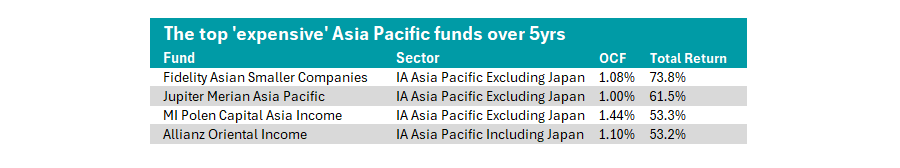

Just four Asia-Pacific funds with a high ongoing charge figure (OCF) have delivered top-quartile returns over the past five years, according to recent research from Trustnet.

These are Fidelity Asian Smaller Companies, Jupiter Merian Asia Pacific, MI Polen Capital Asia Income and Allianz Oriental Income.

In this series, Trustnet looks at the funds in each Investment Association (IA) sector that have paired top-quartile returns with OCFs above 1%.

Source: FE Analytics. Performance in sterling. Data to end of Sep 2025

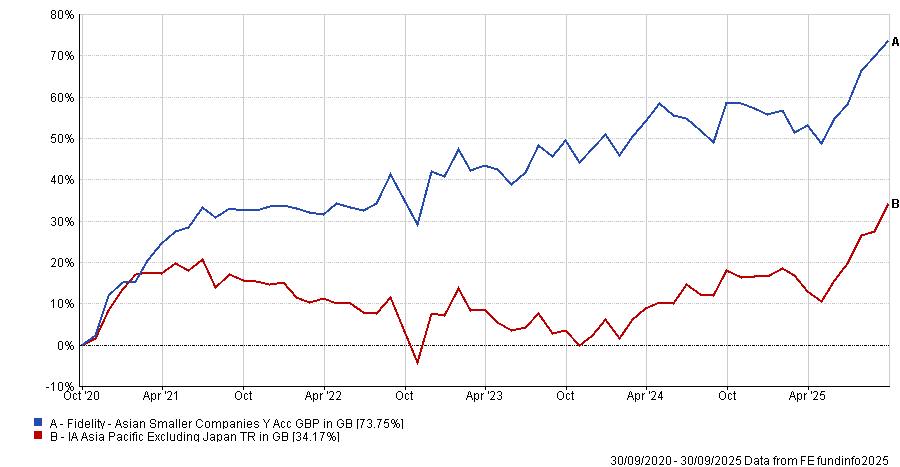

The Fidelity Asian Smaller Companies fund, led by Nitin Bajaj and Ajinkya Dhavale, took the crown for performance. Over the past five years, it has surged 73.8%, the fifth-best return in the IA Asia Pacific excluding Japan peer group, despite a 1.08% charge.

It is a value-tilted stock picking strategy targeting smaller companies with valuation anomalies, with a smaller company defined as a business with a market cap under $8bn, but the managers are willing to invest in companies that do not fit this criteria. For example, the fund’s largest holding is semiconductor chip-making giant Taiwan Semiconductor (TSMC), which has a market cap of more than £1trn.

The fund posted top-quartile results in five of the past 10 years, but bottom-quartile returns in another four.

Performance of fund vs sector over 5yrs

Source: FE Analytics. Performance in sterling. Data to end of Sep 2025

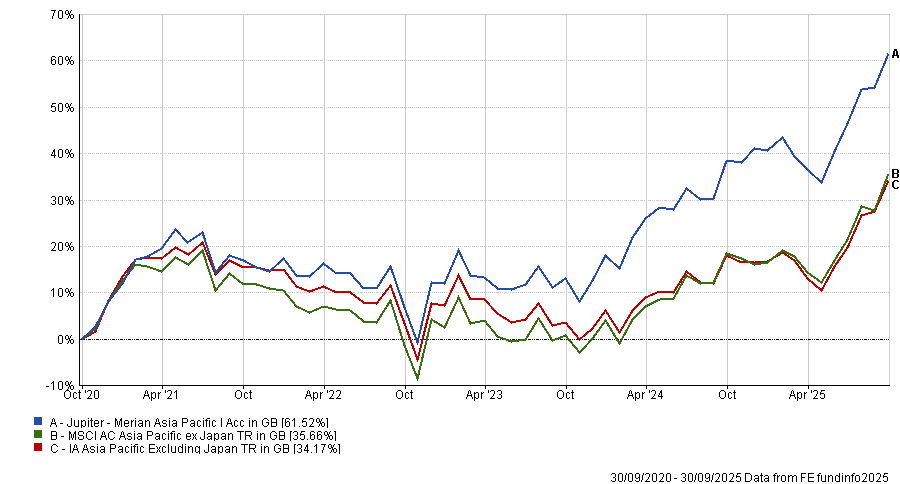

Another expensive fund that justified its higher cost is the Jupiter Merian Asia Pacific fund, led by FE fundinfo Alpha Manager Amadeo Alentorn.

Its 59.2% five-year return is the fourth-best performance in the IA Asia Pacific excluding Japan peer group. It came at a 1% OCF.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics. Performance in sterling. Data to end of Sep 2025

The strategy is well regarded by experts, with analysts at Titan Square Mile awarding it with their ‘A’ rating.

Analysts noted that the managers aim to be “fairly style neutral” by avoiding skewing towards rapidly growing or very cheap companies. After a period of underperformance during the global financial crisis, the fund shifted to a more quantitatively driven strategy that analysts believe has paid off in recent years.

The analysts pointed to 2020 as an example of this, with the fund's new strategy being “properly tested by the pandemic lockdown”. The fund coped well, with a 21.9% total return, outperforming the MSCI AC Asia Pacific benchmark.

“Ultimately, we like the fact that the team are willing to evolve the process over time,” analysts noted.

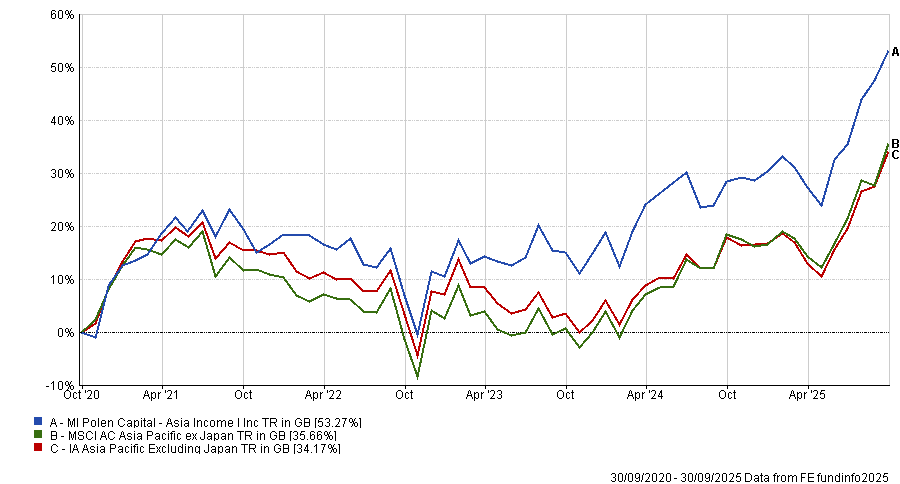

Third on the short list is the MI Polen Capital Asia Income fund. With just £20.5m of assets under management (AUM), it has posted a stellar five-year return of 53.3% in the IA Asia Pacific excluding Japan sector.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics. Performance in sterling. Data to end of Sep 2025

Its three- and one-year returns are also impressive, with further top-quartile results to justify its 1.44% OCF, one of the highest charges in the peer group. However, it should be noted that Polen Capital only took over in early 2024; before this, it was run by Somerset Capital.

The fund aims to deliver an annual net income of “at least 110% of the yield of the MSCI AC Asia Pacific excluding Japan index”. At the time of writing, the index yields 2.24%, with the fund yielding 3.4%.

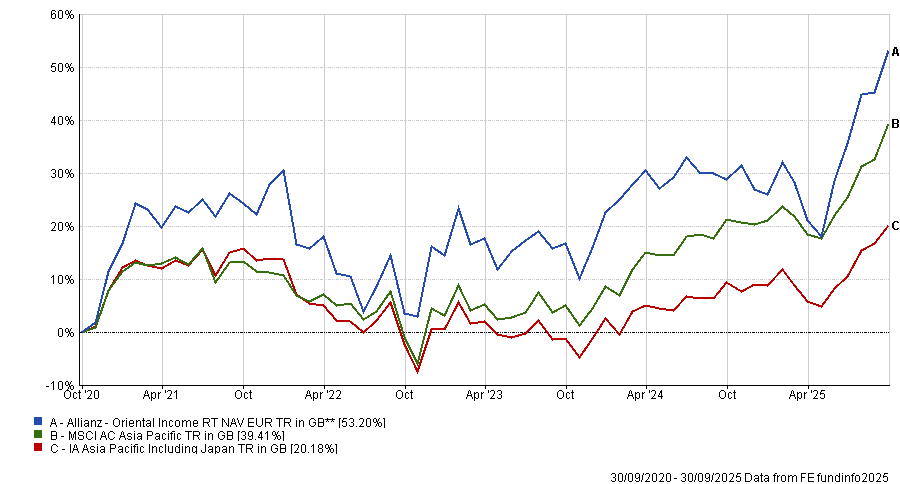

Finally, Allianz Oriental Income also made the list.

Led by Stuart Winchester, the £972m portfolio has delivered a 53.2% total return over the past five years with a 1.1% charge.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics. Performance in sterling. Data to end of Sep 2025

The strategy invests at least half of its total assets in stocks, of which 80% must be in companies in the Asian Pacific region. However, it is not confined to purely equities, with managers willing to invest the remainder of the assets in fixed income (currently it has just 1.6% in fixed income).

As the only strategy from the IA Asia Pacific including Japan sector to appear on the shortlist, it invests 31% of its assets in Japanese equities.

The fund has a 19.8% overweight to industrials compared to the benchmark, with stocks such as engineering company Mitsubishi Heavy and manufacturing company Hoya Corp appearing in its top 10 holdings.

Over the year to date, the strategy is up 17% compared to an IA Asia Pacific Sector average of 7.3%, marking it as the top fund in the peer group.

Previously in this series, we have examined the Global, US, UK, European, Multi-asset and Emerging Markets.