Infrastructure and healthcare may seem like they have little in common on the surface, but they are united by one unenviable statistic: both themes have struggled over the past five years.

At a time when markets have generally been thriving, funds in the IA Healthcare and IA Infrastructure sectors have failed to keep pace with wider stock returns.

Below, Trustnet continues its series looking at the funds that suffered the least while their sectors struggled. Today, we look at healthcare and infrastructure.

Healthcare

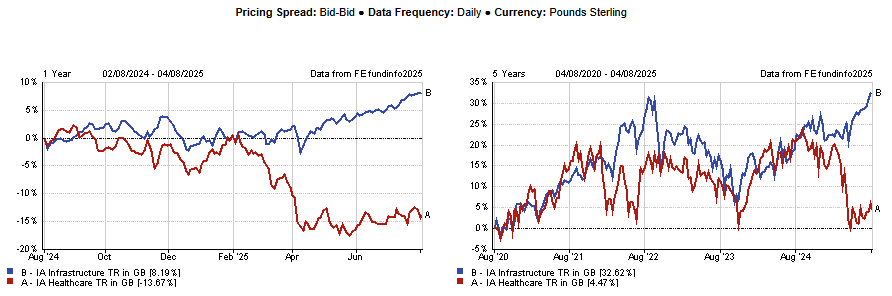

We start with IA Healthcare, where the average fund has suffered a torrid past few years. The sector beat the MSCI World index in 2020 and 2022, but failed to do so in 2021, 2023 and 2024. Over those last two years, the sector made a loss, while the index rose almost 30%.

So far in 2025 things have not improved, with the sector down some 9.5%. Much of this stems from US president Donald Trump’s tariff tirade (making exporting more expensive) and his commitment to reducing drug prices in the US (which will eat into profit margins).

Additionally, nearly $1trn is set to be cut from Medicaid over the next decade as part of his ‘Big, Beautiful Bill’, meaning fewer people will have healthcare coverage.

All this has culminated in a tough half-decade for healthcare specialists, with the average constituent returning just 4%. This made the IA Healthcare the second-worst equity sector across the whole Investment Association universe, second only to IA China/Greater China, which lost close to 20% in the time frame.

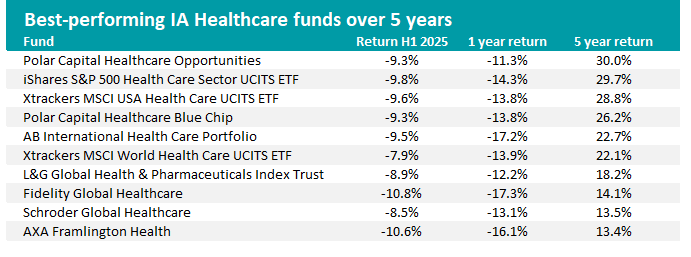

Yet there were some better performers. Polar Capital Healthcare Opportunities rose above its peers with a 30% return against the sector average of 10.9%, as the chart below shows.

Source: FE Analytics

It is a $1.6bn strategy managed by Gareth Powell that has soared over the past three years, topping the sector in 2024 (up 7.8%) and sitting second in the peer group in 2023 and so far in 2025.

Powell typically invests in 40 to 45 positions, chosen with no benchmark or tracking error constraints. As of 30 June, the main geographic exposure of the fund was to the US (25.9%), followed by Sweden (12.9%), Denmark (11.3%) and Belgium (8.6%).

US healthcare occupied the rest of the table’s top three with two exchange-traded funds (ETFs): iShares S&P 500 Health Care Sector UCITS ETF and Xtrackers MSCI USA Health Care UCITS ETF.

Led by FE fundinfo Alpha Manager James Douglas, another Polar Capital made the list in fourth position: Healthcare Blue Chip, which focuses on large-cap names such as Eli Lilly (6.4%), Abbott Laboratories (5.6%) and AstraZeneca (5.1%).

One less successful Polar Capital strategy was Deane Donnigan’s Healthcare Discovery, which lost 2.6% in the past five years.

Other names that stood out included AB International Health Care Portfolio, Fidelity Global Healthcare and the £344m Schroder Global Healthcare, managed by Alpha Manager John Bowler.

Infrastructure

Compared to healthcare, infrastructure funds seem to have been a good investment over the past five years, returning 30% on average. However, they remain below-average compared to the rest of the equity sectors in the Investment Association universe, which added just below 40% during this time.

Performance of sectors over 1 and 5yrs

Source: FE Analytics

It too failed to match the returns of wider global stocks in 2023 and 2024, with the average IA Infrastructure fund sitting broadly flat during these two years while the MSCI World gained some 37%.

The only year the sector has been ahead of the benchmark index was in 2022, when infrastructure benefited from rising interest rates, although it is on top so far in 2025.

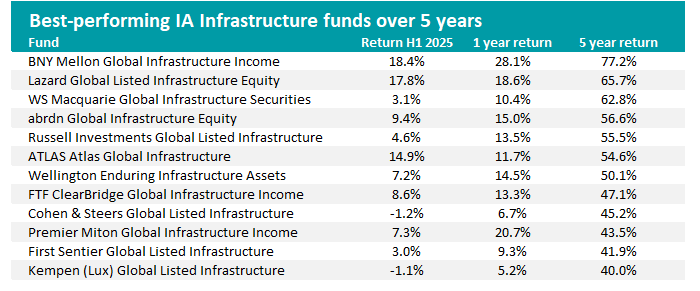

Despite this, there were 12 portfolios able to distance their peers and post returns more in line, or above, those of other equity funds.

Source: FE Analytics

The first to get there was BNY Mellon Global Infrastructure Income, a small strategy of just £44m, which returned 77.2% over the past five years, as shown in the table above.

Benchmarked against the S&P Global Infrastructure index, it mainly invests in utilities, which make up more than 50% of the portfolio, and has shone so far this year, making 22.3%, the top return in the sector. Outside of 2020 – when it was in the bottom quartile – it has beaten the average peer in every calendar year of the past half decade.

In second place with a 65.7% return was the £1.3bn Lazard Global Listed Infrastructure Equity fund. It focuses primarily on equity securities of companies that own physical infrastructure assets that meet certain preferred criteria, such as revenue certainty, profitability and longevity. It is another utilities play, as this sector makes up 56.6% of the fund.

In third position, WS Macquarie Global Infrastructure Securities is different. With only 25.7% in electrical utilities and a sizable position in airport stocks (17.9%), manager Brad Frishberg gained the recognition of RMSR analysts, who praised the scale and extent of Macquarie’s activity within the global infrastructure sector, giving the fund “excellent” access to on-the-ground feedback and information.

They said: “The focus on pure infrastructure plays and the avoidance of ‘satellite infrastructure-linked’ activity brings a set of characteristics to the fund that provide diversification, which is useful in portfolio construction.”

Another noteworthy name was FTF ClearBridge Global Infrastructure Income, which made investors 47.1% over the past five years. Square Mile analysts believe the investment team are able to “alleviate the impact of political or regulatory decisions” that can affect the sector.

“We like that the strategy is run by a team with a strong heritage and expertise in investing in this specialist asset class,” they said. “The investment process is straightforward and well defined, and the team have a clear focus on risk.”

First Sentier Global Listed Infrastructure was another favourite on the list, rated by analysts at multiple companies.

FE Investments experts said: “Infrastructure should provide protection as a defensive asset and protect from inflation and we believe First Sentier Global Listed Infrastructure is one of the best options available.

“First Sentier’s well-respected team of analysts has excellent knowledge of this market, and the experienced portfolio managers have a good track record. Its approach of ranking companies based on both quantitative and qualitative analysis should also stand it in good stead.”

This article is part of an ongoing series analysing the best funds in the worst-performing sectors. Previously, we covered China, India, the UK and the US.