Investors have regained confidence in Europe, as the old continent is gaining momentum on the back of increased defence spending, as well as investors turning away from a concentrated and expensive US market.

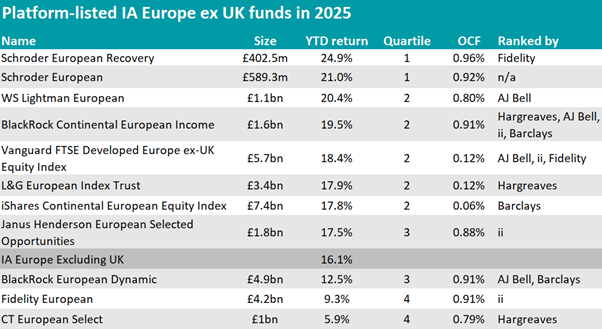

This doesn’t mean, however, that all IA Europe Excluding UK funds have succeeded so far this year – in fact only one fund recommended by the top five investment platforms – Hargreaves Lansdown, Interactive Investor (ii), Fidelity, Barclays and AJ Bell – has achieved top-quartile returns against its peers: Schroder European Recovery.

Ranked by Fidelity in its Select 50 list, this concentrated fund invests across Europe by adopting a contrarian approach, buying companies with depressed share prices.

Manager Andrew Lyddon has been investing on this basis since before the 2008 global financial crisis and was praised by Fidelity analysts for his dedication to value investing, even when times were tough.

“Over the short term, like most equity funds, it sometimes loses value, but tends to recover well,” they said. This makes the fund, which tends to come into its own over periods of five years or more, “a good choice for an investor with a long time-horizon”.

The fund’s exposure to smaller companies has proven beneficial in the first half of 2025 as inflation receded and sentiment improved – contributing positively to performance.

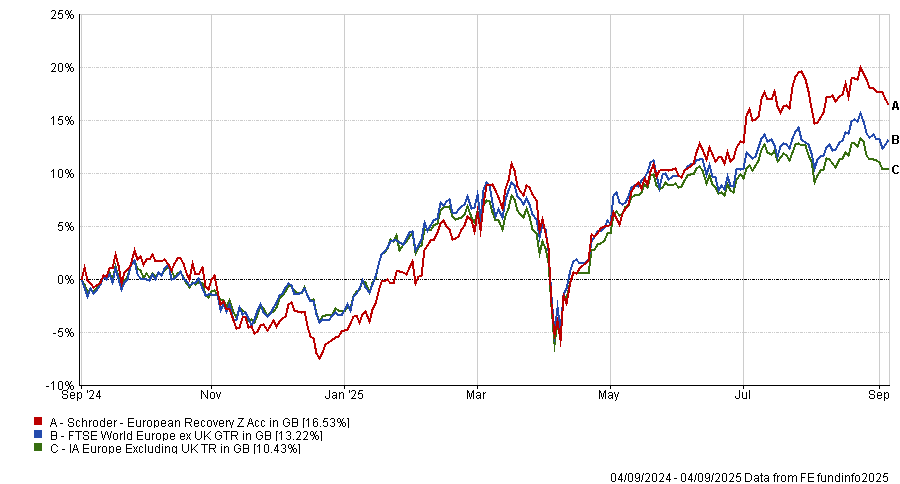

Performance of fund against index and sector over 1yr

Source: FE Analytics

Earlier today, the manager told Trustnet that investors are overly concerned about owning “value traps” and have therefore not picked some of the biggest winners in recent years.

Although relative outperformance in any given timeframe isn’t the main focus of best-buy lists (but rather highlighting funds with the potential to meet or exceed their goals as part of a diversified portfolio), AJ Bell missed the opportunity to rank another top-quartile performer, Schroder European, when it decided to remove it from its Favourite Funds list in March this year.

According to the analyst note, this was done “due to reduced conviction in the fund’s manager and investment approach”.

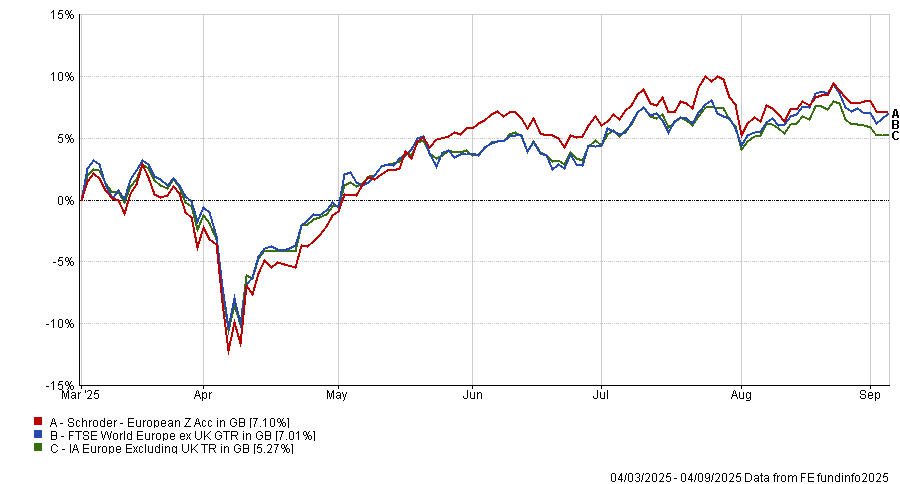

Since then, the vehicle, which is managed by Martin Skanberg, posed a return in line with its benchmark, the FTSE World Europe ex UK index, and two percentage points above its sector, as the chart below shows.

Performance of fund against index and sector over 6 months

Source: FE Analytics

The list of top-quartile outperformers end here, but other platform-backed funds have performed well. The third-best platform-backed fund in 2025 so far has been WS Lightman European, backed by AJ Bell for manager Rob Burnett’s “consistent implementation of his investment process”.

It is typically invested in lower valued stocks and the performance profile is therefore likely to be volatile and different to that of the benchmark index.

Source: Trustnet

The strategy with most recommendations was BlackRock Continental European, which convinced all main UK platforms except Fidelity.

It achieved a second-quartile performance over the year to date by focusing on generating a growing income (the current yield is 3.81%). The portfolio is concentrated by design, so that stock-specific convictions can add value without getting diluted.

Hargreaves Lansdown analysts rank this fund for the strong track record of managers Andreas Zoellinger and Brian Hall, for the defensive and blended investment approach, which “could help limit volatility compared to peers in times of uncertainty”, and for the “attractive income” offered to investors.

There was another active fund by the same provider, BlackRock European Dynamic, backed by AJ Bell and Barclays, although it sits in the third quartile of performance so far this year.

According to Barclays analysts, it is managed by “one of the most experienced and talented European equity teams” with Giles Rothbarth at its head.

“Rothbarth isn’t constrained as to what he must invest in. Instead, he can take a dynamic approach and invest a substantial proportion of the fund into industries and sectors that may only represent a small part of the market, if that’s where he believes the best opportunities lie,” the analysts explained.

“Because of this dynamic and active approach to investing, we believe the fund has the potential to perform well in all market conditions.”

Index-tracking funds also made the list. Vanguard FTSE Developed Europe ex-UK Equity and iShares Continental Europe Equity both achieved second-quartile performances due to positive momentum in their benchmarks.

Fidelity European and CT European Select, backed by ii and Hargreaves Lansdown respectively, were stuck in the fourth quartile of performance against their peers.

This article is part of an ongoing series looking at the year-to-date performance of funds in each major sector currently backed by the main UK Investment platforms. Previously, we have looked at global equity, UK All Companies, UK equity income and multi-asset funds.