Can you spare £1,700 a month for the next five years? If you can (perhaps joining forces with your partner), that adds up to £20,400 a year, meaning you are part of the lucky savers who can maximise their ISA contributions.

Saving £1,700 a month gets you to £100,000 in five years – enough to take a step closer to a new home, a car, turbocharging retirement savings or to go on a dream holiday.

But that’s easier said than done.

Regardless of whether you have that much spare, or are able to save smaller amounts, there are several questions you need to ask before you even start, such as: Where should the money go? How should it be invested? And how do I stay consistent?

Trustnet put these questions to Zoe Brett, financial planner at EQ Investors, who shared her tips below for how to tackle saving £100,000 in five years.

Saving or investing?

Theoretically, the risk-free option is to put all your money in savings accounts. As we recently reported on Trustnet, Britons are very keen to squirrel away spare cash. This is because, in the past three years, we’ve had “really amazing interest rates on cash”, Brett said.

“If you could switch into a fixed-rate bond at 6% that would be great, but I don’t think that’s the long-term trajectory for cash rates.”

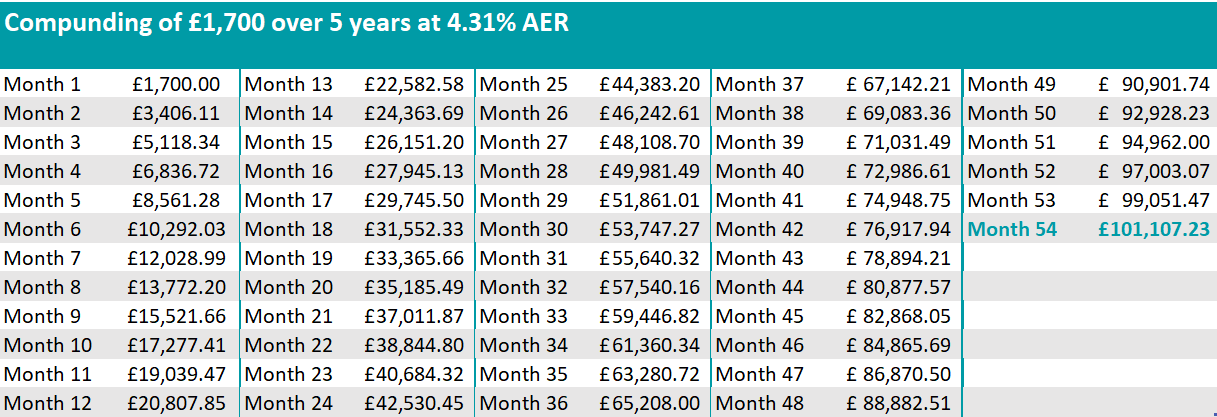

According to moneyfactscompare.co.uk, the top savings account available today is Harpenden Banking Society’s Online Single Access account, which yields 4.31%.

Using our example of being able to save £1,700 a month and assuming that the rate remains the same in the next five years (it won’t), you could reach the £100,000 goal in 54 months, rather than the full 60, as the chart below shows.

It can also help you get to the £100,000 if you are slightly under the magic £1,700 figure, with minimal risk.

Source: Trustnet

If you are in this position and decide against investing in markets or bond funds, Brett preferred money market funds to savings accounts, however, because “it has more of a growth aspect and it’s a managed fund with a professional getting the best rates for you.”

That said, rate cuts could dent the appeal of money market funds for savers, as we discussed this summer on Trustnet.

Invest with discipline and choosing the right platform

Regardless of the amount you have to save, discipline is the key factor in whether you reach your goal.

“Get to pay day and have your £1,700 go straight into your investment account, so you don’t get used to having it in your account,” Brett said. “Anything automated becomes just another bill you pay.”

Not all investment platforms allow you to automate payments into specific funds or stocks, but most do. Others, like Freetrade, let you automate money into your account but not automatically distribute it into your investments.

“You’ll have to check with your provider. AJ Bell is one of the easiest, but be conscious of charges, as every monthly trade with them has about a £1.50 fee,” Brett warned.

“There are also cheap platform alternatives or free ones like Freetrade, which require more manual input, but are free.”

For a guide on how to choose the cheapest platforms, read this Trustnet article.

If you are investing, start with passives to build diversification

For this article we have assumed you are starting with a new pot from scratch. If so, Brett said index trackers are a good place to start a savings journey.

Tracking indices such as the FTSE 100, the S&P 500 or the MSCI World index means replicating the growth in share price of the biggest companies in a particular market.

The main advantages, said Brett, is that they provide “a lot of diversification already” and are also “super cheap”.

Typically, with an index fund, you’d expect to pay anywhere from about 0.15% to 0.25% as an ongoing fee – in comparison, for an actively managed fund investors might pay up to 1%, sometimes 1.5%, depending on the product.

Brett suggested having 80% into a developed world index to start with and then 20% into a UK FTSE tracker, because a home bias usually makes sense.

“You might have some in the FTSE 100, some in the Euro Stoxx index, some in the S&P 500, and try to keep it diversified. If that feels too daunting, there’s the FTSE Developed World, which covers most of the developed world,” Brett said.

Add some bonds?

Another split she suggested was 60% in higher-risk growth assets such as equities and about 40% in lower-risk defensive assets like bonds. That’s the classic make-up of a balanced portfolio.

In this case, Brett still went down the passive route, noting that “there are indexes that will cover that too”.

However, other experts have expressed strong opinions against investing passively in fixed income, because it means getting more exposure to the most indebted companies.

“You can be tempted to go all out in equities because that’s traditionally what’s driven growth. But if the market tanks right when you need the money, that wipes out all your hard work,” Brett said.

“All things considered, I would still stick with the developed world index for about 80% and then 20% UK, especially with where things are at the moment. The UK is really primed for growth.”

Decide if you want to take more risk

Sticking with developed-world indices and a UK bias can be a good entry point for someone without much experience, but if you are comfortable with more risk, then adding emerging markets in the mix “would certainly be helpful over the long term”.

“I would prefer to have some emerging markets in a portfolio,” said Brett. “If you’ve got a five-year time horizon, taking risk is fine.”

For investors with more experience, it might also make sense to go beyond trackers, but that’s better left for when you have more money.

“Once you get to £50,000, that’s the stage when you can do more with the money and having some active managers can add good balance,” Brett said. “Until then, trackers are perfectly fine.”

Hitting £50,000

This is the turning point where you should start “paying more attention to diversification and specific strategies” and potentially hire a professional adviser, said Brett.

“If you know a particular industry well that excites you, you could go for it. But always prioritise diversification, because none of us know everything about a sector and you shouldn’t put all your eggs in one basket.”

The advantage of a professional, according to Brett, is that they can allocate some money to trends or undervalued sectors that an average investor might not know of.

“Above 80% of self-traders lose money. Trading in niche or specific markets yourself can be dangerous. If unsure, stick with index funds, which build that diversification for you.”

Those completely against paying for financial advice could add a managed fund, such as a balanced managed fund, and “leave it alone for a year and a half”, then move into a cautious managed fund when it’s time to de-risk.

De-risk as you approach your goal

A year, maybe 18 months before the money is needed, Brett recommended to start reducing risk, taking 20% off the table 18 months before, then another 20% a year before.

This can be frustrating, she warned, because you’ll see returns from growth assets and be tempted to leave it, but it’s essential for the goal you have in mind (if the money isn’t there when you need it, you might be able to postpone a dream holiday but not a wedding, for example).

Behavioural tips

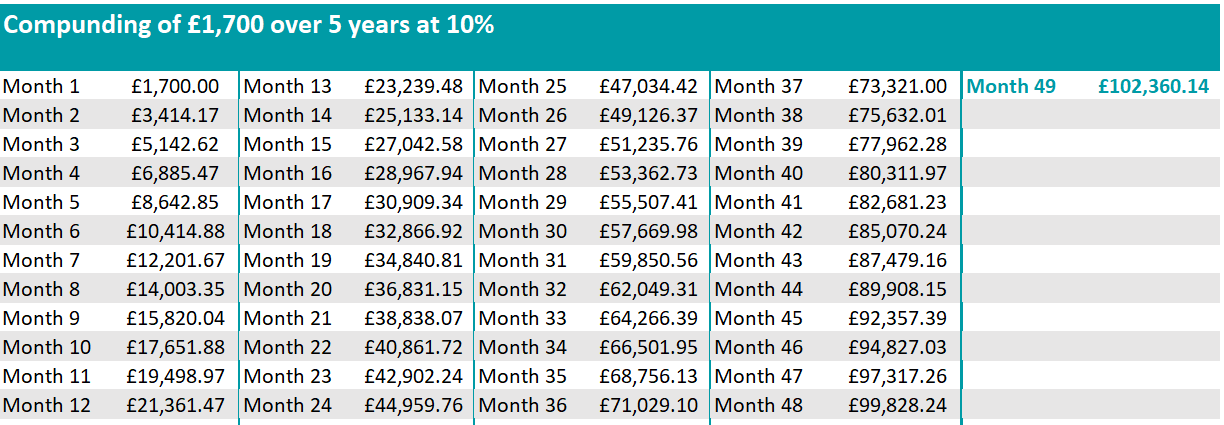

People have come to expect the stock market to deliver an average 10% a year, although that is not something that should be counted on. If that expectation is met, you could reach £100,000 from your £1,700 monthly investment a whole year earlier than expected, as the table below shows. It also helps those saving less each month to achieve the lofty £100,000 goal with lower payments.

Source: Trustnet

The main tip Brett had to get there is to build a portfolio and “just leave it alone”.

“Have a look once a year, otherwise don’t check on it. People who check daily start reacting emotionally but a portfolio should be managed with logic instead,” she said.

Also, visualising what that £100,000 will do for you can keep you motivated. Keeping a good idea of what you’re working towards helps, according to Brett, especially early on when the pot is small and the goal feels far away.

“There will be months where you don’t want to put money in because of a holiday or Christmas, but consistency is what builds wealth,” she said.

“Five years passes quickly. Seeing pots build up can motivate you to add more, reviewing your budget and setting challenges like hitting the goal in three or four years instead of five.”