Consumer stocks and pharmaceuticals are areas of particular concern in the UK, according to equity income managers, who have warned that both could disappoint investors in the coming years.

While the FTSE All Share has posted a 15.5% total return so far this year, there is still significant dispersion in the opportunity set available to investors, they explained. As a result, certain areas of the market are not worth the risk.

For Thomas Moore, co-manager of the AIC Dividend Hero Aberdeen Equity Income Trust, there are minimal opportunities in the pharmaceutical space. “We’re reaching the desperation stage in pharmaceutical stocks,” he explained.

Part of this is due to the current US administration, which he said has “well-known" views on healthcare and seemed to have “an axe to grind” when it comes to the sector. This directly impacts the international revenue of some of the UK’s largest pharmaceutical stocks.

Additionally, drug pricing is coming under heavy scrutiny. “The question to ask is whether these heavily indebted governments have paid too much for their drug prices and if that will come home to roost? I think it might,” Moore said.

On top of this, he pointed to AstraZeneca’s decision to halt research and development in Cambridge as an example of the troubles some pharmaceutical stocks are going through.

“I’m very pleased to say we’ve avoided pharmaceuticals completely. I don’t own any and I don’t have any plans to own them,” Moore concluded.

Meanwhile, Ian Lance, co-manager of the Temple Bar Investment Trust, is cautious about some consumer stocks.

“It’s way too early to buy big consumer names, particularly alcohol and luxury brands,” he said, pointing to Guinness maker Diageo, which “used to be everyone’s favourite stock” but now looks like a trap. “People seem almost desperate to buy it now that it’s rolled over, but it’s still too soon.”

He argued that Diageo had become so expensive that even after its recent significant derating, it still trades on a multiple that is too high to justify.

The opportunities in the UK markets

However, the panel still believed there were plenty of opportunities in the UK market for investors who were willing to be more adventurous.

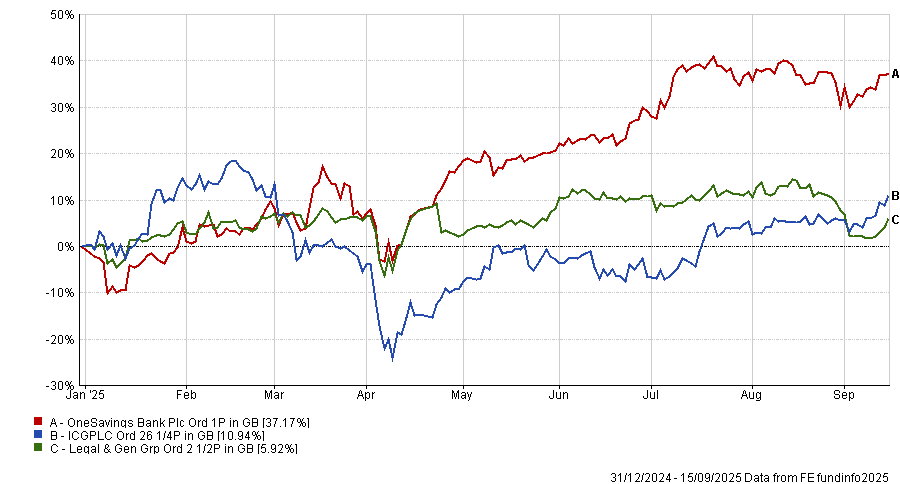

Julian Cane, manager of the CT UK Capital and Income Investment Trust, currently has a 32% allocation towards financial stocks, with top 10 holdings in OneSavings Bank, Intermediate Capital Group and Legal and General.

All are relative overweights compared to the FTSE All-Share and have posted strong total returns this year.

Total return of stocks YTD

Source: FE Analytics

“Price determines a lot of things and there is a world of unusual and cheap financial businesses that often go under the radar,” he said.

Within financials, Temple Bar’s Lance particularly favoured banks, which have been unpopular with managers despite “rapidly improving” fundamentals and businesses.

“I find it amazing that anyone could call any bank a poor-quality business or uninvestable,” he said.

Over the past five years, banks' revenues have risen while their costs have declined rapidly, contributing to earnings per share nearly doubling in some cases. This contributed to a high return on capital, but many are still trading at single-digit price-to-earnings ratios, he explained.

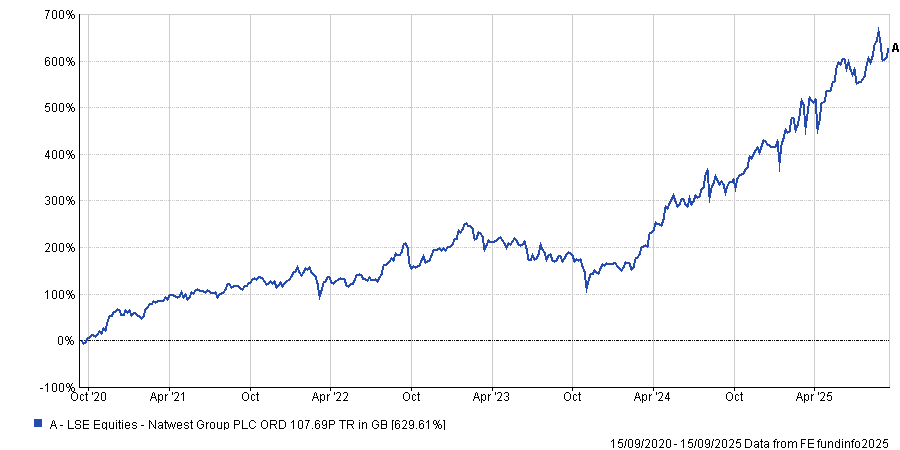

Rather than “sitting around and feeling sorry for themselves”, banks have started buying back their shares to grow their net income. While this has been a trend across the major banks, Lance identified NatWest as a notable example, which has bought back 25% of its own shares.

As a result of this “double whammy” of sector tailwinds and good decision-making, NatWest is up more than 600% over the past five years, comparable to the returns of US mega-cap tech, he argued.

Total return of NatWest over 5yrs

Source: FE Analytics

“NatWest is in its third year of delivering 18% tangible earnings. That’s not a poor-quality business to me,” he concluded.

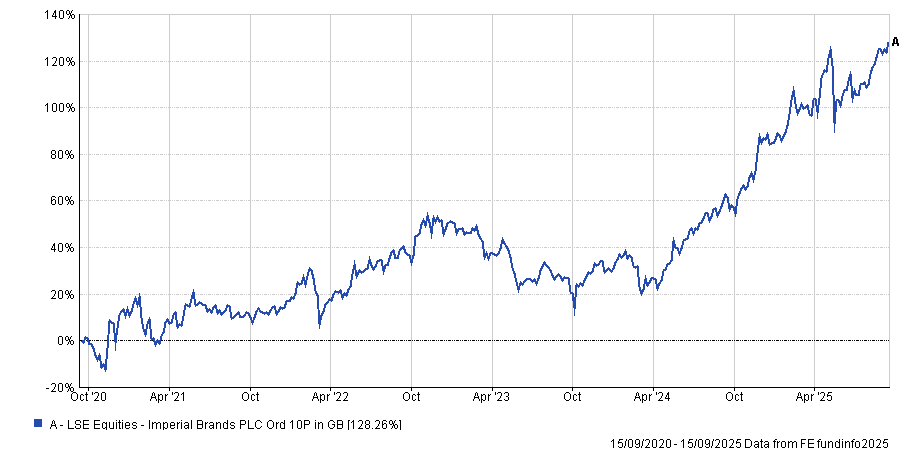

Meanwhile, Aberdeen’s Moore highlighted tobacco company Imperial Brands as one of the most resilient stocks in the UK market.

“I think a few years ago, people would have rolled their eyes at you if you suggested a tobacco stock could bring high dividend yield, dividend growth and capital growth,” he explained.

However, the good returns have “just kept coming” with the business continuing to grow its earnings and revenue at an attractive rate, he said. The current dividend stands at a “respectable” 5%, but two years ago it offered an “eye-watering” yield of around 10%.

This dividend has reduced because, despite macro uncertainty and challenges to the UK economy, Imperial Brands has doubled its share price (up 126%) over the past five years.

Share price performance of Imperial Brands over 5yrs

Source: FE Analytics

“Years ago, you would have had people falling over themselves to own something like a French luxury brand company, thinking it would be resistant to macro woes, but it wasn’t. The stock to own was something like tobacco,” he explained.