Some investors believe we are in a higher for longer interest rate environment with the Bank of England likely to keep rates hovering around 4%, but this thesis is “not sensible”, according to Ed Legget, manager of the Artemis UK Select fund.

“There’s a view going around right now that interest rates will remain around 4% on average in the next few years. To us, this doesn’t stack up as a sensible thesis,” he said.

Instead, the FE fundinfo Alpha Manager argued “Inflation will start to fall sharply” to somewhere around 2% as early as March next year and, as such “expectations around interest rates will follow suit”.

Most investors are not pricing this in, he explained, because they have become too short-termist, with most focused overwhelmingly on the upcoming Budget.

He conceded that there is some short-term uncertainty around the Budget, particularly over concerns about how the government can raise money and what tax levers it might need to pull to make this happen.

He expects this to result in a short-term drop in consumer confidence but argued the government will be very keen to avoid another inflationary Budget. Adding something like VAT to food will only serve to “hit their core demographic”, he noted.

As a result, once there is more clarity, consumer confidence will start to return.

Another issue that will affect interest rates and inflation, he argued, is the labour market. Unemployment has started to edge up in the latest Office of National Statistics data, he explained.

“In our view, there are only two expectations that make sense. Either growth is ok and interest rates remain about where they are, or growth declines and interest rates start to fall sharply,” Legget said.

Inflation will decline, giving the central bank reason to cut rates and growth will remain subdued and below the BoE's 1.5% forecast, Legget expected. As such, to boost economic activity, “the Bank of England will continue to be comfortable cutting rates”.

In preparation for this, Legget and his co-manager Ambrose Faulks have pivoted the portfolio this year, taking profits from prior favourites such as financials and moving into other opportunities in anticipation of potential rate cuts.

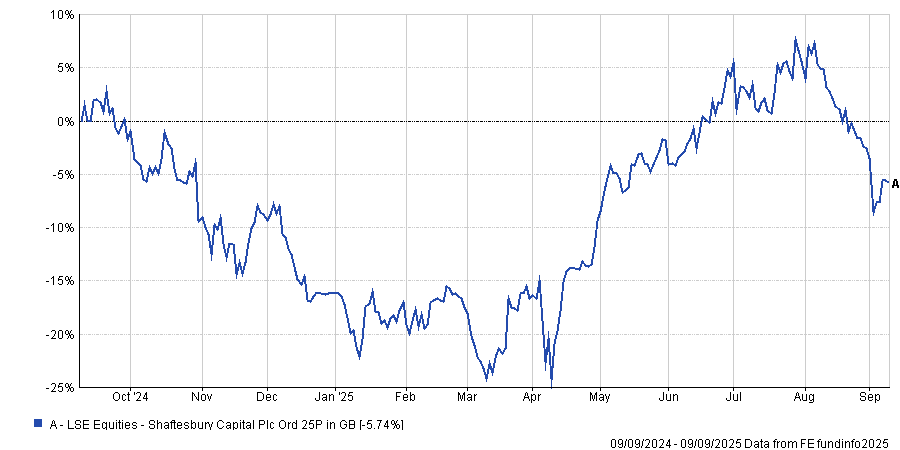

For example, he pointed to real estate investment trusts (REITs) such as Shaftesbury Capital, where shares are down 7% over the past year,.

Share price performance over 12 months

Source: FE Analytics

It is well poised for a turnaround in a lower-rate environment, however, Legget said.

“Come January or February, I think every strategy on the market is going to realise that if rates are going down, you want to own something like REITs, which did terribly last year,” the manager noted.

“That multiple expansion will come very quickly because everyone will decide owning a REIT is a great idea for the year ahead, so you want to buy in anticipation.”

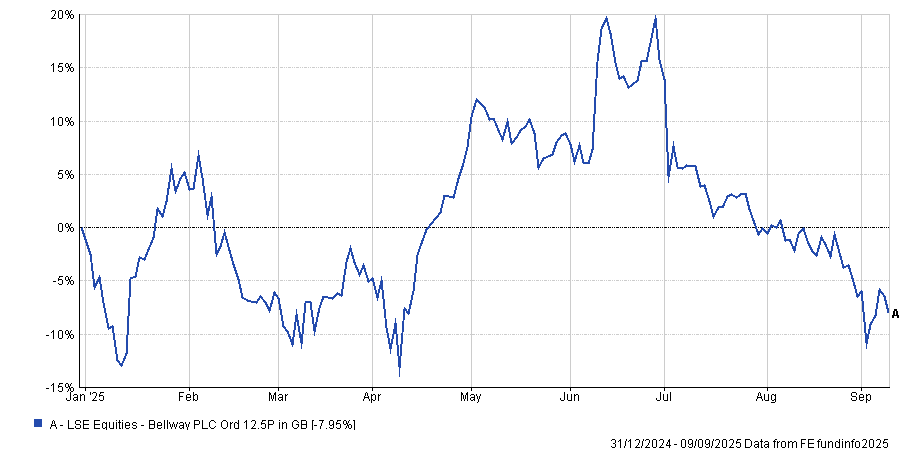

Housebuilders are in a very similar position, he explained, with higher rates leading to more punitive remortgage payments and causing some to struggle to get a loan.

However, poor performance for housebuilders is not a 2025 phenomenon, with the sector struggling in many different periods over the long term, including in 2023, when rising rates hit the sector hard.

Nonetheless, the managers are optimistic, with Faulks noting last year that housebuilders could be at the “epicentre” of a stock market revival in a lower-rate environment.

The team maintained this view going into 2025, increasing their allocation towards Bellway, despite share prices sliding roughly 8% year-to-date and more than 20% in 12 months.

Share price performance YTD

Source: FE Analytics

Legget explained: “We’re going to make our money if interest rates are lower and planning is easier, both of which I think are likely. In that environment, buying early at a big discount to book value has been a historically profitable strategy.”

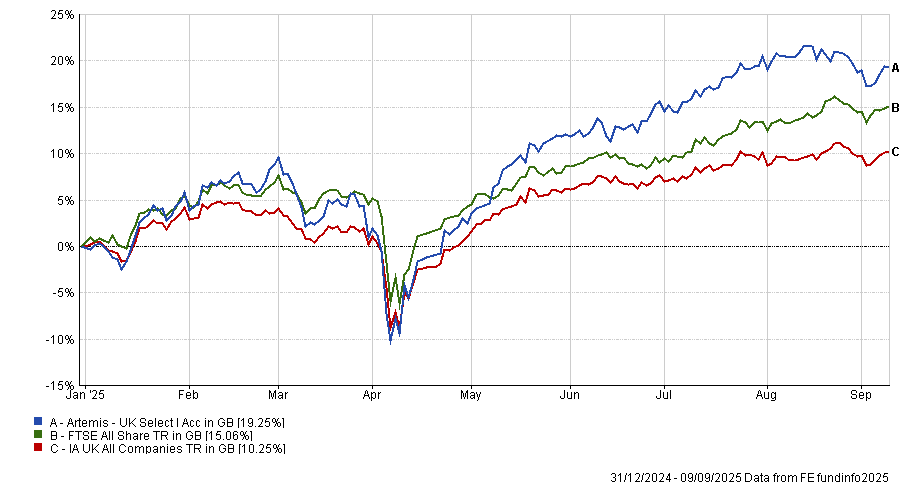

Indeed, this approach has paid off for Legget’s Artemis UK Select fund.

So far this year, it is the fifth-best performing fund in the entire IA UK All Companies peer group, delivering a return of 19.2%, outpacing the average peer and the FTSE All-Share.

Over the long term, it has continued to deliver, with further top-quartile returns over the past one, three, five and 10 years and was one of the most-bought UK funds in the first half of the year.

Performance of fund vs sector and benchmark YTD

Source: FE Analytics