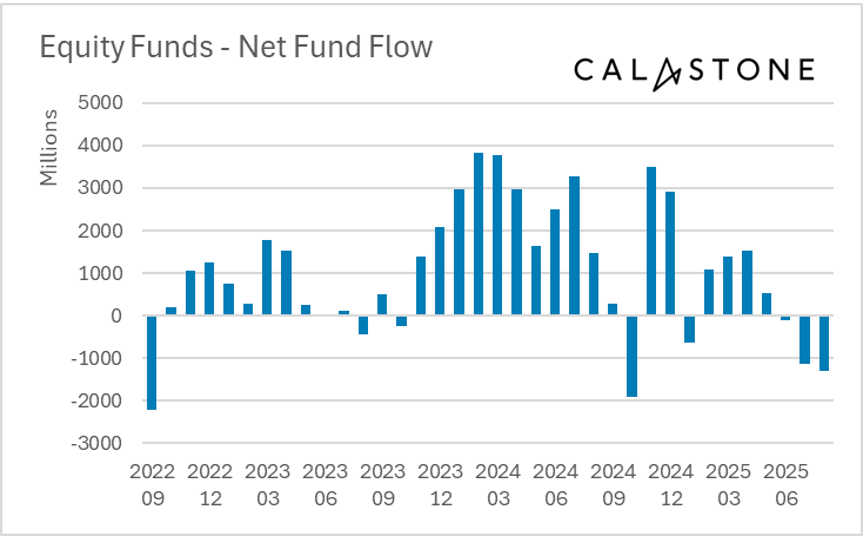

Investors pulled £1.3bn from equity funds in August, marking the worst month of outflows since summer 2022, according to the latest fund flow data from Calastone.

Source: Calastone

Despite stock markets reaching record highs, investors opted for safe-haven money-market funds, which attracted their strongest inflows in two years at £633m.

Edward Glyn, head of global markets at Calastone, said: “Outflows in the summer of 2022 reflected a sharp market sell-off driven by central banks raising rates to squeeze inflation, the oil shock from Russia’s Ukraine invasion and fears of recession (which did not materialise).

“By contrast, this summer, stock markets are ignoring a wide range of negative signals and have continued to reach new highs.”

He said that investors remain “wary”, fearing that a market correction is around the corner.

“August was the third consecutive month of outflows – an usually long stretch, as investors top-slice holdings to hang on to strong capital gains this year and park the proceeds in the money markets to wait out the storm they fear,” Glyn said.

“Whether their caution is justified remains to be seen.”

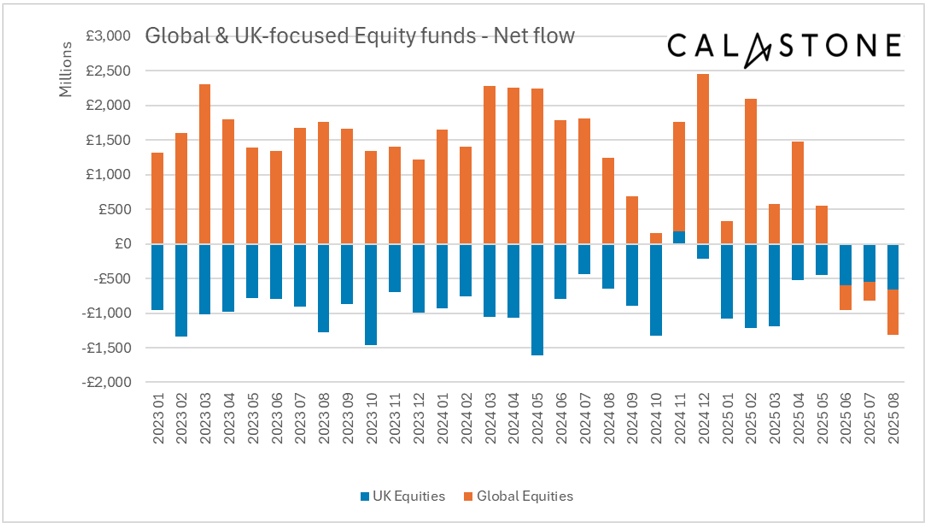

Global equity funds were among the hardest hit, recording a third consecutive month of withdrawals.

“Global equity funds have been the go-to strategy for investors for a decade, almost never seeing outflows, even as capital in other sectors has ebbed and flowed,” said Glyn.

“This has changed markedly in the last three months, [but] is likely to be a temporary phenomenon and doubtless reflects scepticism around the sky-high valuations of global mega-cap stocks, especially US tech.”

Although highly-priced US equities typically enjoy a “disproportionately large weighting” in global funds compared to profits or GDP, thus limiting the diversification benefits, Glyn maintained that global funds continue to save investors from having to pick regional winners.

As such, global equity funds will “doubtless prove attractive again before long”, he said.

Meanwhile, UK-focused equity funds also saw £657m in outflows. However, they still performed better than global peers – for just the second time in eight years.

Source: Calastone

European-focused equity funds maintained their recent run of inflows, while Asia-Pacific equity funds continued to endure their two-year run of net selling, despite stronger performance in 2025.

Fixed-income funds also showed “mixed signals” in August following £122m in July outflows, adding £133m, according to Calastone.

Fixed income funds have shed £628m year-to-date – primarily from the sovereign bond sector.