The summer of 2025 saw a familiar frenzy return to markets, with meme stocks surging once again, fuelled by retail enthusiasm and social media hype.

Meme stocks are companies who experience a sudden surge in their share price driven by a cohort of retail investors that have been whipped up into a frenzy via an online medium rather than the typical markers of an attractive investment opportunity.

But the fall is usually just as steep as the surge, often leaving many investors worse off than they started.

The movement’s latest revival through companies such as US department store chain Kohl’s and camera retailer GoPro has reignited the debate about herd-like mentality and risks to retail investors, with investment experts calling for caution.

Laith Khalaf, head of investment analysis at AJ Bell, said: “The meme stock craze of 2025 is no different in character to 2021 in that it still presents a conceptual challenge to the traditional idea of investment as a rational activity based on an assessment of company fundamentals.”

The idea of ‘meme stocks’ first appeared in 2021, when retail investors engaging with the Reddit forum r/wallstreetbets rushed to buy shares in video game store chain GameStop.

The share price leapt by an unsustainable 400% within a week in February 2021. Retail investors who bought in at or near the top lost out heavily when the price crashed back down again.

Buying stocks based on social media posts represents “significant risk” to retail investors, Khalaf said.

“But it also creates market volatility in certain stocks for those who may wish to hold them for fundamental reasons.”

As the price overinflates, it is natural for a professional investor to take profits and reinvest them elsewhere, especially given the downside risk if the meme stock craze moves on and leaves the stock in freefall, he explained.

What happened this summer?

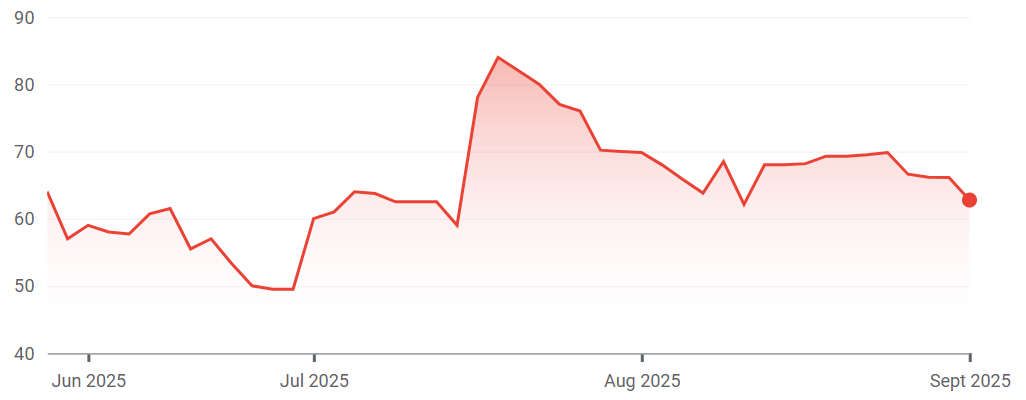

This summer, around 10% of GoPro’s stock was shorted and it saw an 80% surge in value during pre-market trading on 23 July. Meanwhile, doughnut maker Krispy Kreme’s share price rose 39% intra-day on 23 July, before pulling back.

Susannah Street, head of money and markets at Hargreaves Lansdown, said: “Armies of retail investors have realised that, en masse, they have power to influence markets and this herd-like behaviour has been continuing in spurts ever since. But the problem is nostalgia alone won’t sustain the frenzy.”

For example, Krispy Kreme “came back down to earth with a bump” after its second quarter earnings came in worse than analysts expected, Streeter noted.

“The company has written down the value of multiple business units, its losses have mounted up and revenues are sliding,” she said.

“Nevertheless, it is still attracting speculation, with the share price remaining highly volatile, swinging between gains and losses in seconds.”

The company’s share price is down 64.4% year-to-date.

Stock price performance over six months

Source: Google Finance

But not every company targeted by hype-led investors are meme stocks.

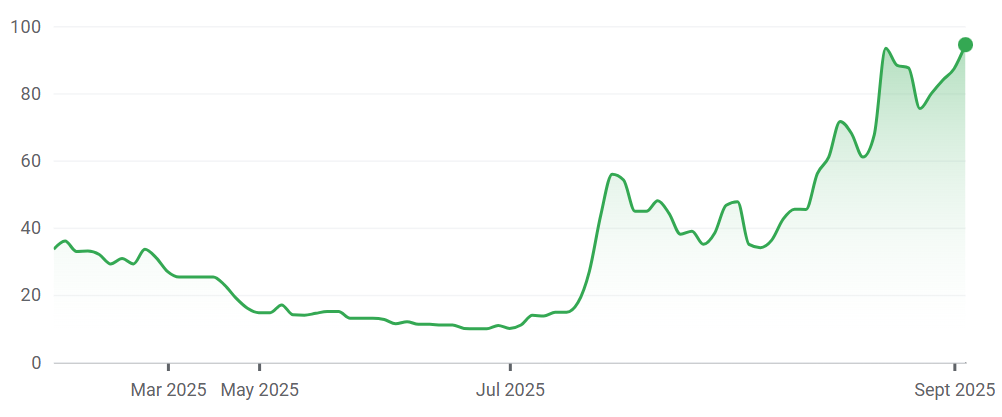

Software company Palantir Technologies has benefitted from the frenetic demand for artificial intelligence, with shares increasing by around 540% over the past year as it broke through the $1bn quarterly revenue mark and secured a multi-year contract with the US army.

“The company’s forward price-to-earnings ratio has soared, leading to concerns that it has headed into wildly overvalued territory,” said Streeter.

“However, it still has stronger fundamentals than other companies whipped up into a meme stock frenzy, as it is generating $1bn revenue a quarter, is profitable and has really strong growth credentials, so is arguably not a meme stock, although its valuation has become frothy.”

Stock price performance over 1yr

Source: Google Finance

Opendoor – an online company that buys and sells residential real estate – was another company that enjoyed a meme-stock-like rally in the summer, following social media posts made by the likes of investor and tech entrepreneur Anthony Pompliano and hedge fund manager Eric Jackson. The company’s share price is now up almost 185% year-to-date.

Stock price performance year-to-date

Source: Google Finance

However, Jackson maintained that he does not view Opendoor as a meme stock but rather a stock that could reach $500 a share due to its strong fundamentals – namely, the commitment to artificial intelligence-driven models and its scalable business model.

“Any meme stock has been a terrible business fundamentally,” he told Trustnet, noting that Opendoor is instead a “turnaround” story.

As an example, Jackson pointed to his decision in 2023 to invest in used car dealer Carvana, which went from $400 to $3 and back to $400. He invested at $15. Today, the stock price is well above $300.

“Nobody ever called Carvana a meme stock,” he said. “Opendoor will be a bigger comeback story than Carvana.”

Investors must ignore FOMO

Nonetheless, when it comes to ensuring long-term financial resilience, short-term speculative decisions are “never a wise move”, according to Streeter.

“When investing, it is really important to ignore FOMO [fear of missing out] pressure and resist chasing after hot stocks,” she said.

“After all, if there is a stampede of investors going after one particular investment, then they are probably buying it at a price higher than it is worth.”

A more effective way to gain exposure to meme stocks would be investing in funds tracking broad market indexes, such as the S&P 500, she suggested, noting that this will also offer investors the diversification needed to ride out the ups and downs of markets.