Despite Europe’s recent market rally, many investors remain understandably cautious about the region’s ability to sustain outperformance. Is this simply another short-lived rebound, or could it mark the beginning of a more structural transformation?

Historically, Europe has struggled to maintain momentum as it is too often hindered by excessive bureaucracy or political uncertainty that disrupts progress just as it begins to take hold.

As bottom-up investors, we typically focus on individual businesses rather than broad macro trends. However, in assessing Europe’s prospects and the potential longevity of this rally, we found it helpful to step back to two notable periods in recent history when a mix of economic and market factors drove sustained performance in European markets – the late 1980s and the early/mid 2000s.

While no cycles are ever directly comparable, the historical parallels suggest that the current circumstances may share similar characteristics to these previous positive periods for European equities.

This bodes well for Europe’s prospects and tallies with the bottom-up opportunities we are finding.

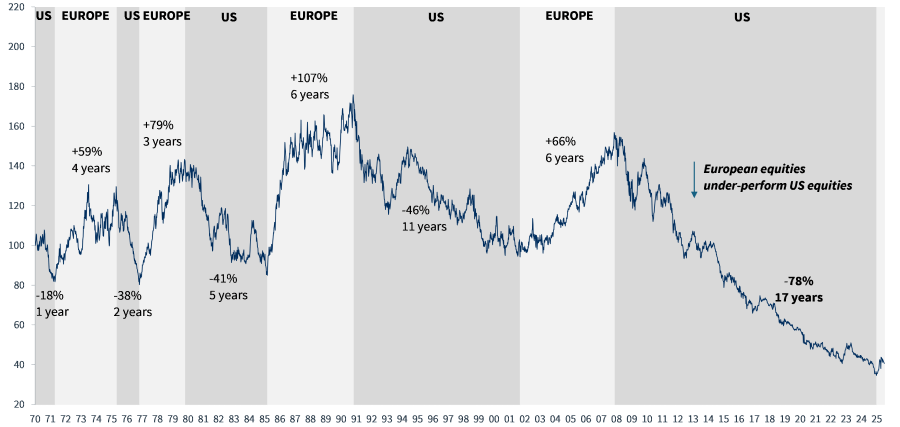

European equities vs US since 1970

Source: Kepler Cheuvreux, Bloomberg

The late 1980s: Laying the foundations for a borderless Europe

The second half of the 1980s marked a pivotal turning point in European economic history. The European Commission launched an ambitious agenda to transform the fragmented European Economic Community into a truly unified market.

This period was defined by optimism, institutional reform and strategic alignment as member states committed to removing barriers to trade, capital, labour and services. The idea of a ‘borderless Europe’ began to take shape as not just a political vision, but also a powerful investment theme.

Against this backdrop, European equities surged, buoyed by stronger currencies, falling inflation and renewed investor confidence. Oil prices collapsed, dropping from $27 to below $10 a barrel by mid-1986. As a net importer, Europe benefited enormously as input costs fell and company margins improved.

With inflation falling sharply, the economy began to recover and investment in West Germany surged while structural reforms in France and Italy boosted efficiency and market appeal. European equities soared by c.70% in 1985 versus c.30% in the US, and another c.40% in 1986.

Meanwhile, the US was in the midst of its own realignment. By the mid-1980s, the country was grappling with a soaring dollar, ballooning trade deficits and mounting pressure from domestic industries struggling to compete internationally.

The dollar had appreciated over 50% since 1980, making US exports uncompetitive and fuelling protectionist sentiment. Concerned about America’s massive trade deficit and the damaging strength of the US dollar, the five largest industrialised nations agreed to a coordinated intervention to weaken the dollar.

The Plaza Accord, signed in September 1985 by the US, UK, France, West Germany and Japan, had a profound impact on the relative performance of US and European assets triggering a shift in capital flows, currency values and equity market leadership.

The result was a sharp realignment in global currencies. The German Deutsche Mark appreciated from 3.45 to 1.90 against the dollar by the end of 1986. European assets became significantly more attractive to global investors, and the dollar value of European stocks surged.

This rare combination of currency realignment, disinflation, falling oil prices and market-friendly reforms ignited one of the most impressive periods of European equity outperformance in recent history.

While today’s backdrop isn’t identical, many of the underlying themes echo the dynamics of that earlier era – notably the weakening of the dollar.

2000-2008: The ‘old economy’s’ resurgence

This period marked a deepening of European integration and the launch of the euro, which brought greater monetary stability and encouraged cross-border investment.

Falling interest rates, increased capital mobility and rising intra-European trade provided a favourable environment for corporate earnings growth.

Yet, much of Europe’s equity outperformance during the early 2000s owed more to the aftermath of the dot-com bubble than to structural reform alone.

The bursting of the bubble triggered a steep decline in US equity markets, which had become heavily concentrated in richly valued technology stocks. The Nasdaq lost nearly 80% of its value over the next two years, dragging down broader US indices.

European markets, by contrast, were cheaper, less tech-heavy and had greater representation across more traditional sectors such as financials, industrials and consumer goods.

As a result, Europe experienced a more moderate correction and steadier growth in the years leading up to 2008 and the global financial crisis (at which point Europe’s heavy weighting to banks proved its undoing).

The early/mid noughties also coincided with a global commodity boom and strong demand from emerging markets, particularly China. Many European firms focused on energy, materials, and capital goods were well positioned to benefit from these trends.

Altogether, these dynamics created a window of relative strength for European equities that lasted through much of the 2000–2008 cycle.

Europe’s case of déjà vu

While no two cycles are identical, several familiar themes are re-emerging, echoing the conditions that supported past periods of European market outperformance: a weakening US dollar, declining energy prices and a resurgence in European capital investment, particularly in Germany.

At the same time, stretched US valuations and an increasingly narrow market leadership centred on mega-cap tech create natural contrasts to the cheaper, more diversified European market.

US exceptionalism remains a powerful force, driven by innovation, entrepreneurial momentum, and the transformational impact of artificial intelligence (AI). But from a relative perspective, we believe the current macroeconomic and valuation backdrop is the most favourable for European equities in many years.

Over the past 15 years, investors have largely come to see Europe as offering little more than the occasional burst of optimism. But for the first time in a long while, there are signs of genuine momentum behind structural reform across the continent.

If this progress continues and meaningful changes take root, Europe’s recent rally could be more than just a temporary bounce. It might instead mark the start of a more lasting recovery for the ‘old continent’ – one driven not only by macro trends and capital flows, but by real, underlying transformation.

Pras Jeyanandhan is a European equity fund manager at Tyndall Investment Management. The views expressed above should not be taken as investment advice.