The outlook for domestic stocks will “probably get worse before it gets better”, according to JP Morgan Asset Management’s Anthony Lynch, who said he is “nervous” about the UK economy.

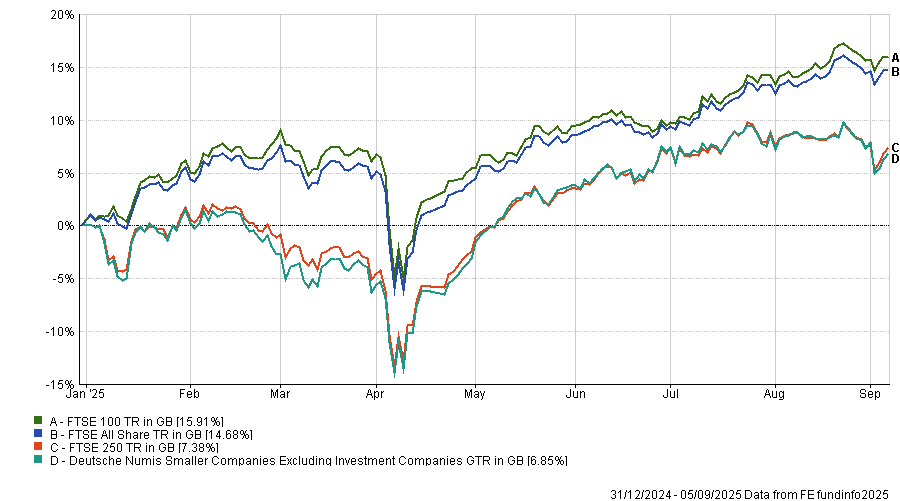

UK companies have rallied this year, with the FTSE All-Share up 14.7%, outperforming the wider MSCI World (up 5.8%). However, not all parts of the capitalisation spectrum have performed equally.

Most of these gains have been limited to companies in the FTSE 100, which has broken an all-time high and is up 15.9%. By contrast, the FTSE 250 and the Deutsche Numis Smaller Companies excluding investment companies indices have trailed behind.

Performance of market indices YTD

Source: FE Analytics

As a result, the opportunity set for UK investors has changed, Lynch explained. Despite small and mid-caps remaining relatively cheap, there are several reasons “to be nervous about the domestic economy”.

Smaller UK stocks are domestically driven and sensitive to the spending power of the average consumer, which could come under pressure if the economy remains sluggish.

Lynch noted the UK economy has had “a difficult few years”, which has made it challenging for more domestic businesses. For example, both long-term and short-term interest rates remain high, which is restrictive for businesses that require capital to grow.

Another “warning sign” for the domestic economy is deteriorating wage growth. For example, he pointed to the ASDA income tracker (a barometer of household free cashflow after taxes and non-discretionary expenditures such as bills).

“The headline is still positive, but actually the majority of households are now seeing real wage decline,” he explained.

On top of this, the upcoming Budget is expected to be one where chancellor Rachel Reeves looks to address the government’s budget deficit, with tax rises a potential outcome. If so, this could slow the economy again and lead to “uncertainty for domestic-facing businesses”.

As such, Lynch said he “wouldn’t get too bullish on domestic stocks, because I think it will probably get worse before it gets better”.

While the team have been finding some opportunities in mid-caps that justify the risk, such as Cranswick and Dunelm, they have been more drawn to the FTSE 100.

“Historically, you’d expect to find your value opportunities in the FTSE 100 and your growth opportunities in the FTSE 250. Nowadays, the market has almost flipped on its head,” he explained.

Part of this is because companies in the FTSE 100 make around 70% of their revenues internationally, so are less reliant on the domestic economy.

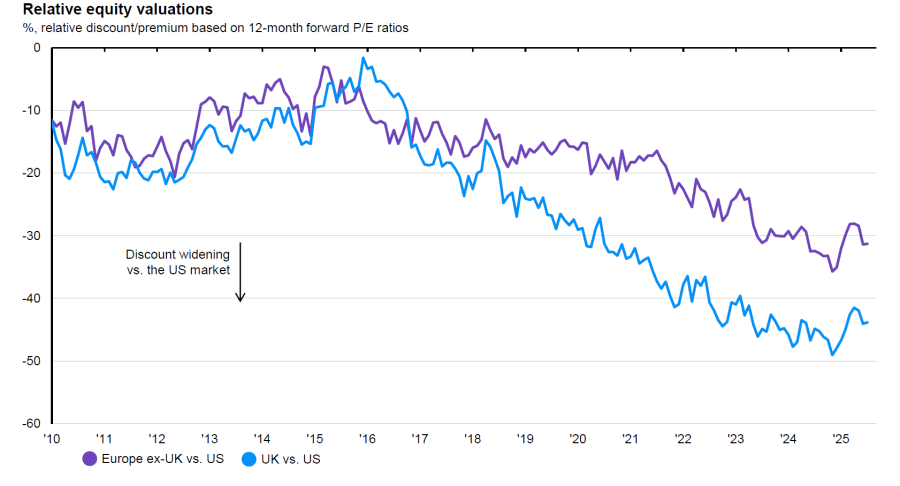

For Lynch, this is currently a boon, as investors remain unsure of betting on the UK, as evidenced by the wide gap in price-to-earnings (P/E) ratios. “You could pay north of 20x for the global economy, or you could pay 11x for it in the UK,” he said.

Some may argue that the UK and US markets have very different compositions, with the UK underweight technology and overweight financials, oil and mining companies.

However, when comparing like-for-like sectors, the UK is cheaper than the US in almost every category. As such, he noted that the UK is “just a good value opportunity”.

Relative equity valuations of UK and US sectors

Source: JP Morgan Asset Management. Valuation shown is price to 12-month forward earnings, as of 1 July 2025.

And breaking it down even further to individual companies, the manager said the blue-chip index has some hidden gems that are growing their market share and expanding internationally, while still remaining modestly valued.

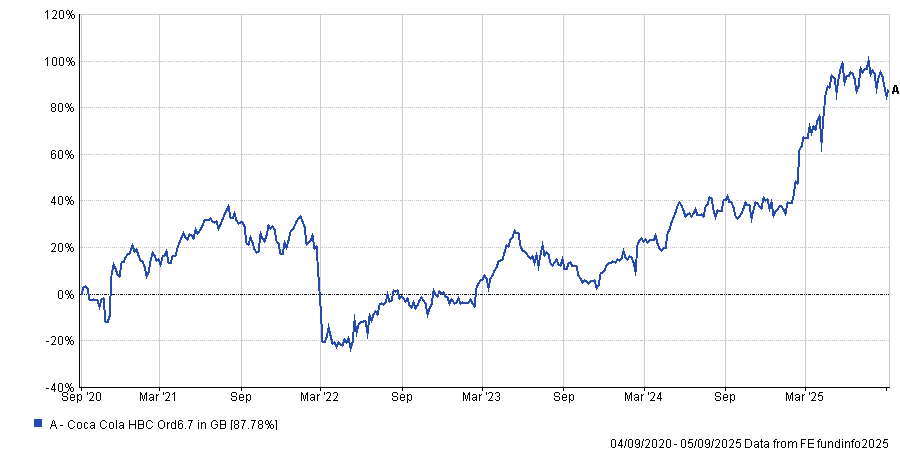

For example, he pointed to Coca-Cola Hellenic, which the team classified as a “quality compounder” in the UK market. The company is the bottling arm of the US soda manufacturer and has experienced sustained recent margin growth. Shares have responded, up nearly 87% over the past five years, but still have plenty of room left to run, Lynch said.

Share price over 5yrs

Source: FE Analytics

This is due to its international focus, with the business selling Coca-Cola products in parts of the world such as Eastern Europe, North Africa and parts of the Middle East, where the hotter climate encourages more spending on fizzy drinks. It also means the stock is less exposed to domestic concerns, he explained.

“This is a dynamic that has only really started playing through and has been very helpful. So, it’s both quite a good growth opportunity as well as a value one,” he said.

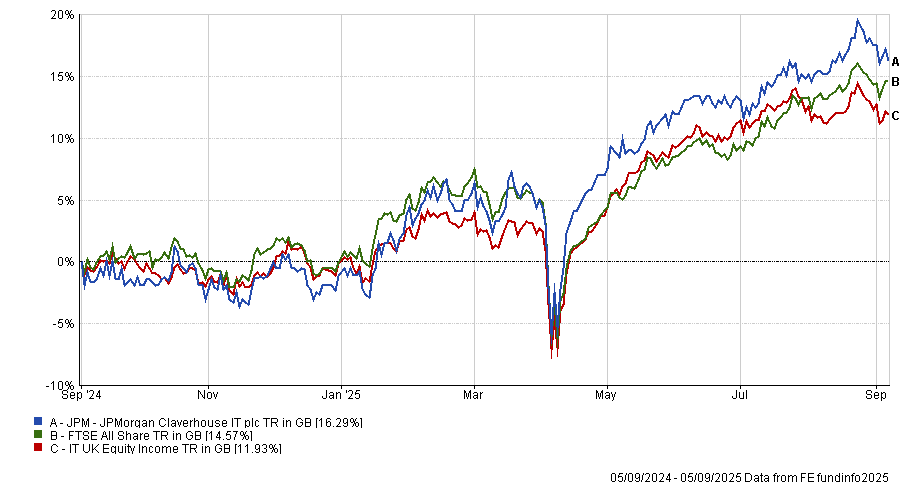

This approach has worked out for Lynch’s trusts, such as the £439m JPMorgan Claverhouse Investment trust. It has delivered a second-quartile return over the past year, since Lynch joined the team, beating the average peer in the IT UK equity income sector, while narrowly outperforming the FTSE All-Share.

Performance of trust vs sector and benchmark over 12 months

Source: FE Analytics