Keeping costs low is vital for investors, with every penny spent in charges eating into their returns. While many consider the costs of their funds, an important factor should also be the fees levied by their chosen platforms, as these can rack up quickly – particularly as the portfolio increases in value.

While platforms can differ on the funds and share classes that are available, if someone can buy the same asset on multiple platforms, it is helpful to know where they’ll be charged the least.

Below, Trustnet examines the cheapest and most expensive options for lump sum investing strictly in funds, in shares (which includes investment trusts) and a mixture of both, using data from consultancy firm The Lang Cat.

The charts are colour-coded to represent the best value compared to peers, with red highlighting the most expensive and green representing the best value.

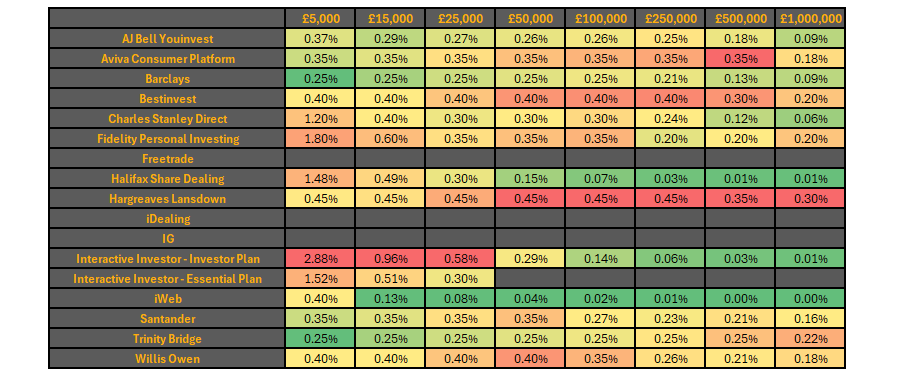

Platform costs to invest lump sums in just funds

Source: The Lang Cat. Fees are accurate to the end of July

For a portfolio that is 100% invested in open-ended funds, the cheapest option for someone ready to invest £5,000 is Trinity Bridge and Barclays at 0.25%.

Both platforms use this as a flat rate on all portfolios up to £100,000, after which Barclays has more variable rates.

For this study we have assumed four fund trades per year, although most platforms do not charge for dealing in open-ended funds.

Santander is also competitively priced for the lowest of our starting range, charging investors a flat 0.35% on all sums up to £50,000.

On any pot above £15,000, iWeb emerged as the cheapest option for investors of all levels. The platform has a consistent pricing structure, charging investors the same fee for investing in funds, shares or a combination of the two.

For more affluent investors who were investing £50,000 or more in a portfolio of funds, Halifax Share Dealing scored well, with mostly green ratings.

Affluent investors would have been hit comparatively hard by Hargreaves Lansdown (HL). It charges a flat fee of 0.45% on all investments up to £500,000, but for any sum above £50,000, this is a comparatively high fee.

Elsewhere, fans of interactive investor (ii’s) investor plan would have found themselves better off with higher pots. For an investment of £5,000 to £25,000, ii had some of the highest charges on all platforms, compared to their relatively cheap charges on anything over £100,000.

Unlike others, it uses a flat monthly fee structure, meaning the charge drops significantly as a percentage the more money an investor has.

Rounding out the shortlist of other popular platforms is AJ Bell. It is moderately priced, generally ranking in green or yellow, which would have made it a compelling option for many pot sizes.

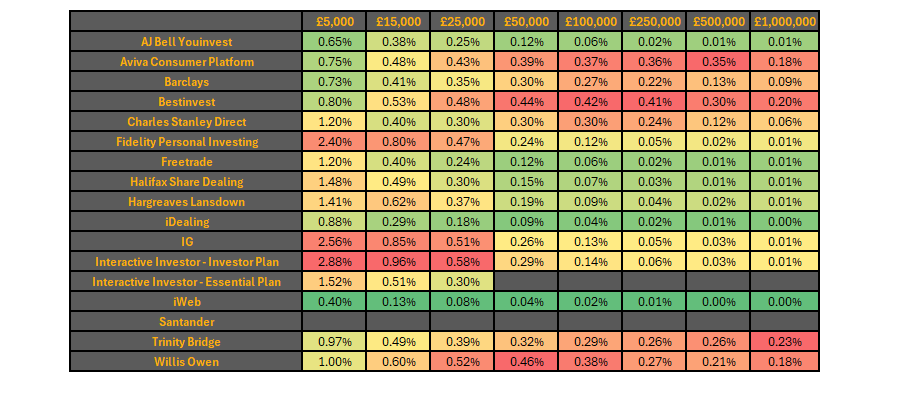

Platform costs to invest a lump sum in shares/investment companies

Source: The Lang Cat. Fees are accurate to the end of July

Investors putting their money to work entirely in shares or investment trusts would have found iWeb to be the cheapest overall option again.

For this study, we assumed four trades per year, as some platforms charge for each dealing.

However, AJ Bell also might have been compelling. For investors with a £5,000 pot, AJ Bell charged just 0.65%, the second-lowest cost among its competitors. For larger pots of more than £100,000, savers are charged between 0.06% and 0.01%.

By contrast, investors with pots of under £25,000 may be tempted to avoid investing shares on interactive investor, IG or Fidelity Personal Investing, which had some of the highest fees for smaller lump sums.

Meanwhile, iDealing charges investors slightly more at the lowest end, but it also green across the board, indicating consistently cheap fees. Hargreaves had a similar fee structure, with comparatively expensive fees for smaller sums, but competitively priced on larger portfolios.

Some platforms are more expensive for more affluent investors. For example, both Aviva and Bestinvest are in the green for a £5,000 portfolio, but are comparatively poor value on any investment of more than £50,000.

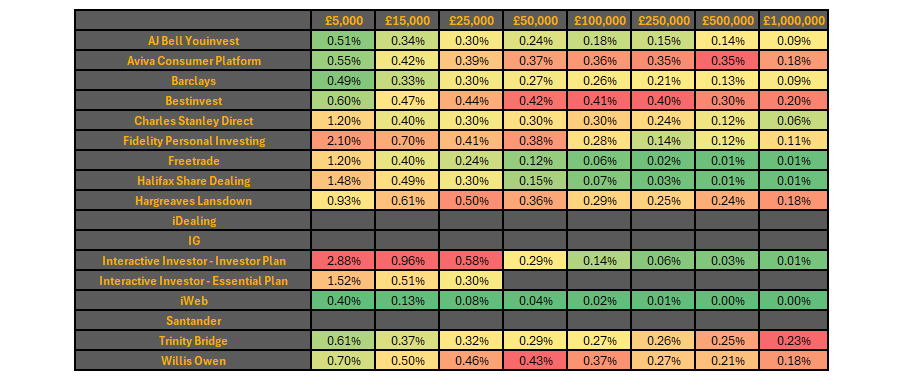

Platform costs to invest a lump sum in funds and shares

Source: The Lang Cat. Fees are accurate to the end of July

Finally, for investors allocating to both stocks and funds, AJ Bell is competitively priced. For a 50/50 split of funds and investment companies (assuming two fund trades and two stock trades per year), it charged modest to cheap fees, represented by mostly green or yellow on the heat map.

Interactive investor is once again the most expensive for investors with small costs, but it is cheaper than AJ Bell for any pot of £100,000 or higher.

Meanwhile, Hargreaves is mostly yellow or orange across the board, indicating slightly higher costs than some of its peers.

For smaller sums, Aviva, Barclays, Bestinvest, Trinity Bridge and Willis Owen are all attractively priced. Most of these platforms have comparatively higher costs on larger pots, however.

Any investor with a lump sum of £50,000 or more may find Freetrade and Halifax Share Dealing competitive, with their fees only differing by 0.03 percentage points. Finally, iWeb is again the cheapest option across the board, beating all other platforms on cost across all pot sizes.