Asset allocators have been looking at the UK with renewed interest as the market has been building up an advantage against the rest of the world this year.

The debate has focused on economic uncertainty and fears for growth, but the UK economy is not the UK market. British businesses have underpinned returns in the IA UK Equity Income and IA UK All Companies sectors, which in 2025 so far have outperformed the average IA North America and IA Global funds.

A portfolio that has been particularly successful – not just over the year to date but consistently in the past 10 years, as a Trustnet study recently revealed – is Artemis UK Select, managed by FE fundinfo Alpha Manager Ed Legget and Ambrose Faulks.

Investors appreciate its style-neutral approach (with a slight tilt towards value) and the managers’ ability to short up to 10% of the portfolio to make money in down markets if the call is right.

Its strong track record made it one of the most-researched fund on Trustnet (experts have highlighted its strengths and weaknesses here) and since October 2022, the fund has grown from £1.2bn to the current £5bn – a 303% growth in assets under management (AUM).

Yet this success was also the reason why Ben Conway, fund-of-funds manager of MI Hawksmoor Vanbrugh, started “gently reducing” his exposure.

“Performance has been astonishing, but we’ve been reducing due to fund size concerns and because relative valuations make mid- and small-caps more compelling,” he said.

“Artemis can run lots of money effectively because the assets are liquid, but running less is always easier than running more, so when a fund attracts billions, you need to watch it.”

In the Vanbrugh fund, Artemis UK Select is currently a 2% position, down from about 3% at the start of the year.

But this doesn’t mean Conway isn’t constructive on the UK market – quite the opposite: he recently told Trustnet that he is excited by UK valuations, which are “barely above trough” and still attractive.

“We’ve got quite high exposure to UK equities, not out of bias but because portfolios are cheap.”

His conviction has translated to positions in Aberforth Smaller Companies and Odyssean Investment Trust.

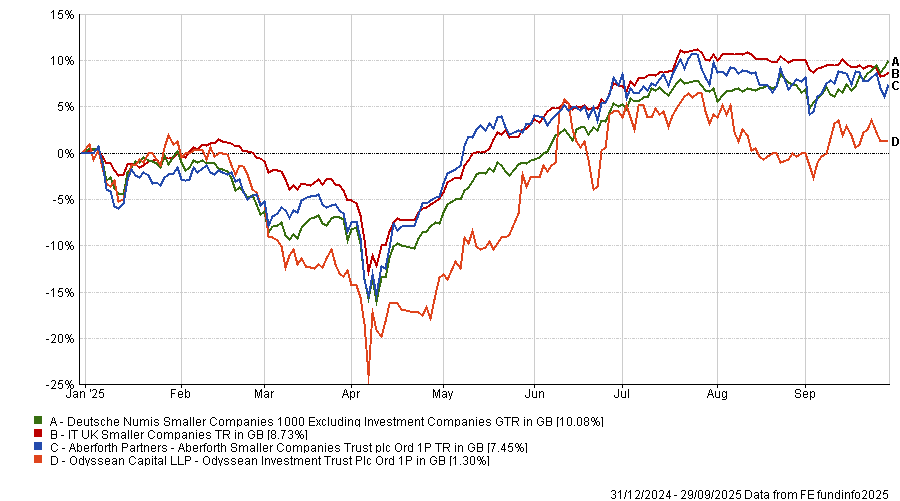

Performance of funds against index and sector over the year to date

Source: FE Analytics

The Aberforth portfolio has recently attracted experts’ attention for both its performance and the potential to narrow its discount.

The trust’s co-manager, Euan Macdonald, is convinced that M&A activity is likely to be the catalyst for a broader re-rating of the UK small-cap sector. Indeed, four companies in the Aberforth portfolio agreed to takeover bids in the six months to June 2025.

Returns have greatly improved since 2021, with the strategy ranking in the top quartile of the IT UK Smaller Companies sector in 2022 and remaining above average in every calendar year since then.

Moving on to Odyssean, Conway likes its approach to buy “cheap, good-quality companies through a private-equity lens”.

Managers Stuart Widdowson and Ed Wielechowski generate returns through stakes in businesses that have fallen out of favour and are trading at discounts to their intrinsic value.

Earlier this year, the trust was included in Deutsche Numis’ equity investment companies recommended list, with analyst Ash Nandi praising Widdowson and Wielechowski’s “engaged approach” as well as stockpicking record, calling Odyssean “an attractive and differentiated addition to a portfolio”.

Finally, Conway accesses the UK market through open-ended funds as well, with the main pick here being Polar Capital UK Value Opportunities.

This mid-cap fund is co-run by the “talented” Georgina Hamilton and George Godber, who have been in charge since 2017 and earlier this year featured in Trustnet’s list of the most skilled stock pickers in 2024 (one of the worst years for active managers).

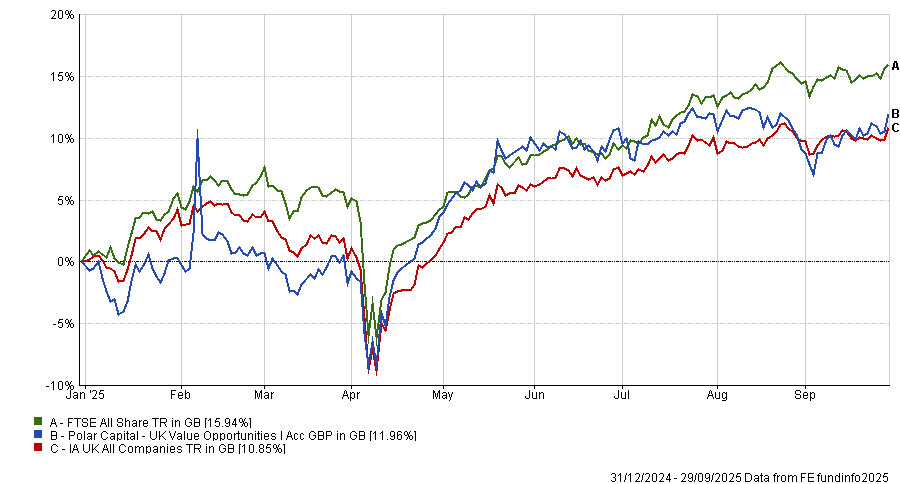

Performance of funds against index and sector over the year to date

Source: FE Analytics

This is a bottom-up strategy with a focus on undervalued companies and flexibility to go in search of opportunities across market capitalisations.

As of the end of August, Hamilton and Godber maintained an almost-equal exposure to the large- and mid-cap end of the spectrum (40.6% in the FTSE 100 versus 43.2% in the FTSE 250), followed by 6.8% in the Alternative Investment Market (AIM) and 0.8% in the FTSE Small Cap index.

Sector-wise, banks are the main exposure (17.8% of the fund). The top-three names are Rio Tinto (3.7%), Premier Foods (3.6%) and NatWest (3.5%).