In a year marked by tariffs, artificial intelligence (AI) disruption and episodic rallies, volatility failed to reward investors in US funds in the 12 months ending July 2025.

Recent Trustnet research found that the average return of the most volatile and least volatile funds in the IA North America sector over the 12-month period was the same at 11.5%, implying that it has not paid to take more risk in recent times.

According to fund experts and managers, this is a temporary phenomenon, driven by an unusual period of upheaval and distortion in the US, rather than a fundamental shift in the risk-return dynamic.

The negligible impact of volatility on total returns in the IA North America sector “has a lot to do with the narrowness of breadth in market performance”, according to Jim Caron, chief investment officer of the portfolio solutions group at Morgan Stanley Investment Management.

“It is true that volatile funds underperformed in risk-adjusted terms – i.e., per unit of volatility – versus lower volatility funds,” he acknowledged but pointed to the ripple effect of ‘Liberation Day’ in April – when US president Donald Trump unveiled a suite of aggressive tariffs and spooked markets – and the subsequent post-90-day rally.

“Higher volatility funds got hurt relative to defensive funds,” he noted, adding that this was “an aberration in the market”.

“We do not think the frontier has changed as it relates to the relationship between volatility, or risk and return potential in the US – the relationship is still curvilinear,” he said.

Dan White, head of global equities at M&G Investments, agreed, noting that these events “masked underlying dispersion”.

“Without these moments of extreme market behaviour, we may have seen a wider gap between the most and least volatile strategies,” White said.

“In this environment, risk management has been paramount. It is not that risk has not paid off, it is that the type and timing of risk exposure has mattered more than ever.”

Over the medium- to long-term, he said that portfolios with differing exposures or risk profiles should ultimately deliver divergent performance.

“If the AI-driven rally begins to cool, for example, we may see less volatile, fundamentally anchored strategies begin to outperform,” White suggested.

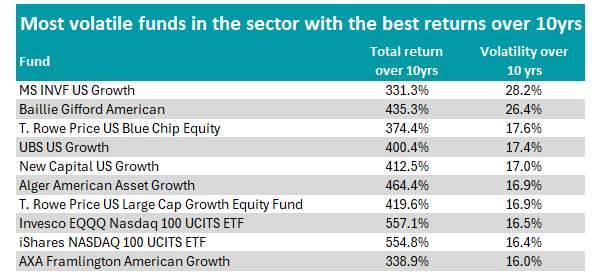

Volatility versus performance over the decade

When looking at the past 10 years ending August 2025, it has ultimately paid off for investors to take more risk, with an almost 35 percentage-point difference in the average total return over 10 years of the most and least volatile funds.

According to FE Analytics, the most volatile funds in the sector averaged 17.8% volatility in exchange for an average 288.7% total return over 10 years, compared with 12.5% volatility and 253.9% gain for the least volatile funds in the sector.

Source: FE Analytics

The most volatile active fund that delivered first-quartile returns over the decade was MS INVF US Growth, with a score of 28.2% in volatility in exchange for a 331.3% return.

Morgan Stanley’s $3.8bn fund has an FE fundinfo Crown Rating of three (out of five) and contains a host of tech stock in its top holdings, including Tesla, Roblox and Snowflake.

However, for a 1.8 percentage point drop in volatility, Baillie Gifford American beat MS INVF US Growth by over 100 percentage points over 10 years, gaining 435.3%.

Similarly, the fund’s top 10 is dominated by tech stocks – but features more of the high-growth Magnificent Seven, including Amazon, Meta and Nvidia.

However, the best-returning fund in the entire sector over the decade was Invesco EQQQ Nasdaq 100 UCITS ETF.

If someone invested in the exchange-traded fund (ETF) a decade ago, they would have made 557.1%. It was also in the fourth quartile for volatility, although was not the most volatile in the bracket at 16.5%.

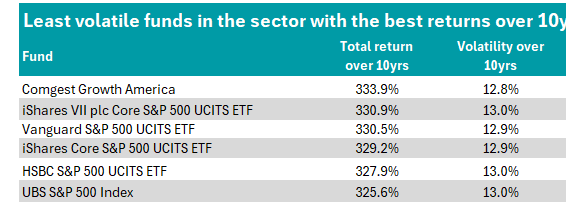

Nonetheless, some of the least volatile funds in IA North America still managed to deliver strong returns over the decade.

Source: FE Analytics

Top of the table for the least volatile funds delivering first-quartile returns over 10 years was Comgest Growth America, at 12.8% volatility and a 333.9% return respectively.

The $977.7m fund commits at least two-thirds of its assets to companies that are headquartered in – or principally carry out their activities in – the US, with top holdings including Microsoft and Oracle.

Will risk continue to pay off?

With trade deals and tariff agreements yet to be ironed out, the US market is unlikely to return to business as normal any time soon.

According to David Aujla, multi-asset portfolio manager at Invesco, uncertainty is baked into the near future in the US.

“My view is that we should be cautious in our US exposure and do some de-concentrating risk from the Magnificent Seven,” he said.

“What we are most interested in is having well-balanced exposure – I am personally happy to give up some of the upside in order to have a more diversified position in the US.”

However, Phil Camporeale, multi-asset solutions portfolio manager at JPMorgan Asset Management, argued that the recent shift in the US landscape could actually be seen as “a return to normal”.

“It has been a long slog for global allocators because many thought diversification meant owning seven stocks in California and that would cover the globe,” he said.

Camporeale highlighted their decision to overweight US equity ahead of the Federal Reserve’s recent decision to cut rates, adding that they are optimistic about US GDP growth next year.

“While there is a lot of noise, I am taking the other side of the bumpy road, as I think there is more certainty today [in the US] than there has been all year.”