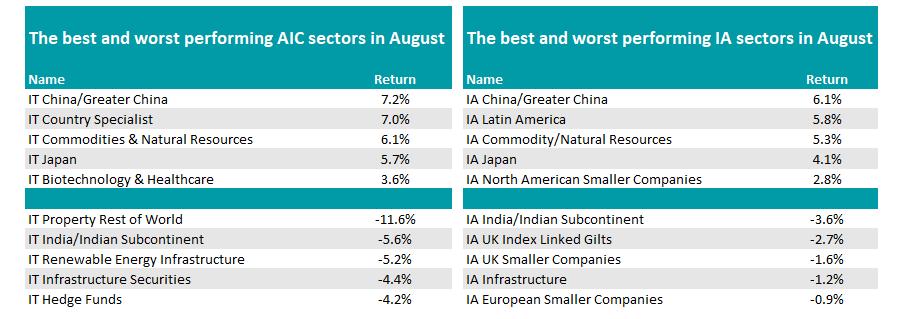

Investors who backed a turnaround for the Chinese market in August were rewarded, with both the IA China/Greater China and IT China/Greater China sectors topping their respective universes for the month.

Ben Yearsley, found of Fairview Investing, said: “It is often counter-intuitive with markets, as economic data released mid-month was mixed with both retail sales and industrial production lacklustre, yet markets continue to rise strongly. Maybe it’s simply value driving investors.”

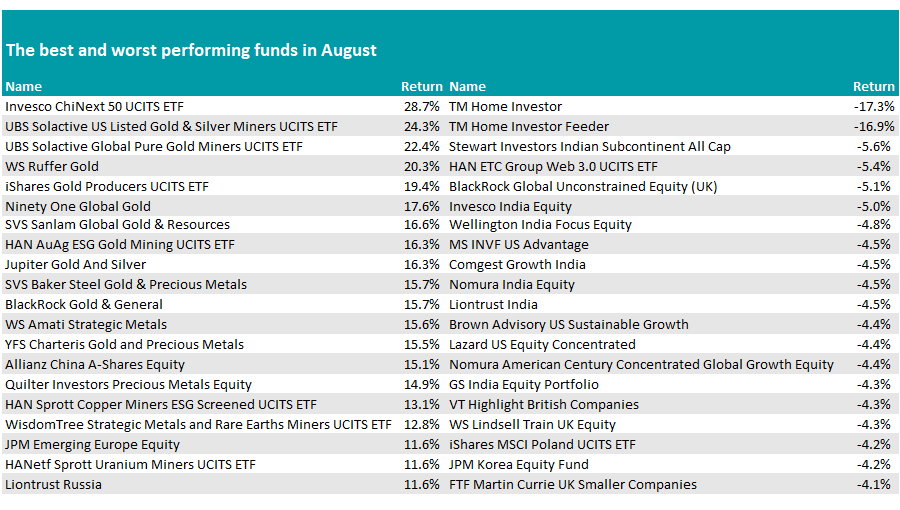

Invesco ChiNext 50 UCITS ETF was the top fund of the month, up 28.7%, although it was one of only two China portfolios among the top 20 Investment Association funds of August. The other was Allianz China A-Shares Equity.

Instead, the top 20 was dominated by commodities, despite the IA Commodity/Natural Resources sector only sitting in third place overall. The rise of gold propelled the likes of WS Ruffer Gold, iShares Gold Producers UCITS ETF and Ninety One Global Gold towards the top end of the table as investors continued to seek the safe haven.

Source: FE Analytics

However, UBS Solactive US Listed Gold & Silver Miners UCITS ETF and UBS Solactive Global Pure Gold Miners UCITS ETF were the top performers in the sector.

Yearsley noted as gold “powered through” $3,500 per ounce it “re-ignited gold equities”. The yellow metal closed the month at $3,518 an ounce, up $175.

“Many commentators still think gold equities are cheap and haven’t kept pace with the rise of the physical price. With rate cuts in the US expected in September, gold could be set for a strong end to 2025 as lower rates reduce the opportunity cost of owning gold,” he said.

Conversely, a barrel of Brent crude reversed July’s gain of $5, falling more than $4 to finish at $68.12, explaining the lower overall returns for the sector.

Splitting the IA Commodity/Natural Resources and IA China/Greater China sectors was IA Latin America, which is often tied to commodity prices also benefited from a weaker dollar, Yearsley said. The greenback ended the money down 2% versus the pound and marginally lower versus the euro and yen.

Source: FE Analytics

At the other end of the spectrum, India funds struggled, with the sector down 3.6% and the top 20 list dominated by individual names.

“Are Trump tariffs to blame?” asked Yearsley. “Stewart Investors Indian Subcontinent All Cap was among the worst hit, down 5.6% in August as three managers left the firm last month.”

“It was interesting to see Morgan Stanley’s US Advantage fund featuring in the quagmire, as normally poor performance from this is associated with an implosion in US tech – Nasdaq rose last month,” Yearsley added.

Also on a downward trajectory were UK index-linked gilts, with the IA sector among the worst performers as investors fretted over the long-term outlook for the UK.

“The UK cuts rates, yet the 10-year gilt fell and the 30-year gilt now offers the highest yield since the 1990s,” Yearsley added.

He described the UK economy as “a bit all over the place”, with housebuilding down, yet GDP up thanks to government spending. Consumer confidence is also high, although 89,000 have been lost in the hospitality sector.

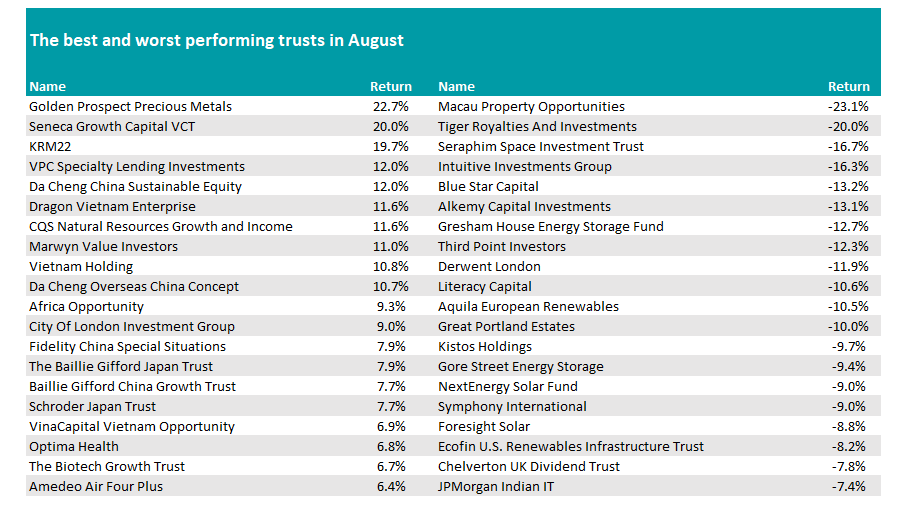

Moving on to investment trusts, China trusts led the way. Three of the top five sectors were the same among both closed and open-ended funds last month: China, commodities and Japan.

On the downside, IT Property Rest of World (down 11.6%) spared Indian trusts (-5.6%) from the top spot as the biggest loser.

Golden Prospect Precious Metals topped the charts but was joined by an eclectic mix that included Vietnam specialists, two China trusts a Japan portfolio and a biotech investment company.

Source: FE Analytics

Conversely, Macau Property Opportunities was the biggest loser of the month, but solar specialists and energy storage trusts were prevalent among the worst performers.

“There was little M&A activity,” Yearsley noted. “There were interesting moves with a few trusts receiving resolutions from disaffected shareholders (Gore Street and Maven Renovar) and even though the resolutions were defeated it is interesting to see more investor engagement in 2025 in the trust world. Shareholder engagement is a good thing.”