Baillie Gifford American, Fidelity Special Situations and a duo of Artemis funds are helmed by the best stock picking managers on the Hargreaves Lansdown Wealth Shortlist, according to analysts at the firm.

Hargreaves Lansdown has spotlighted five funds on its Wealth Shortlist whose long-term track records reveal “exceptional” stock picking records and consistent outperformance by their lead manager.

Kate Marshall, lead investment analyst at Hargreaves Lansdown, said: “When it comes to investing, it is easy to be dazzled by short-term wins or trends but what really matters is skill.

“Anyone can get lucky on a few bets but true success ties within a consistent, repeatable investment process.”

The fund managers listed below added the most value in terms of their investment style and the sectors they invest in combined over the past decade, Marshall explained.

“Fund managers who add value by genuinely understanding companies, not just riding market tides or styles, offer an edge and the potential for returns in various market conditions,” she noted.

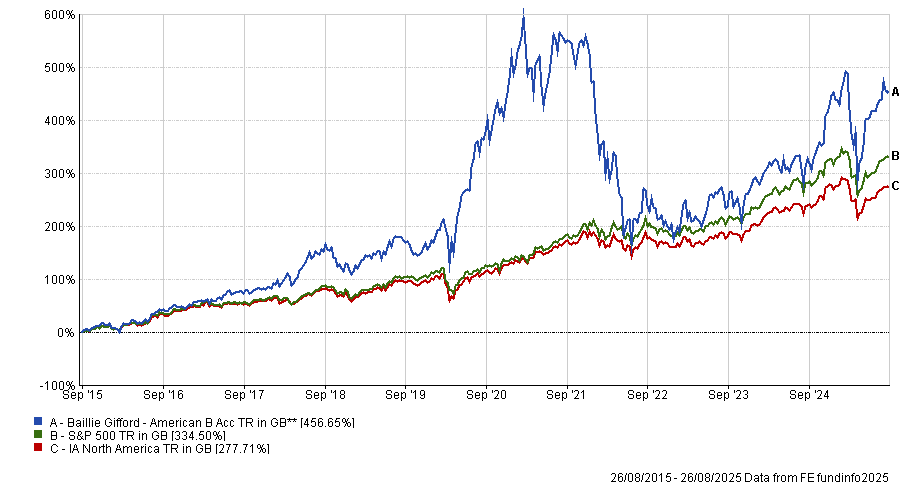

Baillie Gifford American invests in disruptive US-based businesses displaying strong growth potential. The £3.2bn fund is managed by Dave Bujnowski, Gary Robinson, Kirsty Gibson and FE fundinfo Alpha Manager Tom Slater. It is a relatively concentrated fund of between 30 and 50 stocks. Top holdings include Magnificent Seven companies such as Meta and Amazon, alongside DoorDash, Roblox and Shopify.

Hargreaves Lansdown analysts highlighted the managers’ long-term and disciplined investment process.

When explaining its inclusion in the Wealth Shortlist, they said: “We think this fund could work well in a portfolio with little exposure to the US, invested for long-term growth. Its focus on large companies means it could also sit well alongside a US equity fund focused on medium-sized or higher-risk smaller sized companies, or a US fund with a value bias.”

Baillie Gifford American aims to outperform the S&P 500 index by 1.5% per year over any five-year period. It has delivered a 456.7% total return over 10 years and successfully outperformed both the benchmark and sector over one and three years.

Fund performance vs sector and index over 10yrs

Source: FE Analytics

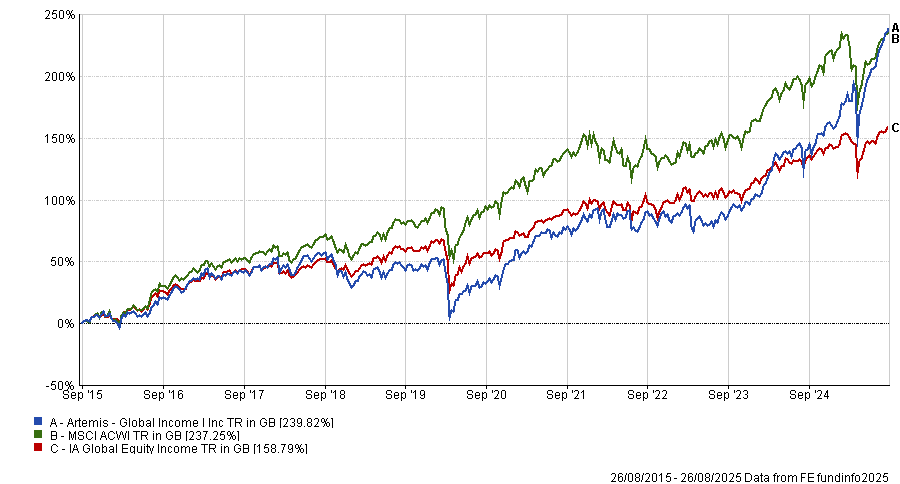

Hargreaves Lansdown also highlighted Artemis Global Income, which is managed by Jacob de Tusch-Lec. As a “natural contrarian”, the managers typically invest in out-of-favour companies with recovery potential.

According to the platform’s analysts, de Tusch-Lec uses a “disciplined” value investment approach that has helped to drive returns, with the £3.2bn fund managing a 239.8% total return over 10 years.

Fund performance vs sector and benchmark over 10yrs

Source: FE Analytics

When explaining their rationale for including the fund on the Hargreaves Lansdown Wealth Shortlist, analysts said the fund was a useful diversifier to “plain vanilla” global income.

They added: “De Tusch-Lec also tends to perform better than his peers in rising markets, but not as well when they have fallen.”

The fund is co-managed by James Davidson, who was brough on in 2020.

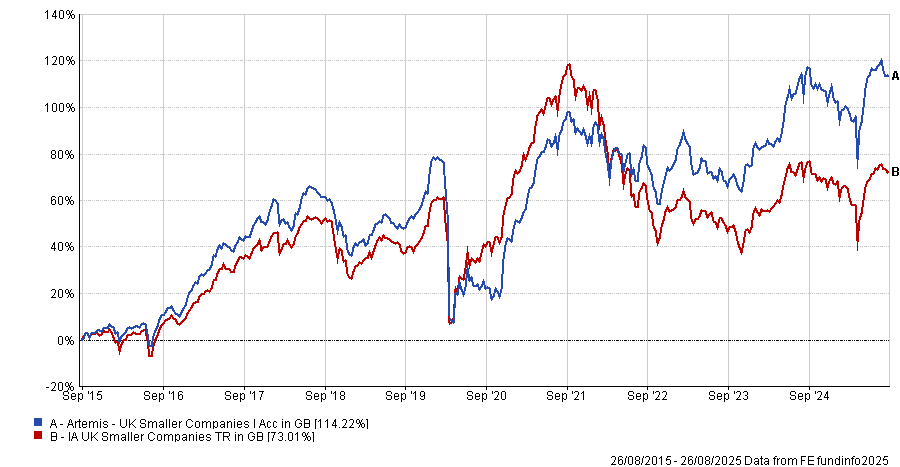

Hargreaves Lansdown also pointed to Artemis UK Smaller Companies, which is managed by Mark Niznik and William Tamworth.

The analysts said the fund offers investors access to the growth potential of smaller companies but warned this does invite more volatility and risk.

When justifying the fund’s inclusion in the Wealth Shortlist, they cited Niznik’s “vast experience” investing in smaller companies, noting “he has skill and support to deliver good returns to patient investors”.

The fund’s valuation-focused approach means it is different to many of its peers – with strong results. The £569.2m fund outperformed the IA UK Smaller Companies sector over three years (21.9%), five years (75.1%) and 10 years (114.2%).

Fund performance vs sector over 10yrs

Source: FE Analytics

“The fund could add diversification to the UK portion of an adventurous global portfolio or could complement a UK-focused portfolio orientated towards larger, more established businesses,” the Hargreaves Lansdown research team said.

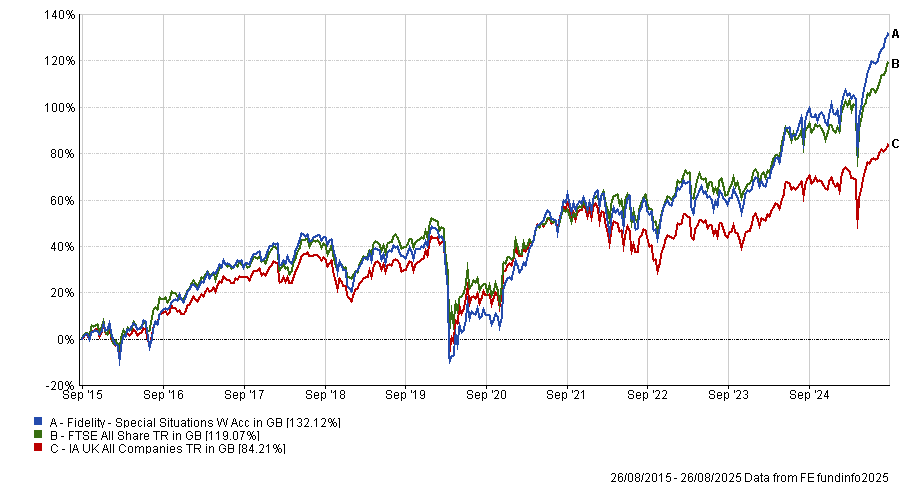

Meanwhile, Alex Wright is lead manager of Fidelity Special Situations, employing a more contrarian approach by focusing on unloved UK companies, according to Hargreaves Lansdown analysts.

“While investment styles go in and out of favour over time, the manager has never deviated from his longstanding investment approach and a strong stock-picking ability has helped to drive returns,” they said.

Top holdings include British American Tobacco, Aviva and NatWest Group.

The £3.8bn fund outperformed both the sector and benchmark over one, three, five and 10 years, delivering total returns of 17.3%, 49.3%, 110.1% and 132.1% respectively.

Fund performance vs benchmark and sector over 10yrs

Source: FE Analytics

Analysts said Fidelity Special Situations would sit well alongside a UK equity fund focused on companies expecting to grow earnings at a more consistent pace.

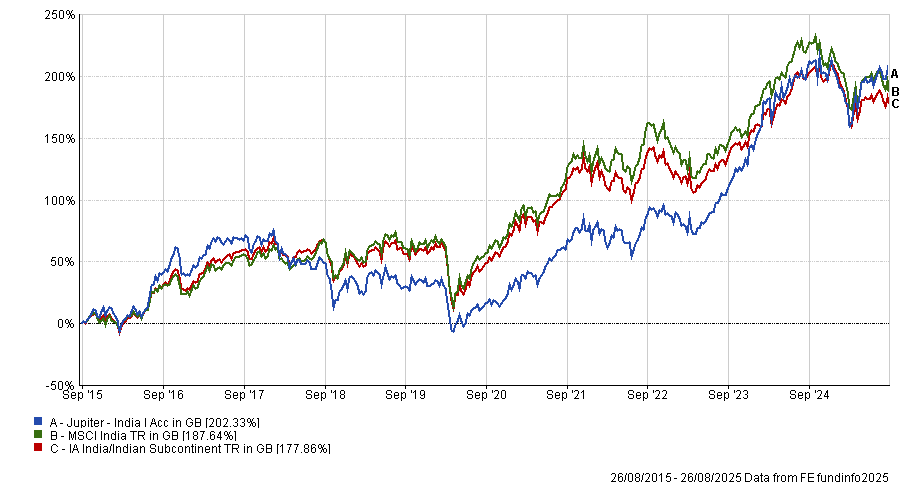

Meanwhile, Jupiter India, which has been managed by Avinash Vazirani since 2008, capitalises on India’s rapidly expanding economy and population. The £1.8bn fund targets companies of all sizes, although has a bias towards small and medium-sized enterprises (SMEs).

It has managed a top-quartile return across one, three, five and 10 years, delivering a 202.3% total return over the decade – versus a 178.3% total return over the same time period by the IA India/Indian Subcontinent sector.

Fund performance vs sector and index over 10yrs

Source: FE Analytics

Hargreaves Lansdown analysts said they were impressed with the manager’s commitment to investing in India and “willingness to invest in areas overlooked by others”.

They added: “We think India has excellent long-term growth potential, though a fund focused on a single emerging country is a high-risk option so it should only make up a small portion of an investment portfolio.”

As such, they suggested the fund could sit alongside funds with a broader Asia or global focus.