The tax advantage that made short-dated UK gilts a compelling option for higher-rate taxpayers has eroded, according to fund managers at Ninety One.

For much of the past 18 months low-coupon gilts offered a rare combination of safety and tax efficiency. Their exemption from capital gains tax at maturity meant investors in the 45% additional rate tax bracket could earn higher post-tax returns than from most taxable income assets.

At its peak, the benefit was so pronounced that a taxable alternative needed to deliver a pre-tax yield of more than 8% to compete.

That situation has changed. Monetary easing, a shrinking supply of suitable gilts and rising demand have all reduced the premium, explained Jason Borbora-Sheen, portfolio manager at Ninety One.

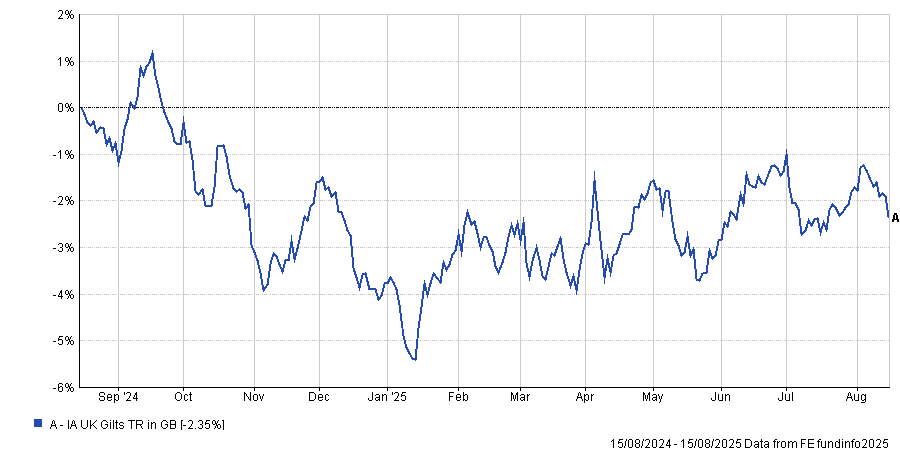

Performance of sector over 1yr

Source: FE Analytics

“The tax efficiency that made gilts so compelling is now materially diminished,” he said. “With the Bank of England having cut rates by 125 basis points and the pool of attractive low-coupon gilts steadily shrinking, the yield advantage is fading and investors risk locking themselves out of more compelling income and capital gains from elsewhere.”

The effect is visible in the tax-equivalent yield (the pre-tax return a taxable asset would need to match the after-tax return on a gilt). This measure has declined from around 8% at its peak to roughly 6% for a one-year gilt today.

As more investors have crowded into the trade, prices have risen and yields have fallen. “At the same time, investors chasing what’s left are now having to take more duration risk – a clear shift from the original short-term, defensive rationale,” Borbora-Sheen added.

John Stopford, head of managed income at Ninety One, said the case for gilts has weakened to the point where investors should actively consider rebalancing.

“We’re at a turning point. Twelve months ago, the trade was dominant. Today, it deserves re-evaluation – and may no longer be doing the job investors expect.”

The managers stressed that gilts can still play a role in diversified portfolios but the unique alignment of factors that drove their dominance for higher-rate taxpayers has faded. The opportunity cost of maintaining heavy exposure is rising as other asset classes may now offer stronger post-tax outcomes.

For wealth managers and individual investors, this creates a decision point. The original attraction of the trade was its defensive profile: short-maturity gilts combined low credit risk with a favourable tax treatment. As both falter, the rationale becomes harder to sustain.

Ninety One said investors who fail to reassess could find themselves exposed to unnecessary duration risk without the offsetting tax edge that once justified it. “When yield, diversification and resilience are all considered,” said Stopford, “the balance is beginning to tilt elsewhere.”