Fundsmith Equity and Lindsell Train Global Equity have long been considered two titans of the UK fund landscape, each boasting a heavyweight manager at the helm.

Their similarities are striking. Both funds – with Fundsmith managed by Terry Smith and Lindsell Train by Nick Train – prefer a low turnover approach, investing in high quality companies that can give investors compounding returns over the long term.

“In both cases, the focus is stock selection rather than trying to follow macroeconomic themes,” said Jason Hollands, managing director at Bestinvest.

Such companies typically trade at a premium but, if held for a long period, they should theoretically outperform the market.

Given their similarities, it can be difficult for an investor to know which to add to their portfolio. So where do the funds differ?

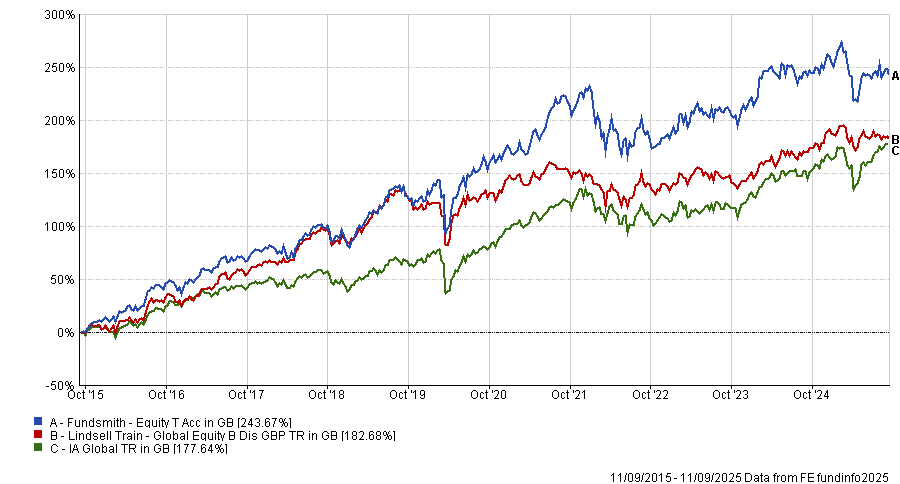

Over 10 years, the £18.5bn Fundsmith has posted stronger returns at 247.1%, while the £3.5bn Lindsell Train Global Equity managed 184.8% – both still beating the IA Global sector average.

Performance of the funds vs sector over 10yrs

Source: FE Analytics

The funds have more recently faced headwinds, driven by their quality-focused, long-term investment style.

While Lindsell Train outperformed Fundsmith over one year, posting a 5.2% gain versus 1.7%, Fundsmith performed better over three and five years, returning 18.9% and 33.4% while Lindsell Train managed 18.4% and 23.2%.

Although Fundsmith Equity outperformed MSCI World and IA Global sector average over a decade, Matt Ennion, head of fund research at Quilter Cheviot noted that “the bulk of this relative performance has come from the earlier years, with the portfolio struggling to keep pace with the wider market over shorter periods”.

Meanwhile, the Lindsell Train fund saw its streak of top-quartile returns over 10 years come to an end in March 2025, and dropped to the third quartile of the IA Global peer group in July. It has since picked up slightly, no nudge up above the average in the latest figures.

This spell of underperformance largely comes down to the funds’ sector weightings, according to Ennion.

He said: “At a sector level, Fundsmith has a significantly higher allocation to healthcare companies, while Lindsell Train has more exposure to communication services and financials. Both funds have similar exposures to consumer staples.”

There are also the geographical splits to consider.

Lindsell Train Global Equity is underweight the US at 46.4% versus 72.5% of the MSCI World Index and has a large home-bias to the UK at almost 30% versus 3.6% of the benchmark. He also allocates around 20% to Japan.

Smith, however, has invested around two-thirds of Fundsmith in the US and has kept his allocation to the UK under 5%.

Lindsell Train also has around 13.5% in European equities and Fundsmith has 20.4%.

Alex Watts, senior investment analyst at interactive investor, said: “Given the US allocation, it is no surprise that Fundsmith exhibits a greater bias towards growth and, on aggregate, higher multiple names than Lindsell Train.”

Although Fundsmith’s higher exposure to high-growth US companies (although notably these do not include Nvidia) has contributed to its stronger long-term performance, this has not necessarily been a good thing in the shorter term, with the US market proving volatile over the course of 2025.

This has translated into fund performance, with Fundsmith proving more volatile over the past 12 months for less return – at 14.4% for a 0.5% return – compared to Lindsell Train Global Equity at 8.5% and 5.3% respectively.

“This will partially reflect Fundsmith’s much greater exposure to the US dollar, which has weakened materially since the Trump administration took office,” said Hollands.

Although Fundsmith’s high exposure to US large-cap stocks makes it more susceptible to greater portfolio swings, Ennion argued that “Lindsell Train may experience less volatility but returns can drag when big tech rallies”.

However, the higher concentration of both funds can make diversification more difficult to achieve.

“As such, these funds are most suited to those that have a higher tolerance for risk and, crucially, a long-term investment horizon that aligns with the respective investment managers philosophies,” said Ennion.

So, which is the better option in 2025?

Of the two, Hollands said he has “kept faith in Fundsmith”, noting better long-term returns, the process and approach remaining unchanged and “the quality of the underlying portfolio remains strong”.

“Even the best fund managers will go through periods of underperformance in their careers and there is no reason to think that the fund cannot deliver strong returns in the future,” he said.

Ennion and Watts also sided with Fundsmith, with the latter noting that interactive investor recommends the fund on its Super 60 due to its disciplined approach and the experience of Smith.

FE Fundinfo also currently holds Fundsmith on its FE Approved List, according to Sophie Turner, fund analyst at the firm.

She said: “It provides us with a good diversifier to pair with more cyclical funds which are likely to benefit from recent market moves with strong artificial intelligence performance.”

Ben Yearsley, director at Fairview Investing, was the only dissenting voice, stating that he prefers Lindsell Train Global Equity.

“I would argue that Lindsell Train is more prepared to change views and adapt,” he said.

Indeed, Train told Trustnet recently how he has shifted the portfolio away from consumer staples and more towards digital winners.

Additionally, Yearsley said he places a great deal in the accessibility of a fund manager, noting he has “never met” Smith, while has found Train “approachable and fascinating to talk to”.

“I do not believe in buying funds where I cannot meet the manager,” he said.

Alternative choices

For investors seeking other options to the two behemoth funds, Watts suggested the £5.6bn F&C Investment Trust, which is also on the ii Super 60.

“It is a compelling option as a one-stop shop for global equity exposure and is very diversified with around 400 holdings,” he said.

It invests predominantly in listed equities but may also allocate to unlisted companies via collective investments and direct positions within the range of 10-15%.

Meanwhile, Ennion from Quilter Cheviot, highlighted JPMorgan Global Growth & Income. As well as having more exposure to the Magnificent Seven stocks, the fund offers greater regional diversification than Fundsmith and Lindsell through its “meaningful allocation” to Pacific ex Japan and Asia.

“It also provides a diversification of investment style in a single fund, meaning that the volatile nature of tech firms should not have an outsized impact on the overall returns of the fund,” he said.