The emerging markets are dominated by two main powerhouses– China and India – but over the long term Ian Simmons, manager of Fiera Emerging Markets, prefers India.

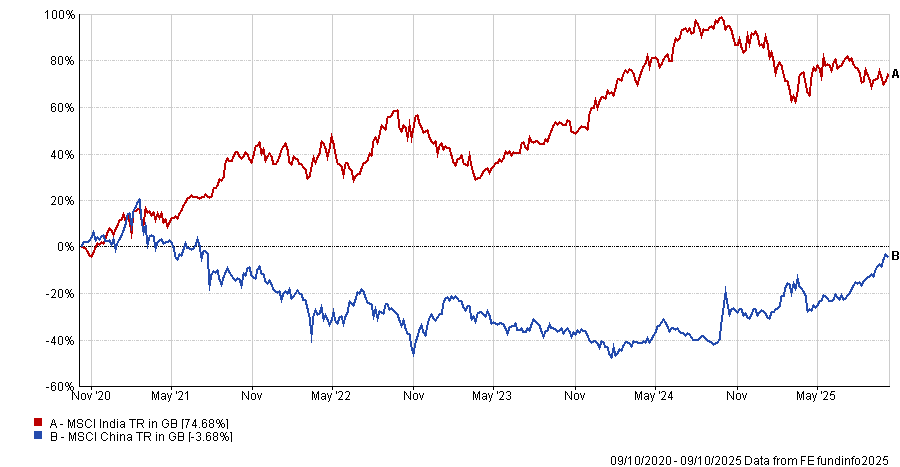

Both markets have had contrasting fortunes in recent years. While China has rocketed in 2025, up some 32.3% year-to-date, India has languished, losing investors 6% in sterling terms. However, India shone from 2021-2023 at a time when Chinese stocks fell sharply.

As a result, India has pulled a long way ahead over five years with China taking the lead in more recent timeframes.

Performance of indices over 5yrs

Source: FE Analytics

When asked which country he prefers over the long term, “I would pick India with a 15-year timeframe,” said Simmons. “I think it is more likely to be a compounder despite the starting point.”

Indeed, one of the criticisms of the Indian market is that it is expensive, currently sitting on a cyclically-adjusted price-to-earnings (CAPE) ratio of 36.2x, more than double China’s 18x.

However, this did not concern Simmons as much, who said his fund (which is 21.2% invested in China and 13.4% in India) does not invest in pricier benchmark positions.

“I am not a big fan of the heavy index names right now on a shorter time horizon. We don’t own anything in India that is in the MSCI [index],” he said.

He warned that the strong performance of the benchmark has “largely been led by multiple re-rating rather than earnings growth”, but said over the next 15 years there is “huge potential” for earnings to compound over time.

He particularly likes the small- and mid-cap space, which is a “huge” market that “doesn’t have as much coverage and as many minds pouring over it as China”.

While there has been a “spurt” of India-only funds launched in recent years on the back of the market’s strong performance, it remains lowly researched and therefore has “more inefficiencies” to exploit.

Meanwhile, it is “very difficult” to predict the Chinese market over the next 15 years, with uncertainty over the economic data produced by the country among many factors investors need to take note of.

Others include the country’s debt situation, the threat of deflation and geopolitical uncertainty, particularly with the US in the race to own the artificial intelligence (AI) space. One threat he does not see happening “anytime soon” is China invading Taiwan, however.

Like India, he said the market has risen due to share prices re-rating rather than earnings upgrades, although stocks remain on lower valuations in aggregate compared with Indian peers.

As such, there could be some short-term appeal to the market, especially with “trillions of dollars” in excess savings sitting in household accounts that are unlikely to be put to work in property anymore – the “traditional destination” for those savings, he said, alluding to the Chinese property scandal of 2023.

“At the same time, rates in the Chinese fixed income market have been falling, so that doesn’t offer much of a return anymore either,” said Simmons.

With government initiatives to push the stock market “to the fore”, money sitting on the sidelines is now being moved into the equity market.

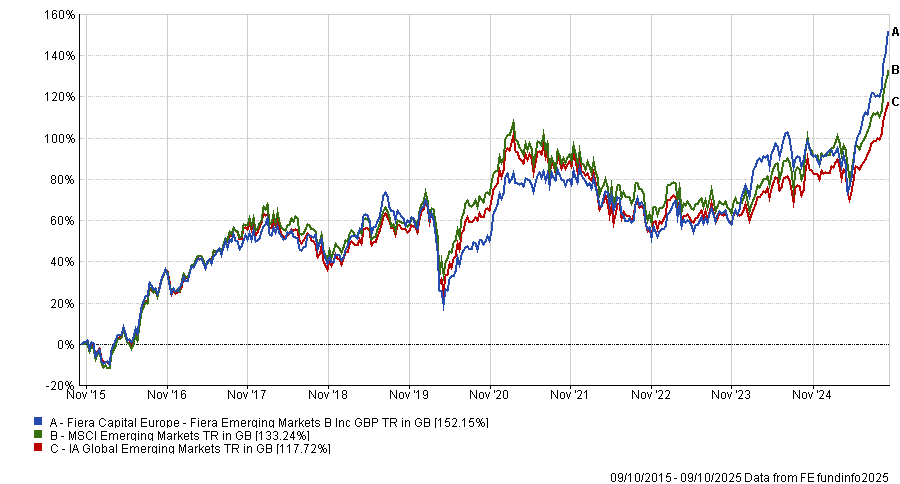

Simmons runs the top-performing Fiera Emerging Markets fund alongside deputy managers Stefan Bottcher and FE fundinfo Alpha Manager Dominic Bokor-Ingram.

It has been a top quartile performer in the IA Global Emerging Markets sector over one, three, five and 10 years, as well as since Simmons took charge in 2017.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

With an ongoing charges figure of 1.42%, £197m portfolio was one of the expensive emerging market funds justifying their higher costs, as Trustnet revealed last week.

The managers look at a plethora of metrics to determine their holdings, including high return on equity and invested capital, and low leverage.

They like for companies to make “decent” earnings growth, arguing that, over time markets “track earnings growth”.

Simmons said they also look at cashflows and like their companies to pay dividends or conduct share buybacks, all while being “valuation sensitive”.

“We’re not going to own any attractive businesses if we believe they are too expensive and not going to generate absolute returns for our investors,” he said.

Lastly, the managers look for a catalyst that can improve the fortunes of the businesses they invest in.

“We don’t think about ourselves as value or high-growth investors. We have companies in the portfolio trading at 4-5x earnings and some at 20-25x earnings,” said Simmons.

“We are looking for inefficiencies in the emerging market asset class and the best opportunities to generate absolute returns wherever they may be.”