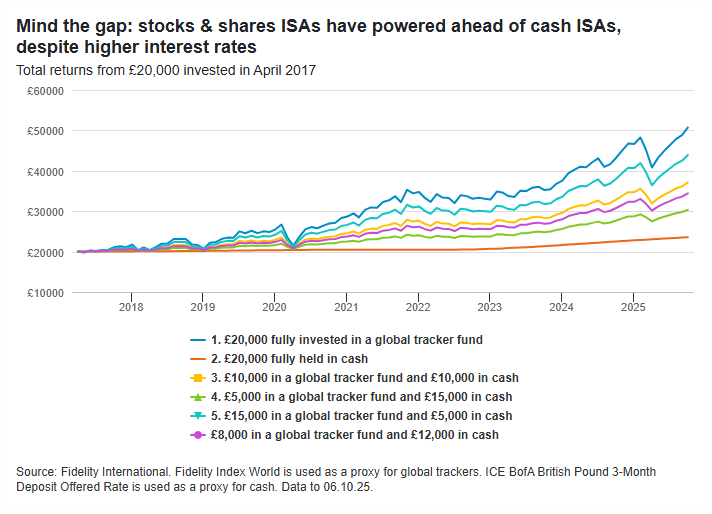

Fidelity International found that, since the ISA limit was raised from £15,240 to £20,000 in April 2017, those utilising the full allowance in a cash ISA that year would now have £23,549 based on average rates. This would have resulted in savers being poorer in real terms, however, as the pot would have needed to reach £27,000 to keep pace with inflation.

By contrast, someone who invested £20,000 in a global tracker fund would now have roughly £50,700.

How much £20,000 put away in April 2017 would be worth now if held in cash or invested

Jemma Slingo, pensions and investment specialist at Fidelity International, noted cash should always “have a role in a sound financial plan”, but said when it comes to growing wealth over time, cash alone can “only take you so far”.

The message is clear – for most people that want to put money away, investing is a far better option than cash, especially over the long term.

So the ISA policy in a vacuum makes sense, and is something fund managers and industry experts have been clamouring for since the start of the year.

Where the chancellor confused the issue, however, was with her other policies. Upping dividend tax payable on investments held outside of an ISA or SIPP by 2 percentage points sends completely the wrong message. Yes, she upped income tax on savings by the same amount (and property gains), but this is hardly the right way to get people shifting to investing.

Similarly, lowering the tax efficiencies on venture capital trusts (VCTs), meaning people will soon only claim back 20% of their investments against income tax rather than the previous 30%, is another kick in the teeth for investors.

The government has been strong on wanting to invest in UK businesses, yet this policy smacks of the opposite. VCTs are (broadly) only allowed to invest in start-up domestic companies.

Making them less attractive will only serve to reduce the amount of money flowing into these funds and therefore restrict the cash available to companies that need it.

Then there was the most controversial topic: salary sacrifice. Here the chancellor announced a £2,000 annual cap for auto-enrolment pensions, which will come into effect from April 2029.

This comes at a time when too few are saving enough for their retirement and again undermines the message that people need to invest more rather than save.

Safe to say then that it wasn’t a home run for the UK investing scene.

Despite the clear mixed policy picture, the chancellor is right: we do need to invest more. I just wish there were more policies that helped people to do so.