Savers are missing out on substantial returns by sticking with high street banks instead of shopping around, according to recent analysis from Moneyfactscompare.

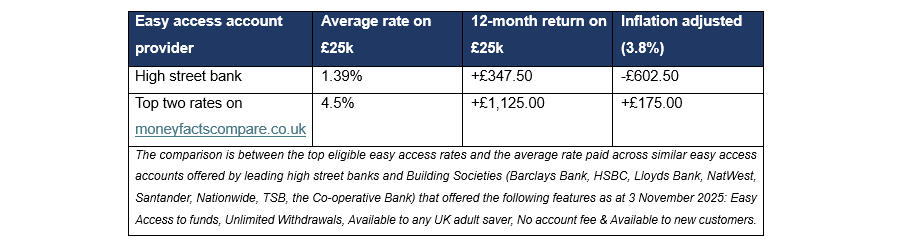

The average easy-access account at a high street bank offers a rate of 1.39% on a pot of £25,000. This results in a 12-month return of just £347.50, a loss of £602.5 when adjusted for 3.8% inflation.

By contrast, the top easy-access savings accounts available from competitors pay investors a 4.5% rate on the same pot size, beating inflation and resulting in a £1,125 return over one year, as seen in the chart below.

Source: Moneyfactscompare

Adam French, head of news at Moneyfacts, said: “Big banks are taking far too many savers for granted by paying them paltry returns on their savings, but the best way to fight back is to ditch your apathy”.

Small changes in interest rates can “make a big difference over time”, meaning that looking around for better rates can help savers achieve their goals much quicker, he explained.

“Especially when a simple change can mean hundreds more in returns,” he said.

However, many savers have yet to take advantage of this. The Moneyfacts Savings Trend Index (a survey of 2,000 UK adults) found that 23% of respondents have never switched savings accounts.

A further 23% admitted they switch accounts less than every few years, meaning that almost half of savers could be missing out on easy returns.