Just 43% of households are on track for an appropriate retirement, according to the Hargreaves Lansdown (HL) Savings and Resilience Barometer.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, said there was still “a mountain to climb” to get people saving enough to afford retirement.

However, the figures are “rosier” than they have been in previous reports as Hargreaves has changed the standard it defines as an adequate retirement.

Previously it used the Pension and Lifetime Saving Association’s moderate retirement income level. In the latest report it has switched a combination of the Pension Commission's target Replacement rate (which aims for a pension income of two-thirds of pre-retirement income), while taking into account a basic living wage pension benchmark.

Previously, around 6% of the bottom 20% of earners were believed to be saving enough for retirement, versus 52% of the top 20% of earners. However, under the new metric, there is a more even split as lower earners benefit from “state pension and auto-enrolment minimum contributions, which will go a long way towards replacing a large proportion of their pre-retirement income”, said Morrissey.

In fact, the worst group are the earners in the highest quintile, who need an extra £64,800 if they want to maintain their lifestyle in retirement.

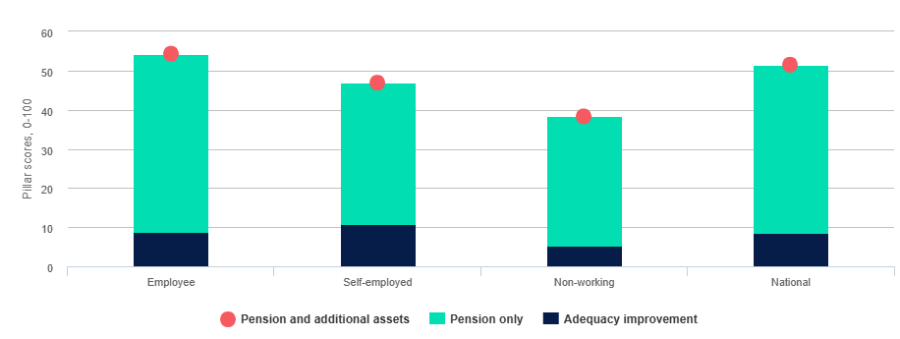

However, although pensions are a very tax-efficient way of saving for retirement, they are not the entire picture and other assets can contribute to retirement.

For example, investments outside of a pension can also be used for retirement and can be a “significant boost” to the total figures, particularly for the self-employed, who may not save into pensions, Morrissey explained.

Breakdown of pension adequacy

Source: Hargreaves Lansdown

The Barometer also looked at the wider investment picture, where behaviour trends are mixed. Sarah Coles, head of personal finance at Hargreaves, explained that while the number of investors in the UK is up 3.7 percentage points since the pandemic, some “alarming gaps endure”.

For example, around 63% of the top 20% of households by earnings invest, compared to just 23% of low-earning households.

However, not all who can invest are doing so, with 42% of the 8.8 million households holding enough spare cash to put some into markets, opting not to. Almost a third of high-earning households (31%) can invest but are choosing not to, a “worrying reluctance” according to Coles.

The Barometer considers households as able to invest if they have enough emerging savings, are not in arrears and do not have burdensome debts.

“With no financial reason for holding back from investment, it comes down to a lack of confidence and knowledge, where people don’t feel they know enough about investment, have inflated fears about risk, or underestimate potential gains”, Coles continued.

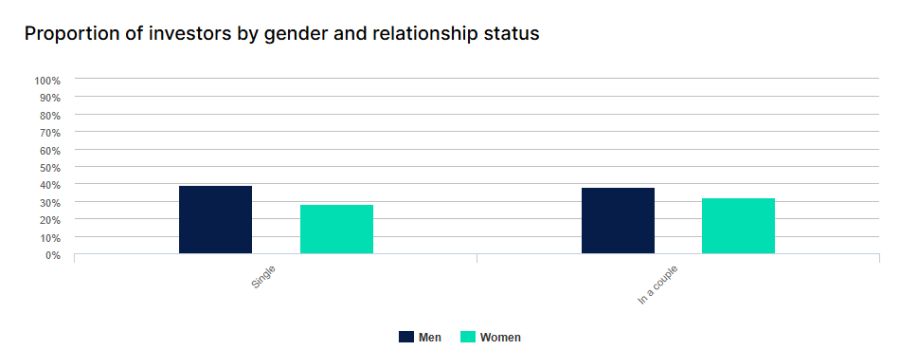

Gaps in investor behaviour were also found based on marital status and gender. The Barometer found 48% of couples invest, compared to 32% of single people, with couples' tendency to invest rising to 58% by the time they are over 50.

Coles added: “Living on your own means you’re on the hook for everything, so single people spend significantly more than each member of a couple on the essentials so, to make ends meet, they have to make much bigger compromises on everything from where they live to the clothes they buy and how they get around.”

Meanwhile, women invest less than men because they tend to be on “lower average incomes and those who earn less tend to invest less”. In single households, only 28% of women invest compared to 39% of men, rising to 32% of women in couples and 38% of men.

Source: Hargreaves Lansdown

Another “alarming” trend is that 29% of households are investing before they should, instead of focusing on short-term resilience, Coles said. This is partially because people are unhappy with their financial circumstances and are trying a “get-rich-quick approach out of desperation”, she added.

While aiming to invest is admirable, Coles warned that doing so before people are financially ready could lead to a worse position than they started in.