UK stocks face a mixed outlook in the months ahead, with some shares poised for gains while others remain under pressure, according to Chris Beauchamp, chief market analyst at IG.

Using the start of the new premier league season last weekend as an analogy, below Beauchamp identifies three companies he believes are well-positioned for near-term strength and should sit towards the top end of the table by the time the season closes in nine months’ time.

He also picked three stocks that could struggle to build or maintain momentum and could find themselves in danger of relegation from the FTSE 100.

Greggs: Strong performance baked in

The British bakery chain “continues to outmanoeuvre consumer sector peers” with strong market share gains and operational innovation, said Beauchamp, making it a top-of-the-table contender over the next few months.

Greggs has sustained its recent expansion drive, boasting hundreds of new store openings while its delivery partnerships and menu diversification continue to drive growth.

Although the share price has fallen year-to-date by 42.8%, he said “brand loyalty and adaptability help Greggs maintain momentum despite cost-of-living headwinds”.

Greggs is listed on the FTSE 250 and offers a price-to-earnings (P/E) ratio of 11x.

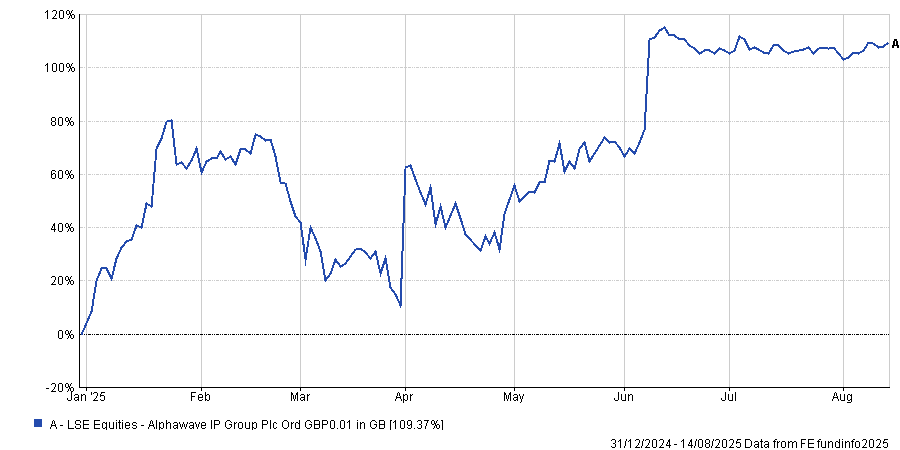

Alphawave: Riding the seas of change

The semiconductor company, which has a market capitalisation of around £1.4bn, currently “sits at the centre of the semiconductor intellectual property boom”, according to Beauchamp. It provides crucial technology for high-speed data connectivity.

Other megatrends set to bolster Alphawave’s performance include artificial intelligence, advanced chips and 5G.

Beauchamp said: “A growing international client base, strong order pipeline and profitable business model position Alphawave for potential ‘Champion’s League’ status.”

The share price has increased by 92.3% year-to-date, with Beauchamp suggesting it could continue to perform well into next year.

Stock performance year-to-date

Source: FE Analytics

SSE: The future is green

As a multinational energy company with a lot of skin in the net-zero transition, SSE benefits from defensive regulated earnings with long-term growth from decarbonisation investments in its sustainable wind, hydroelectric and grid offerings.

“Strong policy backing for net zero and a proven ability to weather inflationary pressure make SSE one of the most dependable performers for the season ahead,” said Beauchamp.

SSE offers a dividend yield of 3.6% and a 16.5x P/E ratio. Shares in the £19.7bn company are up 9.3% year-to-date. Wall Street analysts agree, according to online tool tipranks, with the average analyst suggesting a target share price of £21.52, some 21% higher than the current £17.83.

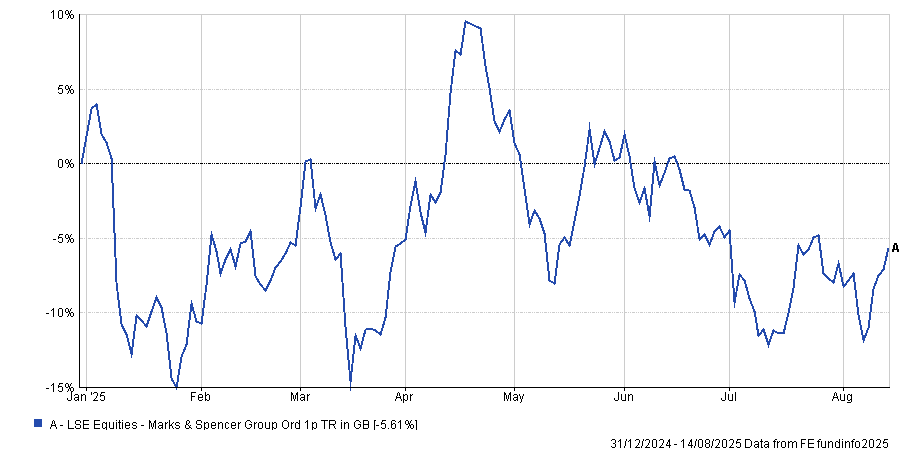

M&S: Squeezed at the margin

On the downside, first up is M&S, with Beauchamp noting that rising wage costs and supply chain pressures “continue to squeeze margins, while the general merchandise division remains sluggish”, despite modernisation efforts across food and digital channels.

This follows weeks of fallout following a ransomware incident that struck the British retailer in the spring, which caused serious disruption across the business.

“The high street environment remains fiercely competitive, with inventory issues and subdued consumer spending adding to the challenges,” he said.

“M&S needs to demonstrate stronger growth momentum to climb out of the relegation zone.”

The company’s share price is down 9.2% year-to-date and it remains expensive, on a P/E ratio of 25x.

Stock performance year-to-date

Source: FE Analytics

B&M European Value Retail: No quick turnaround

Meanwhile, general merchandise discount retailer B&M European Value Retail has endured a “brutal” year, Beauchamp said, with shares falling more than 50% after weak holiday trading and profit warnings following chief executive Alex Russo’s departure.

In addition, discounter competition and margin pressure have both intensified. The push to review online operations also adds complexity to the situation, Beauchamp said.

“Cost control and promotional strategies may help stabilise the business but the market remains unconvinced about any quick turnaround given the tough consumer backdrop.”

The company remains cheap, on a 7x P/E ratio, while also offering a 6.6% dividend yield. The share price has fallen 36.7% year-to-date.

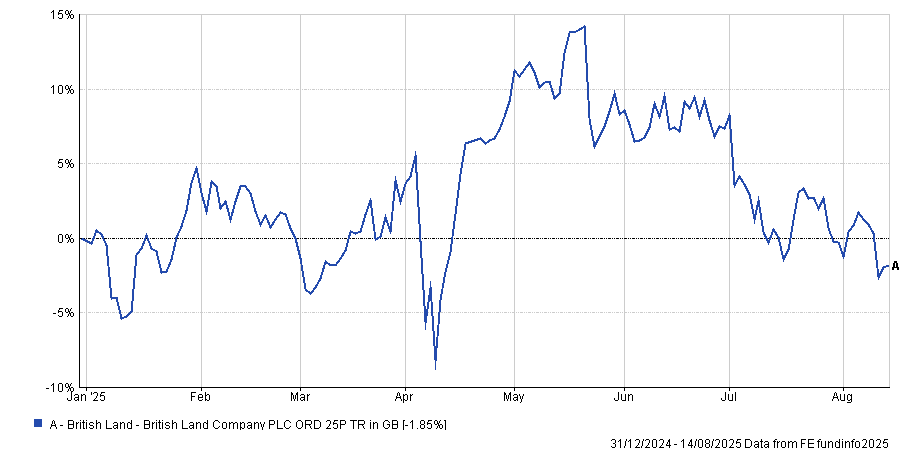

British Land: Property under pressure

UK commercial property company British Land, which has a market cap of £3.4bn, has continued to struggle due to weak office demand and elevated borrowing costs, according to Beauchamp.

“London vacancy rates remain stubbornly high, with hybrid working pattens suggesting the office recovery could prove longer and more painful than anticipated,” he said.

Sluggish property valuations and financing risks also add further pressure.

The share price has fallen 3.8% year-to-date – and 5.7% over five years. Trading at just shy of 10x P/E ratio, it also offers a 6.6% dividend yield.

Stock performance year-to-date

Source: FE Analytics